State revenue growth was strong in fiscal year 2019 (July-June for 46 of the 50 states), but not as robust as in 2018. And temporary revenue increases for fiscal year 2019 combined with a slowing economy suggests revenue growth in fiscal 2020 may be weaker still.

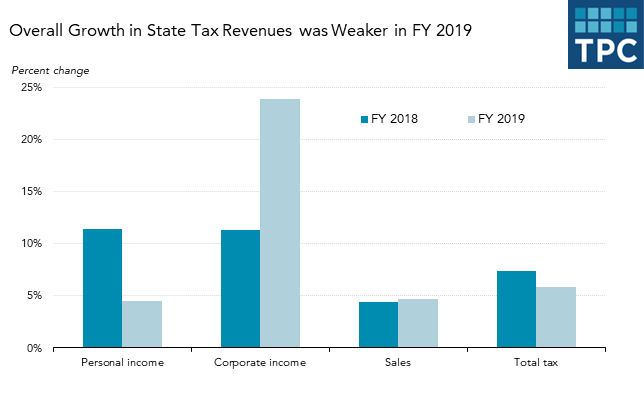

According to preliminary data collected by the Tax Policy Center, total tax revenue grew by 5.8 percent in fiscal year 2019, compared to 7.4 percent in fiscal 2018. However, there was wide variation by state and by revenue source. Overall, personal income tax revenues grew at less than half the pace in fiscal 2019 as compared to fiscal 2018; sales tax revenues grew at roughly the same rate; and corporate income tax revenues increased by 24 percent, more than double the rate of the prior year.

The best fiscal news in 2019 may have been that nearly all states managed to approve their budgets on time for the second year in a row. Only New Hampshire and North Carolina failed to meet their deadlines. Solid revenue growth made budget decision-making relatively easy.

However, state tax revenues saw large fluctuations in the timing of income tax payments throughout 2019, largely due to federal tax changes from the 2017 Tax Cuts and Jobs Act (TCJA).

Personal income tax revenues grew by 4.5 percent in fiscal year 2019, despite a dip in December 2018 and January 2019 that reflected later than normal tax filing and associated payments. Taxpayers may have delayed filing as they tried to understand the impact of the TCJA on their state taxes. The volatility in income tax collections may also have been caused by some high-income taxpayers who accelerated state income tax payments into calendar year 2017 to take advantage of the full deductibility of the state and local taxes, which the TCJA capped at $10,000 beginning in 2018. (For more discussion of the TCJA’s impact on state income tax payments, please read Urban Institute’s State Tax and Economic Review quarterly reports).

Corporate income tax revenues surged, growing about 24 percent in fiscal year 2019. While most states reported double-digit growth rates, corporate income tax revenues remained a small share of total state tax revenues. The unprecedented growth in corporate income taxes was driven largely by the recent federal tax changes, which created a strong, but temporary, revenue surge. The TCJA reduced the federal corporate income tax rate from 35 percent to 21 percent, which created an incentive for corporations to shift profits from 2017 into 2018, temporarily boosting state tax revenues (because states generally did not reduce their corporate income tax rates). The strong corporate income tax performance also was driven by the TCJA’s taxation of deemed repatriated foreign corporate earnings (which increased the corporate tax base for both federal and state systems).

State sales tax revenues grew 4.7 percent in fiscal year 2019, slightly faster than the 2018 pace of 4.4 percent. There were two primary reasons: First, states moved aggressively in the wake of the US Supreme Court’s Wayfair decision that allowed them to require remote retailers to collect sales taxes on purchases by buyers inside the state. Second, by cutting taxes for the vast majority of households, the TCJA put money into consumers’ pockets, much of which they likely spent on products or services subject to state sales tax.

Overall, most states ended fiscal year 2019 in a good place. However, state revenue forecasters are predicting weaker growth in income tax revenues in fiscal year 2020, reflecting the temporary nature of some of the prior increases, uncertainty about trade policy, and a slowing US economy. It makes sense for states to be cautious about their fiscal futures.