(213.5 KB)

Display Date

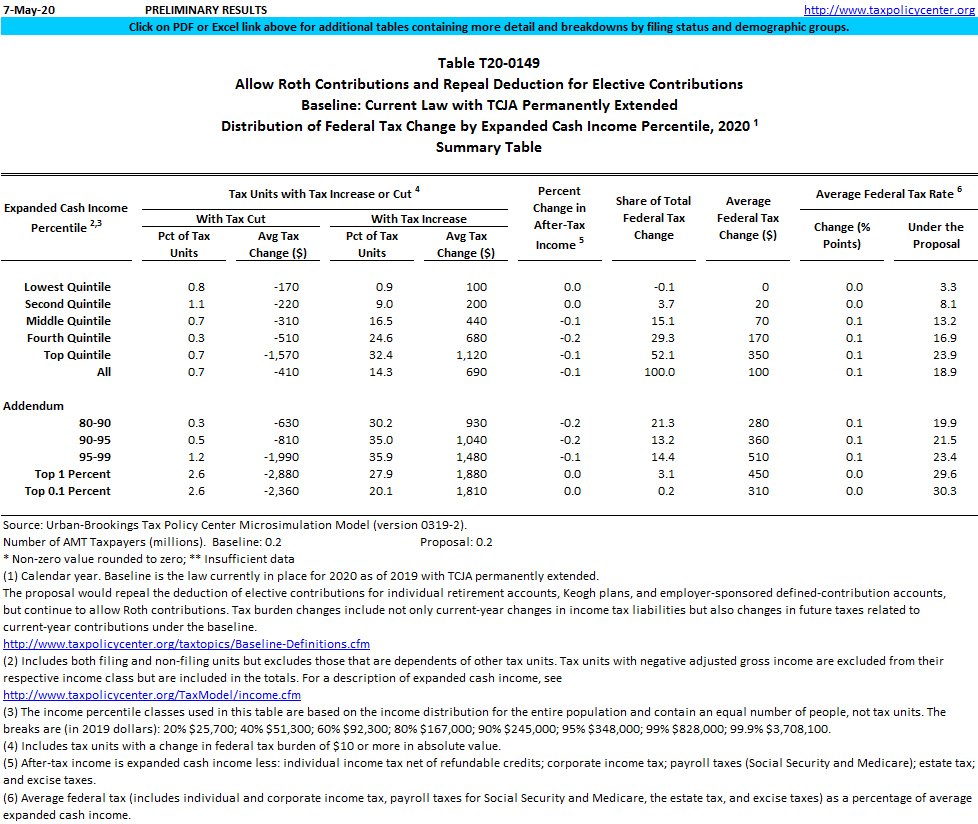

The proposal would repeal the deduction of elective contributions for individual retirement accounts (IRAs), Keogh plans, and employer-sponsored defined-contribution accounts, but continue to allow Roth contributions. Tax burden changes include current-year changes in income tax liabilities and also account for changes in future taxes related to current-year contributions under the baseline. Baseline is the law in place as of December 18, 2019, with the Tax Cuts and Jobs Act of 2017 (TCJA) permanently extended.

Image

T20-0138 - Eliminate Deductions for New Contributions to Retirement Saving Plans, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0148 - Replace Deductible Defined-Contributions with Revenue-Neutral Nonrefundable Expanded Savers' Credit, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0147 - Replace Deductible Defined-Contributions with Revenue-Neutral Refundable Expanded Savers' Credit, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0146 - Limit Maximum Defined-Contribution to $20,000 and Repeal Catch-Up Contributions, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0145 - Limit Maximum Defined-Contribution to $15,000 and Repeal Catch-Up Contributions, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0144 - Limit Maximum Defined-Contribution before Catch-Up Contributions to $20,000, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0143 - Limit Maximum Defined-Contribution before Catch-Up Contributions to $15,000, Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0142 - Eliminate Tax Expenditures for Retirement Saving Plans (Present Value Method), Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0141 - Eliminate Tax Expenditures for Retirement Saving Plans (Alternative Cash-Flow Method), Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0140 - Eliminate Tax Expenditures for Retirement Saving Plans (Treasury/JCT Method), Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0139 - Eliminate Deductions for New Contributions to Retirement Saving Plans, Baseline: Current Law, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

T20-0150 - Allow Roth Contributions and Repeal Deduction for Elective Contributions (No Change in Future Taxes), Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020