(16.5478515625 KB)

Display Date

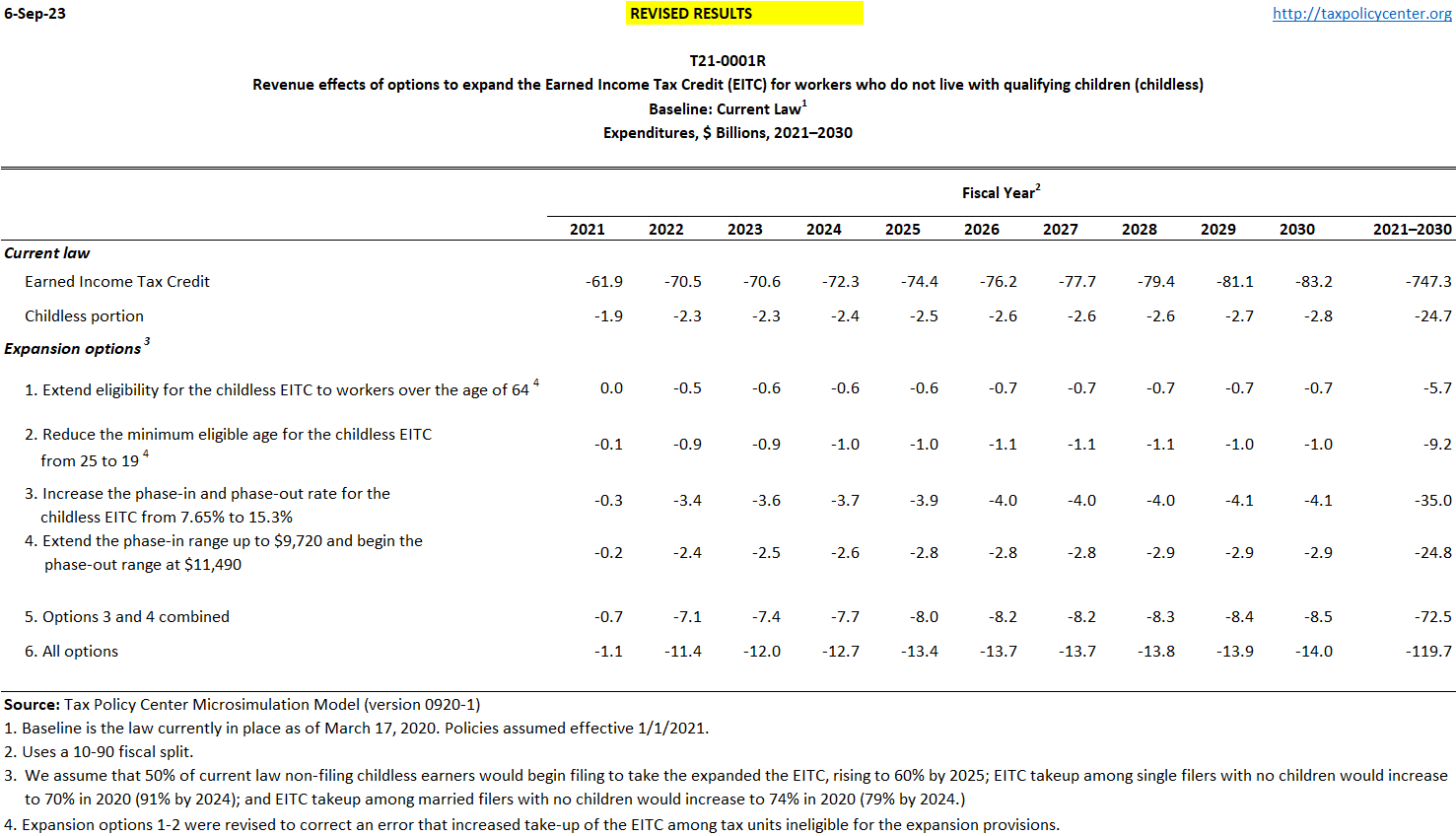

Table shows the tax benefits of the earned income tax credit under current law and the change in individual income tax revenues between 2021 and 2030 of 6 options to expand the current earned income tax credit for workers who do not live with qualifying children.

This table was revised to correct an error that increased take-up fo the EITC among tax units ineligible for expansion options 1 and 2.

Image

T21-0009R - Extend eligibility for the childless EITC to workers between the ages of 19 and 24; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0008R - Extend eligibility for the childless EITC to workers between the ages of 19 and 24; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0007R - Extend eligibility for the childless EITC to workers over the age of 64; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0006R - Extend eligibility for the childless EITC to workers over the age of 64; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021