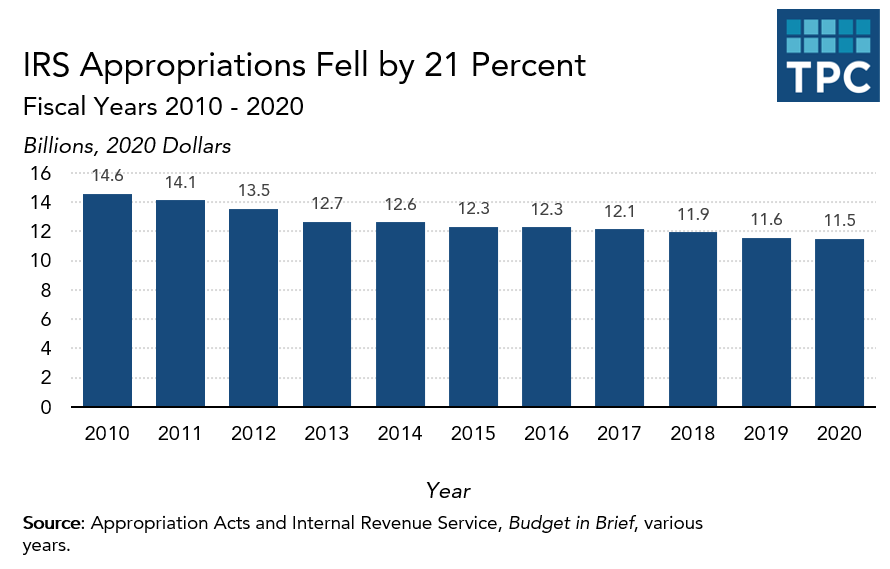

The fiscal 2020 budget signed into law December 20, 2019 is a big disappointment for tax administration, continuing the over 20-percent inflation-adjusted decline in IRS funding since 2010 that has eroded enforcement, reduced audits, and handicapped performance.

Here are the key takeaways for tax administration:

First, overall IRS funding increases by $207 million from Fiscal Year 2019, to $11.5 billion. While this 1.8 percent increase over last year is not a surprise, it is a big disappointment. It comes up on the short end of splitting the difference between the IRS budget recommended in bills passed earlier by the House ($12 billion) and Senate ($11.4 billion). And it fails to keep pace with expected inflation for 2019-2020. Moreover, a 3.1 percent pay increase for federal civilian workers will absorb virtually all of the modest boost for the labor-intensive IRS, where two-thirds of the budget goes to staffing.

This year’s IRS appropriation is just more of what we’ve seen over a decade of decline. Compelling articles by ProPublica on the gutting of the IRS have reported that “An eight-year campaign to slash the agency’s budget has left it understaffed, hamstrung and operating with archaic equipment.”

Second, Congress kept a tight lid on each of the four parts of the IRS budget.

- Taxpayer Services funds will increase by a meager 0.8 percent, or $20 million, to $2.51 billion, a drop in real (inflation-adjusted) resources. So don’t expect any shorter wait times on IRS phone lines or much progress toward online accounts. Anemic support for customer service weakens voluntarily compliance. One bright spot: Matching grants for free tax preparation programs increase to $48 million, with a nearly 40 percent jump for VITA (Volunteer Income Tax Assistance)—a victory for grass-roots lobbying by low-income-taxpayer advocates. Volunteers prepared 3.6 million returns in 2019.

- Enforcement funds are up 3.1 percent to $5 billion, which may slow the plunge in audits of high-income taxpayers and large corporations and help trim the nearly $600 billion gap (at projected 2020 levels) between taxes due and those paid on time, but not by much. Audits are down by more than half since 2010 to the lowest level in at least four decades; enforcement staff is down by a third. Yet enforcement funds can more than pay for themselves through increased collections, so skimping on enforcement may be a self-defeating gift to scofflaws.

- Operations Support funding edges up by 2.3 percent to $3.81 billion, $290 million less than the 11 percent increase requested by the administration. These funds cover finance, accounting, human resources, real estate, research, and other non-taxpayer-facing activities.

- Business Systems Modernization dollars grow by 20 percent but only to $180 million, $130 million less than the administration’s request, slowing a proposed six-year infrastructure upgrade program. The IRS still relies on nearly 60-year old databases; half of IRS hardware is obsolete; and, as of 2017, a third of its software was at least two updates overdue. Increased investment in modernization is crucial to keep the IRS functioning.

In presenting the administration’s FY 2020 IRS budget, Treasury Secretary Mnuchin said his goal was to “deliver a customer experience comparable to the best financial institutions in the world.” But if reaching that goal depends on more resources, it’s hard to see how the new budget will advance it very rapidly.

Former IRS Commissioner John A. Koskinen (2013-2017) regularly warned Congress of the rising risks of reduced resources, calling budget cuts “penny wise and pound foolish.” Current Commissioner Chuck Rettig’s response has been more muted.

But whether the reaction is protest or silence, there is ample cause for alarm.

The IRS remains a deeply challenged agency with reduced resources, nearly half of senior executives eligible for retirement, outdated computer systems, and facing more than a billion cyberattacks yearly and an identity theft refund fraud epidemic. It’s playing catch-up in halting tax shelters and income-shifting to offshore tax havens, and at high risk of filing season glitches affecting over 155 million individual taxpayers.

The FY 2020 budget keeps the IRS on a steadily declining course, a path far from the breakthroughs needed to make it a fully functional 21st century tax agency.