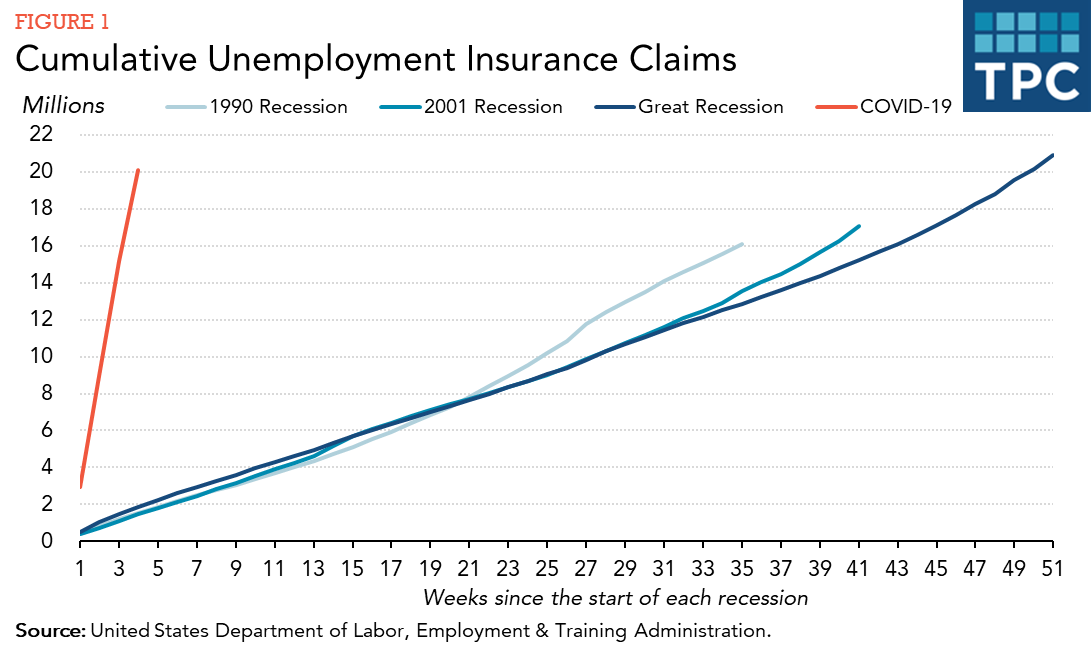

How rapidly is the economy collapsing in the wake of the COVID-19 pandemic? In just the past four weeks, total weekly unemployment insurance claims were higher compared to any point in the 1990's and 2001 recessions and exceeded the first 50 weeks of claims in the 2008-2009 Great Recession. As of April 11, about 20 million workers lost their jobs largely due to the virus itself and government efforts in 43 states to limit its spread by closing businesses and issuing stay-at-home orders.

There is wide variation in claims across the states. Unemployment insurance claims exceed those filed during the first 50 weeks of the Great Recession in 31 states and the District of Columbia. In six states – Georgia, Louisiana, Massachusetts, Minnesota, Texas, and Washington – claims are now at least 100,000 higher than they were over the first 50 weeks of the Great Recession. State-by-state numbers and trends are available upon request.

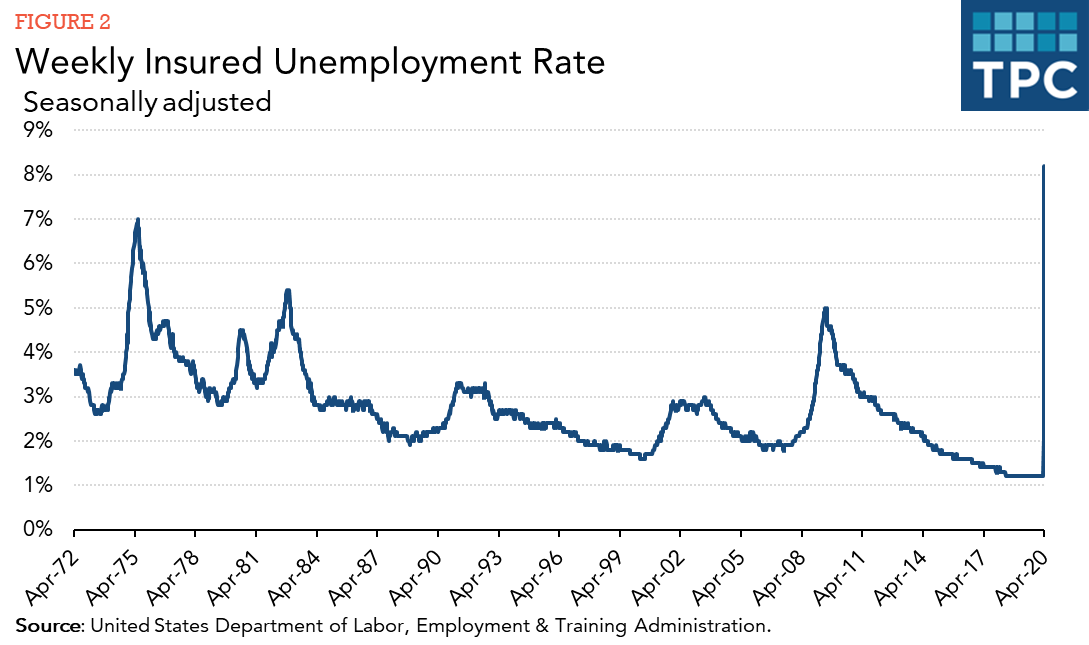

The seasonally adjusted insured unemployment rate jumped to 8.2 percent for the week ending on April 4, which is the highest level in at least 45 years.

So many unemployment insurance claims in such a short period of time put an enormous administrative and financial burden on states. They must process and pay claims and provide those who have lost their jobs various public benefits, all while their revenue base is falling rapidly. In three recent measures aimed at providing some economic relief, Congress provided some funding for unemployment benefits as well as some other financial support to the states, but it is far less than what the states need.

It is likely to take many months—or even years—for an economic recovery to fully take hold. If commerce can gradually resume, we may see a slowing of the rate of new unemployment claims, but it will be a long time before those 20 million newly unemployed will be back to work.