The direct payments (called recovery rebates) included in the Senate’s latest coronavirus stimulus plan would target two-thirds of their benefits to low- and middle-income households, according to a new analysis by the Tax Policy Center. All households with incomes of about $91,000 or less would be eligible for the payments under the bill.

The provision is one piece of a massive measure proposed Sunday by Senate Majority Leader Mitch McConnell (R-KY) that is aimed at stabilizing the disease-ravaged economy. It would give payments of $1,200 to each adult and $500 to each child under age 17, generally based on 2019 income. It would begin to phase out for individuals with adjusted gross income of $75,000 ($150,000 for couples filing jointly and $112,500 for single parents). While lawmakers appeared to largely agree on the direct payment provision, the overall bill stalled in the Senate as the result of partisan disputes over unrelated issues.

The version proposed on Sunday was a big improvement from a plan McConnell proposed last Friday. That proposal would have made the full payment available only to those who paid taxes in 2018, and, as a result, would have reduced the assistance for about 40 percent of households—primarily those with low- and moderate-incomes who most need extra cash to pay for rent, food, health care, and other daily living expenses.

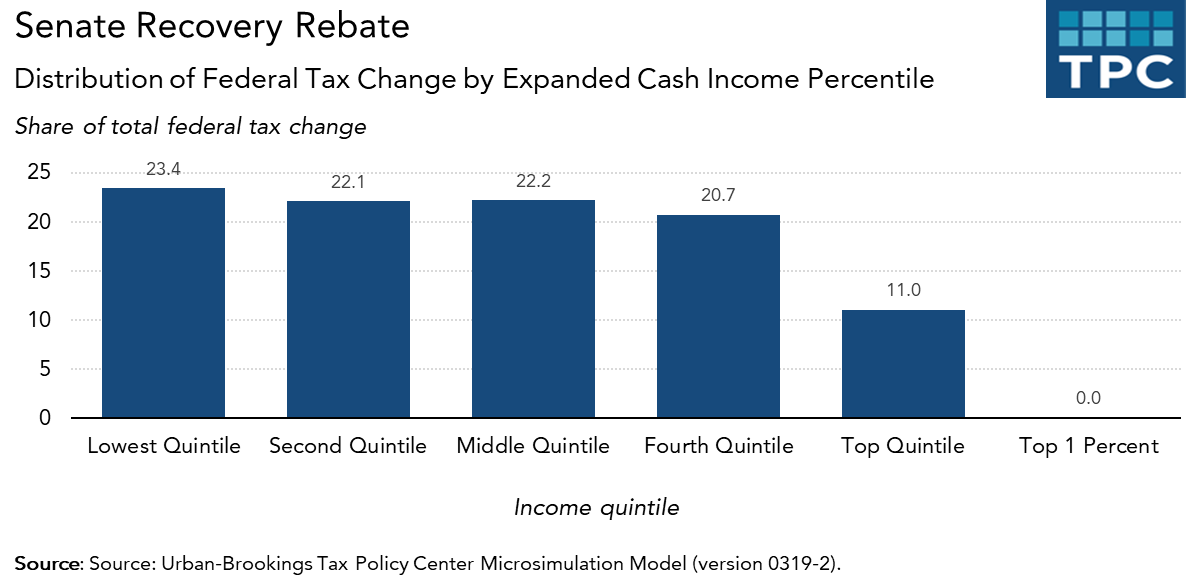

Under Sunday’s version, low- and middle-income households would receive about 68 percent of the payments. Because of the income-based phase-outs, the top 20 percent of households (those with incomes of $163,000 or more) would get only about 11 percent of the benefits , and the top 1 percent would get none.

TPC found that the lowest-income households (those with incomes of about $25,000 or less) would receive an average payment of $1,480 and their after-tax income would increase by nearly 11 percent. Middle-income households (those making between about $51,000 and $91,000) would get a payment of about $1,810, on average, or about 3 percent of their after-tax income.

TPC’s estimates assume that all of those eligible for a payment receive one. However, it is likely that some will not, perhaps because they did not file a tax return or receive a Social Security benefit in 2019. Even though the payment could be based on 2018 or 2020 income tax returns for those who did not file in 2019, there still will be some who may not get payments, perhaps because they did not file returns for those years, are unbanked, or may have moved.

The overall stimulus package is big, complicated, and still very controversial. But senators seem to have found a relatively simple and well-targeted way to get money into the hands of those who need it most.