(20.2421875 KB)

Display Date

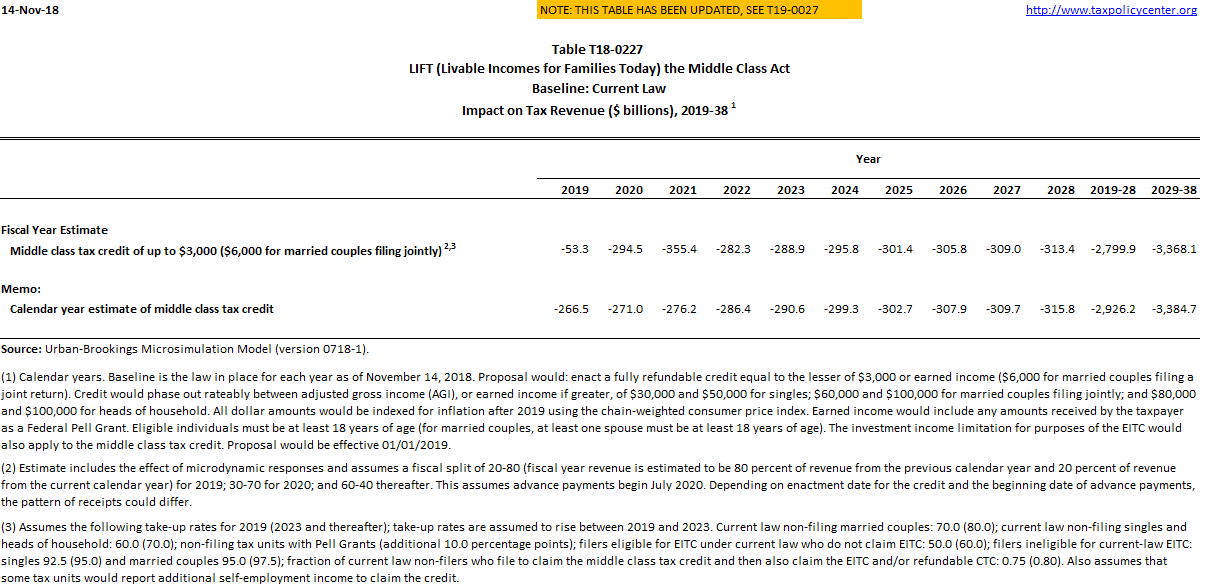

Revenue impact of Senator Kamala Harris' LIFT (Livable Incomes for Families Today) the Middle Class Act, under a current law baseline as of November 14, 2018. These estimates are based on a preliminary version of the bill in which the credit for heads of household phased out between $80,000 and $100,000. Updated tables that show the credit for head of household filers phasing out from $60,000 to $80,000, consistent with S.4 – 116th Congress (2019-2020) and S. 3712 – 115th Congress (2017-2018) are now available. Estimates are shown for fiscal years and calendar years 2019-2038.

Image

T18-0228 - Distributional Effect of Senator Kamala Harris' LIFT (Livable Incomes for Families Today) the Middle Class Act, By Expanded Cash Income Level, 2019

T18-0229 - Distributional Effect of Senator Kamala Harris' LIFT (Livable Incomes for Families Today) the Middle Class Act, By Expanded Cash Income Percentile, 2019