(191.5 KB)

Display Date

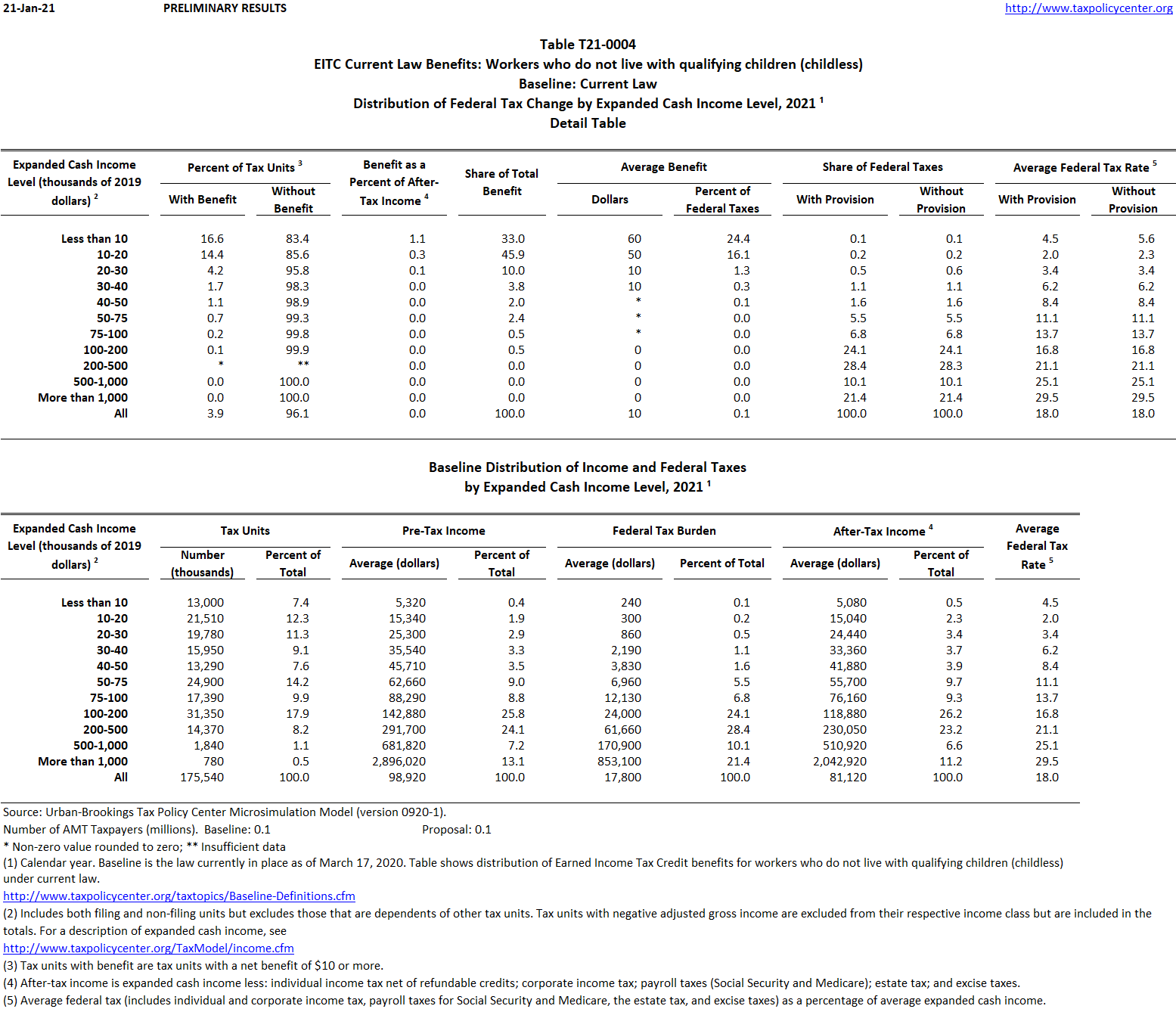

Distribution of current law tax benefits by expanded cash income level from the earned income tax credit for workers who do not live with qualifying children, 2021.

Image

T21-0016 - Expand eligible age range, increase phase-in and phase-out rates, and extend income range for childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0015 - Increase end of phase-in, beginning of phase-out, phase-in rate, and phase-out rate for the childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0014 - Increase end of phase-in, beginning of phase-out, phase-in rate, and phase-out rate for the childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0013 - Extend the phase-in range for the childless EITC to $9,720 and begin the phase-out range at $11,490; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0012 - Extend the phase-in range for the childless EITC to $9,720 and begin the phase-out range at $11,490; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0011 - Increase the phase-in and phase-out rates for the childless EITC from 7.65% to 15.3%; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0010 - Increase the phase-in and phase-out rates for the childless EITC from 7.65% to 15.3%; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0005 - EITC Current Law Benefits for Childless Workers; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0003 - EITC Current Law Benefits; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0002 - EITC Current Law Benefits; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0017 - Expand eligible age range, increase phase-in and phase-out rates, and extend income range for childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021