(241.5 KB)

Display Date

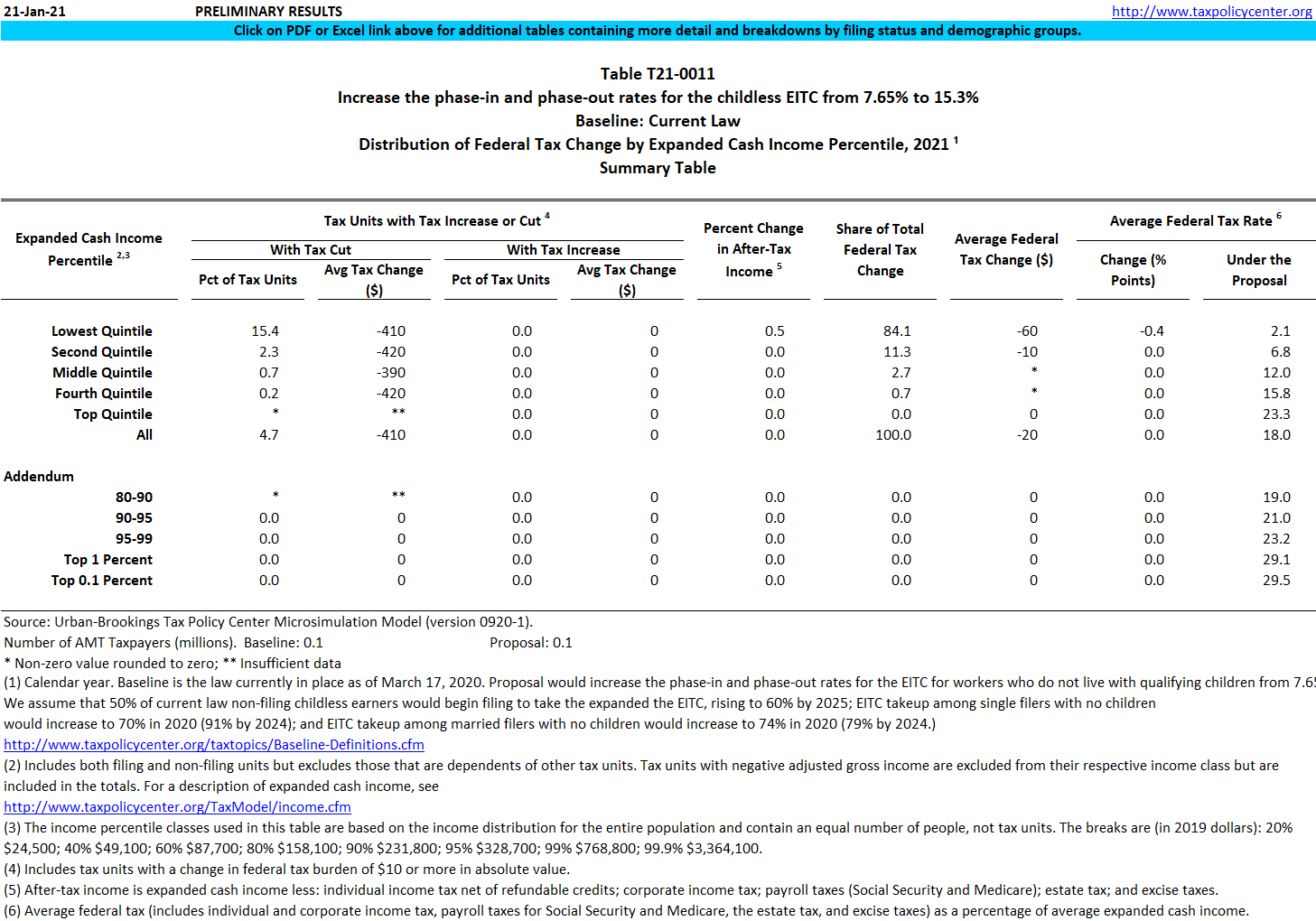

Distribution of tax benefits by expanded cash income percentile from increasing the phase-in and phase-out rates for the childless EITC from 7.65% to 15.3%, 2021.

Image

T21-0016 - Expand eligible age range, increase phase-in and phase-out rates, and extend income range for childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0015 - Increase end of phase-in, beginning of phase-out, phase-in rate, and phase-out rate for the childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0014 - Increase end of phase-in, beginning of phase-out, phase-in rate, and phase-out rate for the childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0013 - Extend the phase-in range for the childless EITC to $9,720 and begin the phase-out range at $11,490; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0012 - Extend the phase-in range for the childless EITC to $9,720 and begin the phase-out range at $11,490; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0010 - Increase the phase-in and phase-out rates for the childless EITC from 7.65% to 15.3%; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0005 - EITC Current Law Benefits for Childless Workers; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0004 - EITC Current Law Benefits for Childless Workers; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0003 - EITC Current Law Benefits; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T21-0002 - EITC Current Law Benefits; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T21-0017 - Expand eligible age range, increase phase-in and phase-out rates, and extend income range for childless EITC; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021