(221 KB)

Display Date

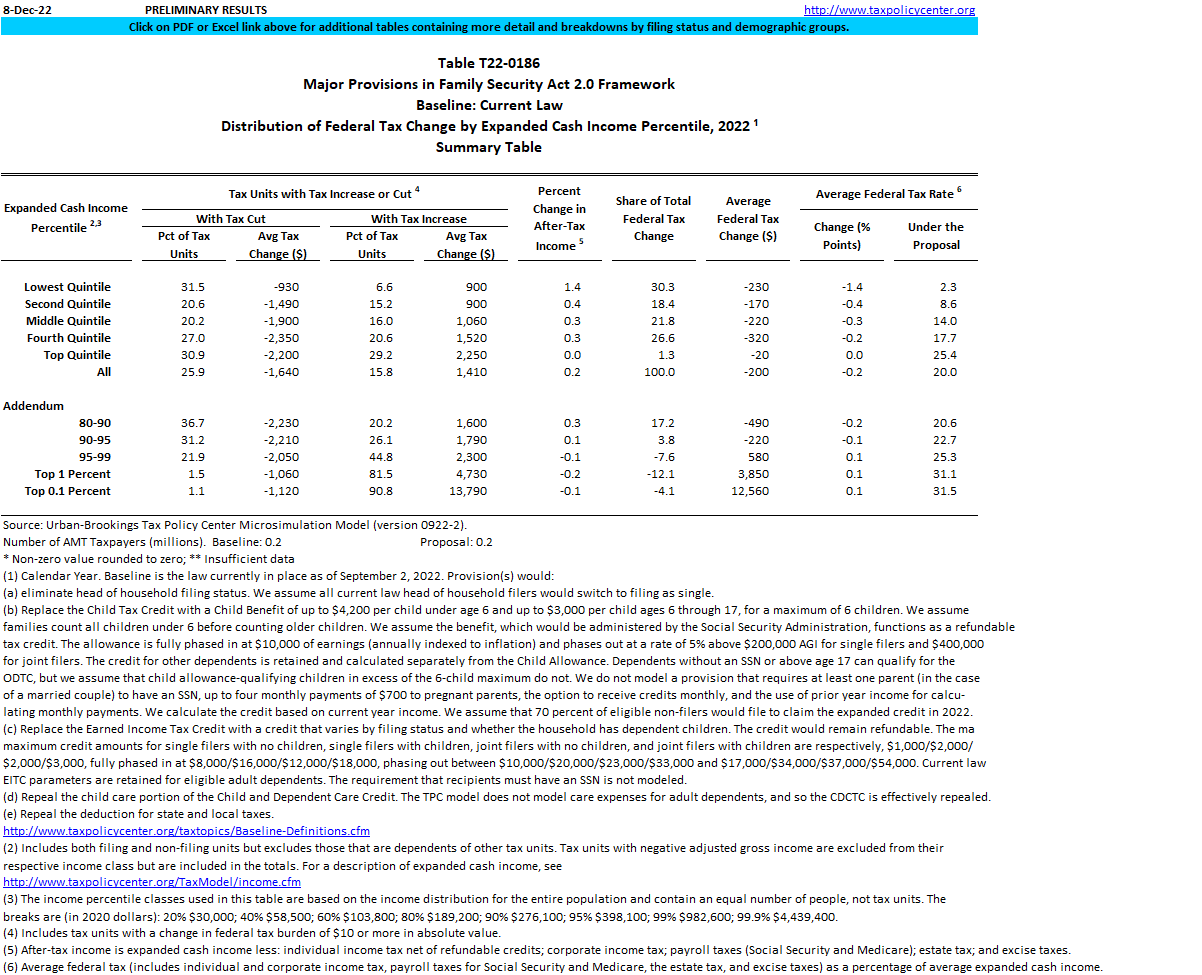

Table shows the change in the distribution of federal taxes, by expanded cash income percentile in 2022, of enacting major provisions in the Family Security Act 2.0 Framework.

Image

T22-0184 - Major Provisions in the Family Security Act 2.0 Framework, Impact of Tax Revenue (billions of current dollars) 2022-25

T22-0185 - Major Provisions in Family Security Act 2.0 Framework, Distribution of Federal Tax Change by Expanded Cash Income Level, 2022