(212.5 KB)

Display Date

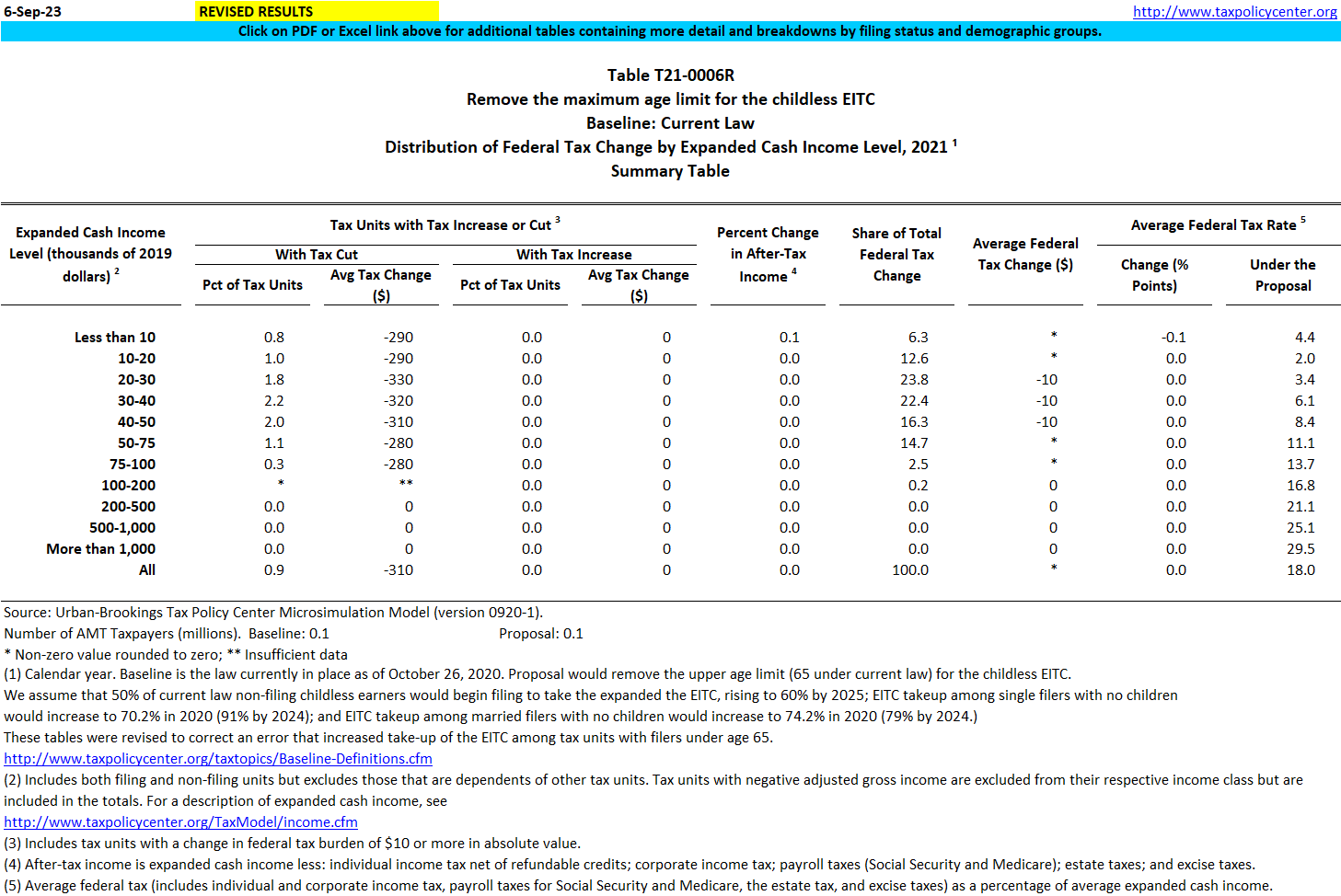

Distribution of tax benefits by expanded cash income level from extending eligibility for the EITC for workers who do not live with qualifying children to those above the age of 64, 2021.

These tables were revised to correct an error that increased take-up fo the EITC among tax units outside the 65+ age range.

Image

T21-0001R - Revenue effects of options to expand the Earned Income Tax Credit (EITC) for workers who do not live with qualifying children (childless)

T21-0009R - Extend eligibility for the childless EITC to workers between the ages of 19 and 24; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0008R - Extend eligibility for the childless EITC to workers between the ages of 19 and 24; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0007R - Extend eligibility for the childless EITC to workers over the age of 64; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021