(311.5 KB)

Display Date

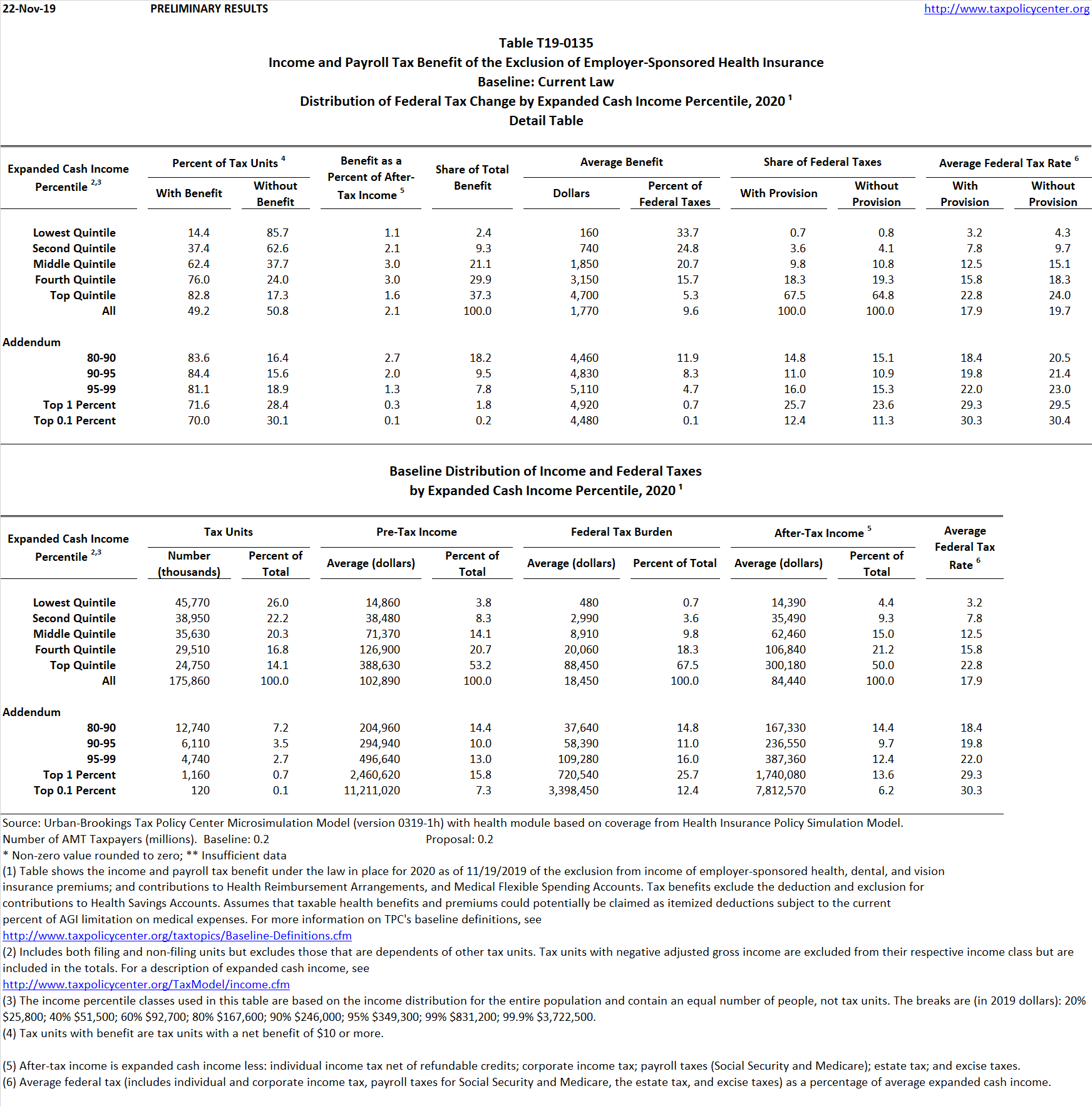

Table shows the income and payroll tax benefit under the law in place for 2020 of the exclusion from income of employer-sponsored health, dental, and vision insurance premiums; and contributions to Health Reimbursement Arrangements, and Medical Flexible Spending Accounts.

Image