(230 KB)

Display Date

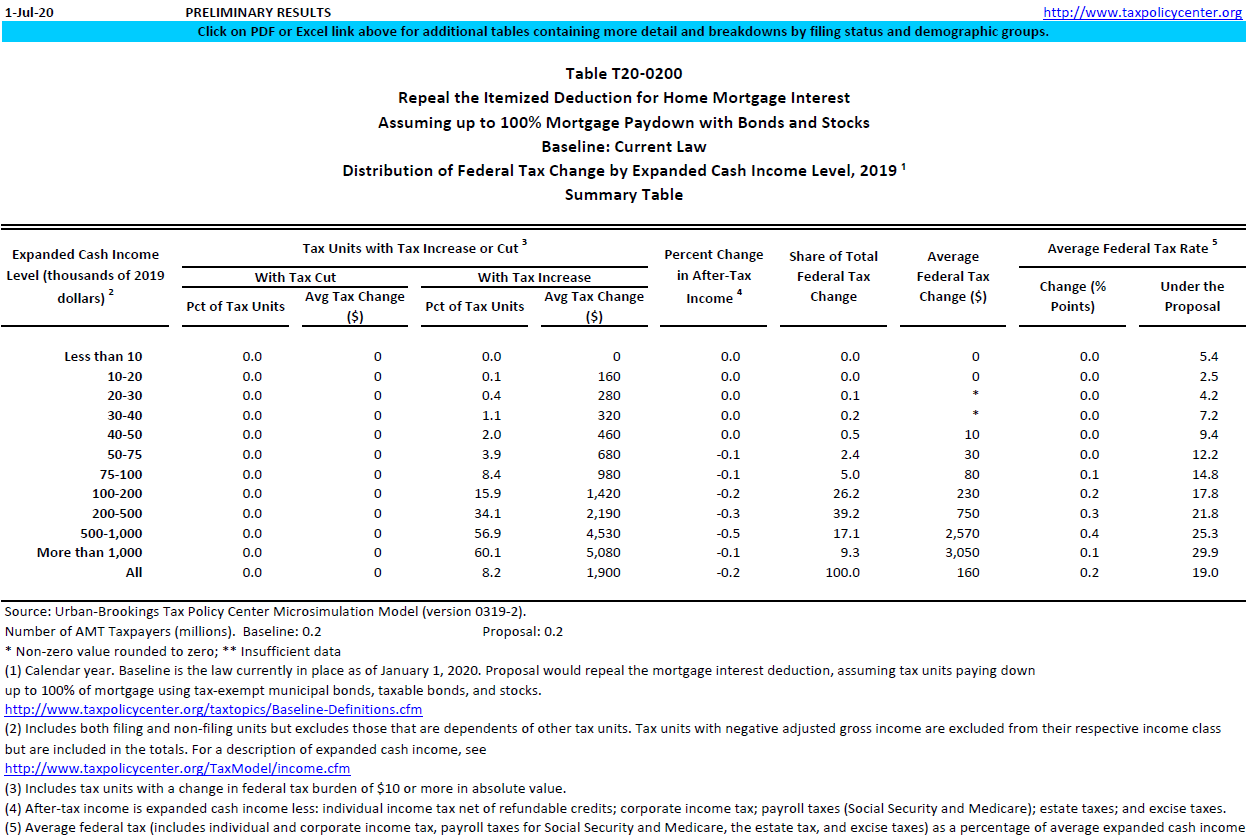

Distributional estimates in calendar year 2019 for a proposal to repeal the current-law home mortgage interest deduction, assuming up to 100% mortgage paydown with tax-exempt municipal bonds, taxable bonds, and stocks. To avoid the economic uncertainties associated with 2020, we use a baseline of current law at 2019 income levels, and assume that the provision was enacted in 2019.

Image

T20-0204 - Replace the Home Mortgage Interest Deduction with a 7.3 Percent Refundable Tax Credit, by Expanded Cash Income Level, 2019

T20-0203 - Replace the Home Mortgage Interest Deduction with an 8.3 Percent Non-refundable Tax Credit, by Expanded Cash Income Percentile, 2019

T20-0202 - Replace the Home Mortgage Interest Deduction with an 8.3 Percent Non-refundable Tax Credit, by Expanded Cash Income Level, 2019

T20-0201 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 100% Mortgage Paydown with Bonds and Stocks, by Expanded Cash Income Percentile, 2019

T20-0199 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 50% Mortgage Paydown with Bonds and Stocks, by Expanded Cash Income Percentile, 2019

T20-0198 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 50% Mortgage Paydown with Bonds and Stocks, by Expanded Cash Income Level, 2019

T20-0197 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 25% Mortgage Paydown with Bonds and Stocks, by Expanded Cash Income Percentile, 2019

T20-0196 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 25% Mortgage Paydown with Bonds and Stocks, by Expanded Cash Income Level, 2019

T20-0195 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 100% Mortgage Paydown with Bonds, by Expanded Cash Income Percentile, 2019

T20-0194 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 100% Mortgage Paydown with Bonds, by Expanded Cash Income Level, 2019

T20-0193 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 50% Mortgage Paydown with Bonds, by Expanded Cash Income Percentile, 2019

T20-0192 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 50% Mortgage Paydown with Bonds, by Expanded Cash Income Level, 2019

T20-0191 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 25% Mortgage Paydown with Bonds, by Expanded Cash Income Percentile, 2019

T20-0190 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming up to 25% Mortgage Paydown with Bonds, by Expanded Cash Income Level, 2019

T20-0189 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming No Mortgage Paydown, by Expanded Cash Income Percentile, 2019

T20-0188 - Repeal the Itemized Deduction for Home Mortgage Interest, Assuming No Mortgage Paydown, by Expanded Cash Income Level, 2019

T20-0205 - Replace the Home Mortgage Interest Deduction with a 7.3 Percent Refundable Tax Credit, by Expanded Cash Income Percentile, 2019