Under a plan to temporarily expand the child tax credit (CTC), unveiled by Senate Finance Committee Chair Ron Wyden (D-OR) and House Ways and Means Committee Chair Jason Smith (R-MO), households who would benefit would see an average tax cut of $680 in 2023, according to new Urban-Brookings Tax Policy Center model estimates.

The agreement released this week also includes business tax changes and other assorted measures. TPC’s analysis of the overall bill is forthcoming.

The current CTC offers a tax break of up to $2,000 per child, with as much as $1,600 available as a refund. The credit phases in with each dollar a taxpayer earns above $2,500 annually. Low-income families typically owe little to no income tax, limiting the CTC benefits they can receive. The new proposal would phase in the credit faster for families with more than one eligible child and raise the amount of the credit available as a tax refund. TPC’s Elaine Maag discusses those policy changes in further detail here (see Options 2 and 3). The Wyden-Smith deal would also index the CTC to inflation.

The American Rescue Plan Act of 2021 (ARPA) temporarily increased the value of the CTC and made it fully refundable, allowing all households with kids to access the maximum credit amount regardless of earnings. Previous TPC analysis has shown that about 19 million children receive less than the full credit under the current CTC because their families earn too little. Attempts to reinstate the ARPA version of the CTC ran into opposition over the fiscal cost and concerns about a more generous credit reducing work incentives.

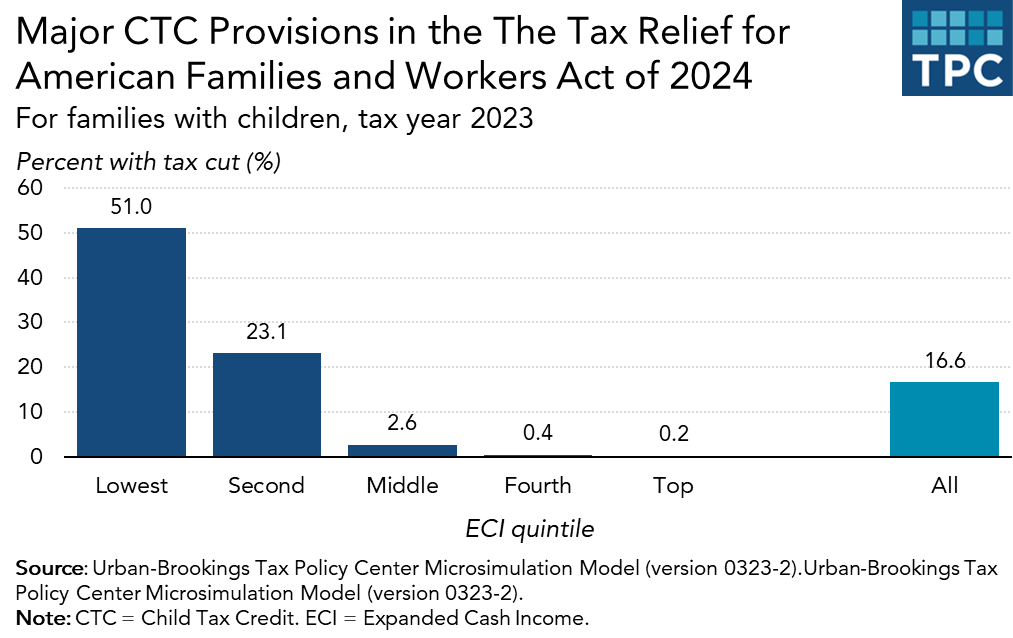

Assuming the new legislation passes in time to implement it in the upcoming filing season, most of the benefits for 2023 would go to households in the two lowest income quintiles. About half of households with children in the lowest income quintile (income below $21,000 a year) would see a tax cut from the CTC change in 2023, along with almost a quarter of households with children in the second lowest income quintile (income below $40,500 a year).

By 2025, many middle and higher-earning households would also see a tax cut, due to the provisions adjusting the CTC for inflation. However, those in the bottom two quintiles would still see more of the benefits, both as a percent change in after-tax income and in raw dollar terms.

In exchange for the CTC expansion through 2025 and changes to the low-income housing tax credit, Republicans have pushed for restoring more generous versions of business tax breaks that were temporarily implemented as part of the 2017 Tax Cuts and Jobs Act (TCJA).

When the TCJA was enacted, firms could immediately deduct investment costs for new equipment and machinery. However, that tax break has already started to phase down (it will revert to prior law at the start of 2027). The TCJA also placed limits on the ability of firms to deduct their interest expenses and now requires firms to deduct R&D expenses over several years, instead of immediately when the costs are incurred.

TPC modeled potential reforms to these business provisions in late 2022, when talks of a negotiation including the CTC first surfaced. At the time, we projected the costs of these policy changes on a permanent basis. The Wyden-Smith proposal only extends through the end of 2025, at which point all of the TCJA’s individual income tax provisions are set to expire. As more information becomes available on the new framework, TPC will publish additional analyses and model estimates.