(37 KB)

Display Date

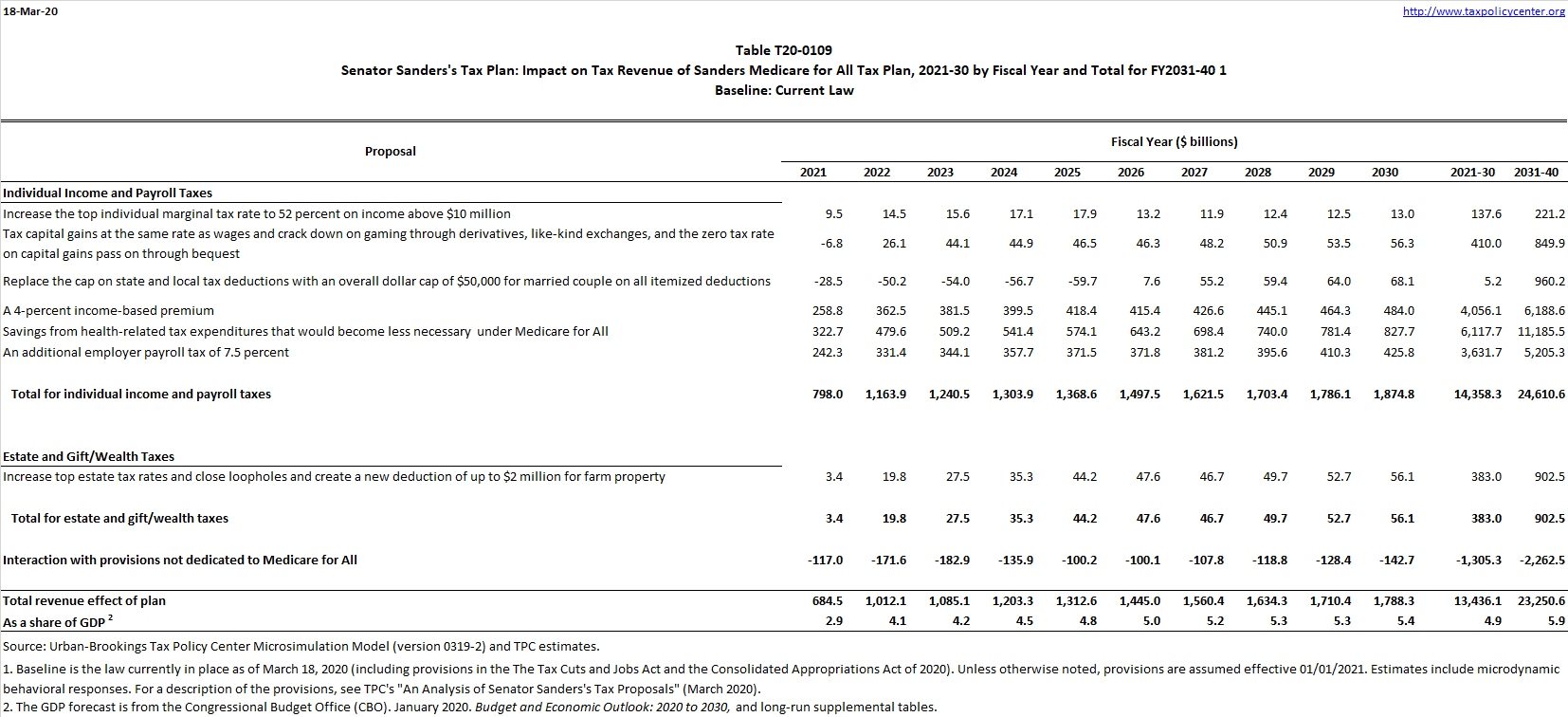

Impact of Senator Sander's tax plan to fund Medicare for all on federal tax revenue relative to current law as of March 18, 2020.

Image

T20-0108 - Senator Sanders's Tax Plan: Impact on Tax Revenue, Excluding Provisions Dedicated to Finance Medicare for All, 2021-30 by Fiscal Year and Total for FY2031-40

T20-0110 - Senator Sanders's Tax Plan, Excluding Provisions Dedicated to Finance Medicare for All: Distribution of Federal Tax Change by Expanded Cash Income Level, 2021

T20-0111 - Senator Sanders's Tax Plan, Excluding Provisions Dedicated to Finance Medicare for All: Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

T20-0112 - Senator Sanders's Tax Plan, Excluding Provisions Dedicated to Finance Medicare for All: Distribution of Federal Tax Change by Expanded Cash Income Level, 2030

T20-0113 - Senator Sanders's Tax Plan, Excluding Provisions Dedicated to Finance Medicare for All: Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2030