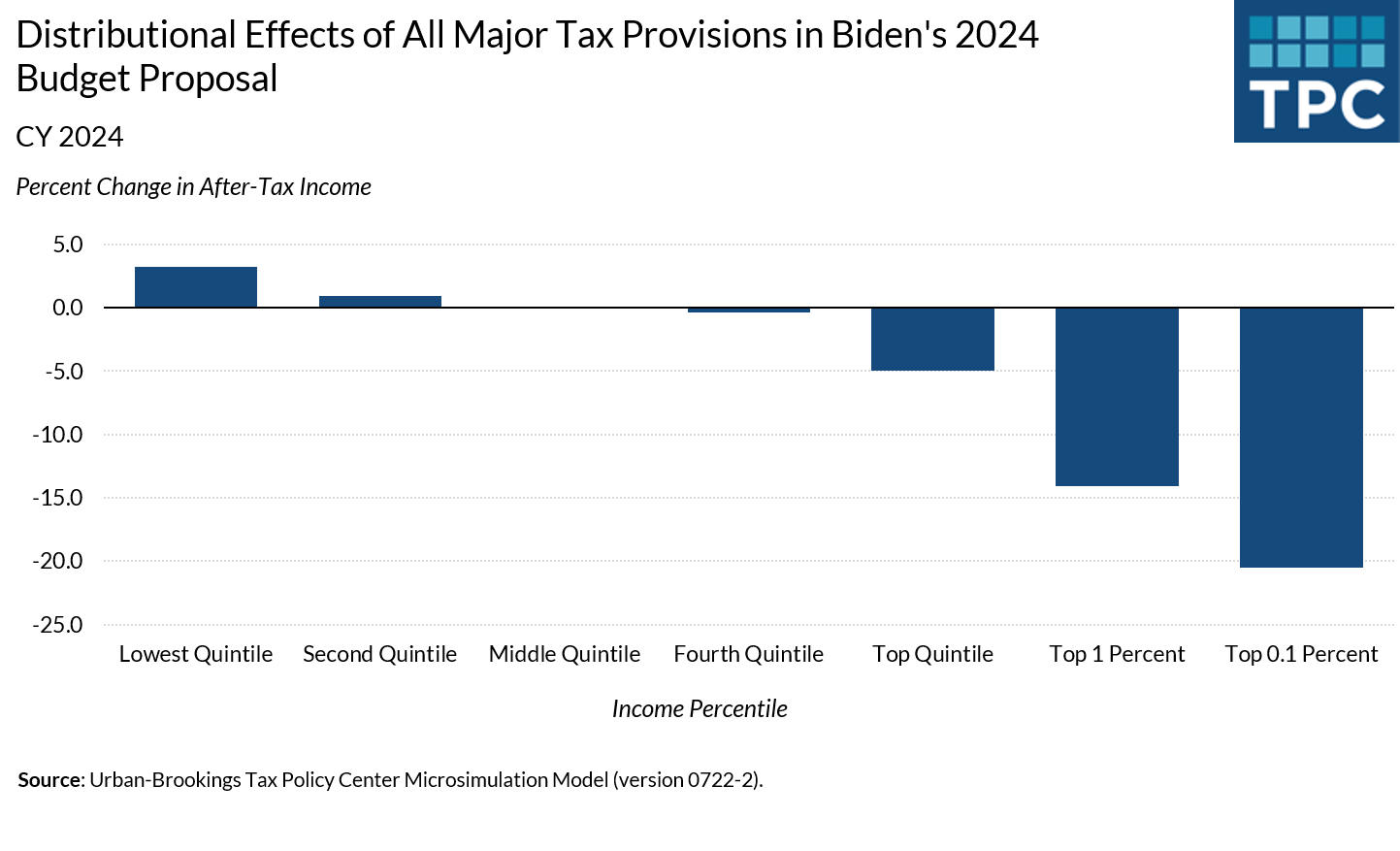

The revenue provisions of President Biden’s fiscal year 2024 budget would lower after-tax incomes by an average of about $2,300 next year, according to a new analysis by the Tax Policy Center. His plan would raise average after-tax incomes for low-income households in 2024, leave them effectively unchanged for middle-income households, and lower after-tax incomes significantly for the highest-income taxpayers.

