(340.5 KB)

Display Date

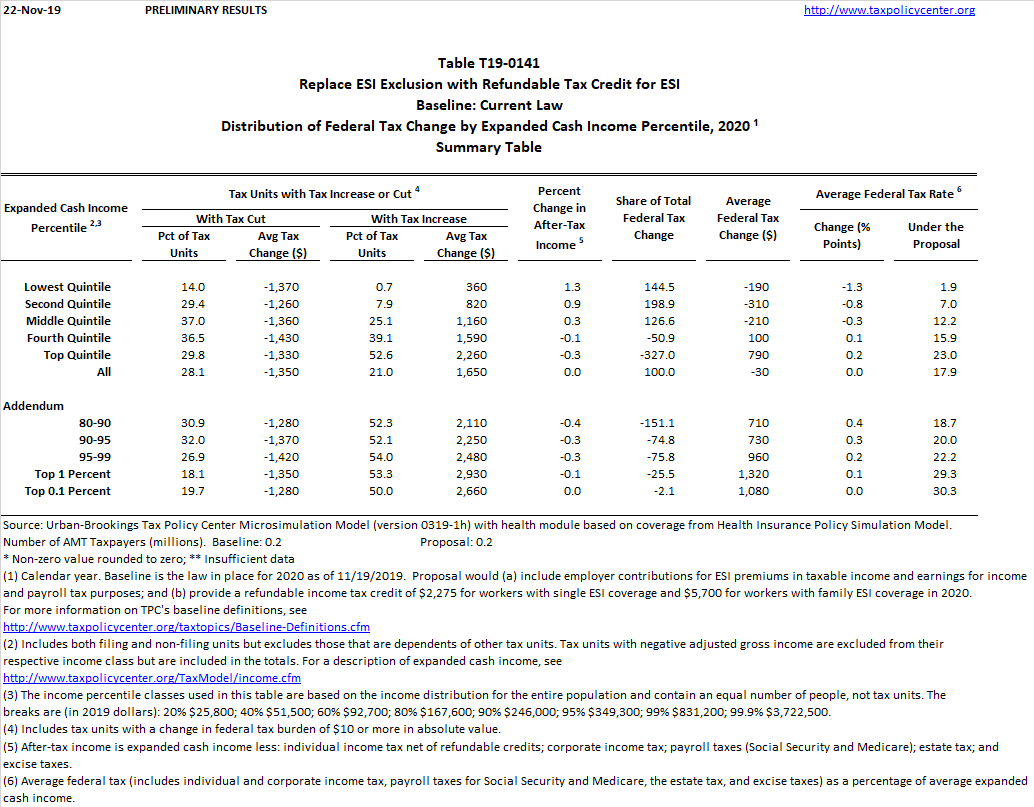

Table shows distributional effects of (a) including employer contributions for ESI premiums in taxable income and earnings for income and payroll tax purposes; and (b) providing a refundable income tax credit of $2,275 for workers with single ESI coverage and $5,700 for workers with family ESI coverage in 2020.

Image

T19-0139 - Tax Benefit of Medical Expense Deduction, by Expanded Income Cash Percentile, 2020

T19-0140 - Limit Income and Payroll Tax Exclusion for Employer-Sponsored Health Insurance above 50th Percentile of Premiums, by Expanded Income Cash Percentile, 2020

T19-0142 - Baseline Effective Marginal Tax Benefit of Employer Contributions to Health Insurance Premiums, by Expanded Income Cash Percentile, 2020