The recent compromise between Republicans and Democrats on extending the federal debt limit was hailed for avoiding the disaster of a default, demonstrating that both parties can work together on some issues, and modestly reducing the nation’s deficits.

Still, analysts at the Center for a Responsible Federal Budget, the Concord Coalition, and the Bipartisan Policy Center have concluded the deal’s debt reduction is quite small. And the rules put into place to achieve that modest goal are likely to be overridden by future congressional action.

Here is a simple corollary to those observations: the debt ceiling agreement makes only modest changes in the allocation of federal budget dollars. And those changes go in the wrong direction.

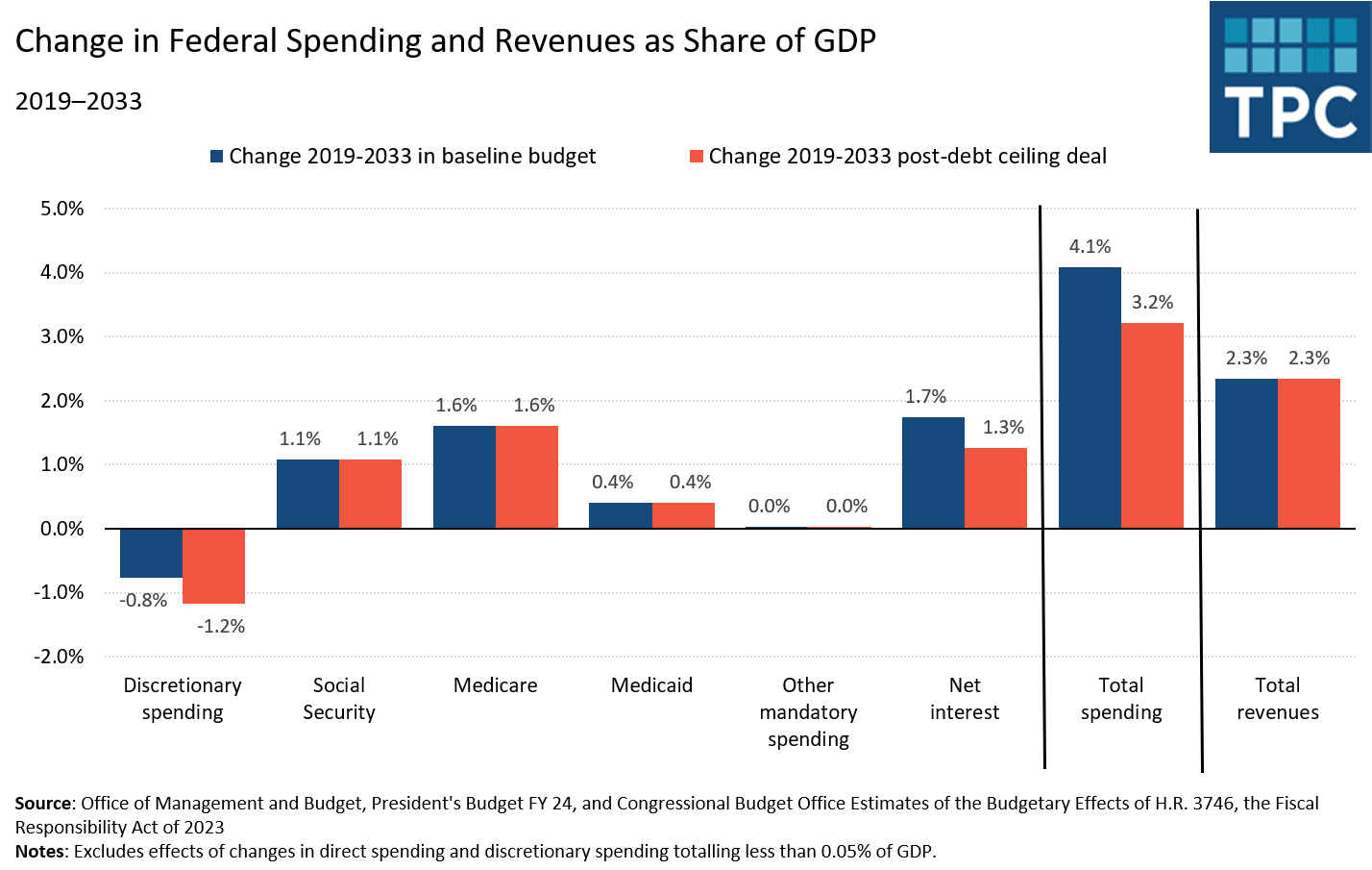

This budget agreement failed to touch the major items of spending growth, health and Social Security. Both remain on an unsustainable path. Instead, it simply cut discretionary spending items, both defense and non-defense, that have already been cut significantly as a share of national income over the past few decades (see graph, which compares the resulting significant growth in net spending and revenues in 2033, as a share of GDP, relative to their levels in the pre-pandemic year, 2019).

The chart also shows how modest changes can compound over time to produce important savings in annual interest costs.

Let’s be clear about what’s driving things. Every year that mandatory health care and retirement program reforms are put off, the unsustainable trajectory gets harder to fix. Why? As spending rises in the near- and long-term, beneficiaries and providers of services become accustomed to higher payments and more dependent upon these programs. For instance, the extra increase in prescription drug coverage or retirement benefits for new retirees can’t easily– and often shouldn’t – be retracted in future years. That makes even larger the required future revenue increases or spending cuts needed to attain a sustainable budget.

Moreover, overreliance on cutting discretionary spending risks hampering those portions of the budget more likely to be growth oriented. Many investments, whether in research, preventative healthcare, education, or infrastructure, take place on the discretionary side of the budget. Successful efforts produce a return over time that becomes lost when the investment doesn’t take place.

In a dry and parched land, legislators need to do more than bring leaky buckets to contain the threat of the fire that could stretch well beyond that arid soil.