Prior research has shown that criminal legal fines and fees can impose significant harm on the well-being of families across the US.

The latest data from the US Census Bureau shows where, and to what extent, places are relying on fines and fees for revenues. That knowledge can help policymakers, advocates, and other stakeholders understand where fines and fees fit in current revenues and to design more effective and equitable policies.

1. Nearly $14 billion in fines, fees, and forfeitures make up a small portion of state and local budgets

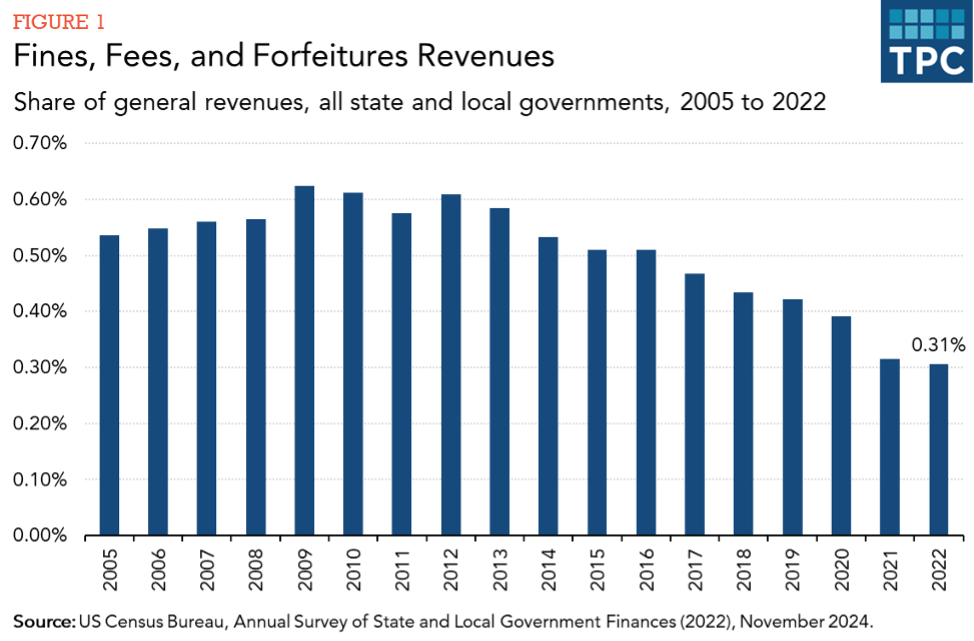

Every five years, the Census releases revenue and spending information for each county, city, town, special district, and school district in the US. The latest release of fiscal year 2022 data reveals nearly 20,000 local governments and 50 states collected a combined $13.9 billion from criminal legal fines, fees, and forfeitures in 2022.

Between 2017 and 2022, fines and fees revenues collected remained about the same while state and local budgets grew. As a result, fines and fees revenues comprised only 0.3 percent of state and local general revenue in 2022, the lowest share in 17 years.

2. At the state level, fines and fees are a small revenue stream compared to taxes

Revenues from fines and fees comprised just 0.2 percent of total state general revenues in 2022, far less revenue than from income taxes, sales taxes, property taxes, and motor vehicle licenses.

In terms of dollars collected, California ($966 million), North Carolina ($327 million), and New York ($326 million) raised the most fines and fees revenues in 2022. Notably, California has eliminated various criminal legal fees since 2020, which is likely to show up in subsequent years’ data.

But as a share of state general revenues, Colorado (0.6 percent), Louisiana (0.4 percent), and Maryland (0.4 percent) relied the most on fines and fees.

3. Smaller cities rely more on fines and fees

Smaller cities, towns, and villages were more reliant on fines and fees than larger cities in 2022.

Anacoco, Louisiana, and Linndale, Ohio, villages with less than 1,000 residents each, raised over 90 percent of their budgets from fines and fees. Anacoco is located near a major highway and spends a significant portion of its budget on law enforcement activities. Linndale, too, has been in the news for its speed trap.

Two small Texas municipalities, Cumby and Richland, also relied on fines and fees for over 70 percent of their general revenues in 2022.

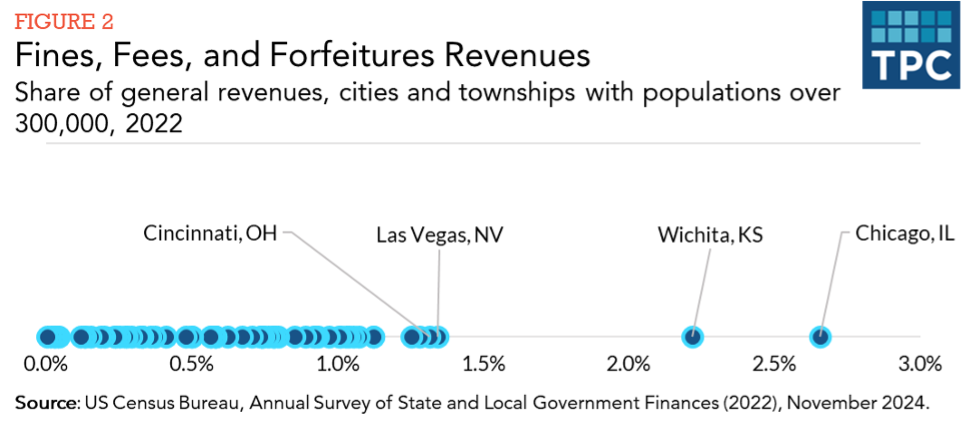

4. New York City collected over $1 billion, and Chicago was an outlier

In dollars collected overall, New York City ($1.2 billion) was the only jurisdiction nationwide to raise over $1 billion from fines and fees. Chicago ($309 million) and the District of Columbia ($169 million) collected the next most city-level fines and fees revenues in 2022.

Chicago’s share of general revenue from fines and fees was 2.7 percent, compared to under one percent for most large cities. Prior reporting has shed light on Chicago’s fines and fees, including racial disparities in its traffic ticketing practices.

5. School districts collect fines and fees too

Per the US Census Bureau, three school districts in Texas—Barbers Hill, Gregory Portland, and Houston—raised over $20 million each from fines and fees in 2022, despite decade-old state legislation barring on-campus misdemeanor citations.

Gregory Portland School District in Texas was among those most reliant on fines and fees as a portion of their budgets, along with Oklahoma’s Banner and Indiahoma school districts. Oklahoma’s Republican Governor Kevin Stitt has led statewide discussions to eliminate various fines and fees reforms in recent years.

Prior reporting in Illinois has also shown the harms from local police involvement issuing thousands of tickets each year for truancy, vaping, and fights.

What are states and localities doing about fines and fees?

Revenues from fines and fees do not paint a full picture of their implications because many go unpaid: six percent of all US families owe money for unpaid fines and fees, and criminal legal debts exceed $27 billion.

Further, fines and fees can unjustly burden Black, Latine, and other historically underserved families and create conflicts of interest for law enforcement and courts.

In 2023, the US Department of Justice issued guidance to state and local courts and government agencies on various legal and policy concerns with fines and fees. Investigations into Ferguson, Missouri, Lexington, Mississippi, and Brookside, Alabama, have revealed disproportionate harms from local fines and fees.

Many states and localities across the country have acknowledged these harms, eliminating certain fees and also addressing their nonfinancial consequences.

Knowing how much money is at stake and which places may be relying more on fines and fees revenues may help policymakers, advocates, and other stakeholders identify alternative revenue sources or reduce the financial and nonfinancial costs from fines and fees to remedy their harms.