If you look only at Biden’s proposed changes in direct taxes on households, including individual income taxes, payroll taxes, and estate taxes, the average tax increase falls by more than half, to about $1,100. Low- and moderate-income households would get slightly larger tax cuts and very high-income households would face a smaller tax hike than with all tax changes. This calculation excludes corporate tax increases, which TPC assumes indirectly affect workers and shareholders by lowering their future wages and investment income.

Biden’s Pledge

Since his 2020 presidential campaign, Biden has insisted he would not raise taxes for households making $400,000 or less. His changes in direct taxes largely achieve that goal, though a very small fraction of households making less than that threshold would pay more. If all of his proposed tax changes are included, he’d fall short, though Biden never made clear exactly which was his goal.

Note that TPC looked at incomes above and below about $410,000 since that reflects the 95th income percentile. But households making $400,000 are very similar to those with incomes of $410,000.

The picture is roughly the same in 2026, after many individual provisions of the 2010 Tax Cuts and Jobs Act (TCJA) are scheduled to expire. However, average tax hikes for high-income households would be somewhat smaller while low-and moderate-income households would pay a bit more in 2026 than in 2024. Keep in mind that Biden and congressional Republicans say they want to extend at least some of those TCJA tax cuts, though his budget did not do so.

The top 1 percent, with at least roughly $1 million in income, would pay an average of $300,000 more than under current law, dropping their after-tax incomes by 14 percent. Those in the top 0.1 percent would pay almost $2 million more on average, a 20 percent reduction in after-tax incomes.

For direct tax changes only, the lowest-income households would see their after-tax incomes rise by an average of about $650 or 3.6 percent. Middle-income households would pay about $500, or roughly 0.7 percent, less on average. The highest 0.1 percent would pay an average of $1.6 million more in individual income, estate, and payroll taxes, cutting their after-tax incomes by a bit more than 16.5 percent.

Winners And Losers

Overall, Biden’s tax provisions would reduce after-tax incomes for nearly two-thirds of households. But for those making less than $410,000, nearly all of that decline would be due to their share of the corporate tax hikes.

By contrast, individual income, payroll, and estate taxes alone would raise taxes on only about 2 percent of households. And nearly all of them will make $410,000 or more. Nearly 40 percent of the lowest-income households and almost one-quarter of middle-income households would get a tax cut.

The Big Drivers

Biden’s proposed tax cuts include expansions of the Child Tax Credit (CTC) and the Earned Income Tax Credit (EITC), both of which primarily benefit low- and moderate-income households. TPC estimates a smaller overall benefit from Biden’s CTC changes than the Administration, in part because TPC was unable to model some proposed CTC revisions. Those features could significantly affect the CTC proposal’s cost and distributional impact.

The biggest single source of tax hikes on high income households is Biden’s proposal to raise the top rate on capital gains from 20 percent to 39.6 percent.

Other important tax increases for high-income households: Biden’s proposed increase in the top rate for wages and salary income to 39.6 percent, and his proposed expansion and rate hike for the Net Investment Income Tax. Biden’s minimum tax on individuals with more than $100 million in wealth affects only about 20,000 households but would be substantial tax increase for those who get hit.

Finally, as investors and highly paid workers, high-income households would pay a larger share of Biden’s proposed corporate income tax increases. They include a higher corporate income tax rate and tough new tax rules on US-based multinational corporations.

The president is nothing if not consistent. As Biden has made clear since his 2020 campaign, he wants to raise taxes substantially on high-income households and corporations and provide modest tax cuts to low- and moderate-income households. And, like it or not, that’s what his budget does.