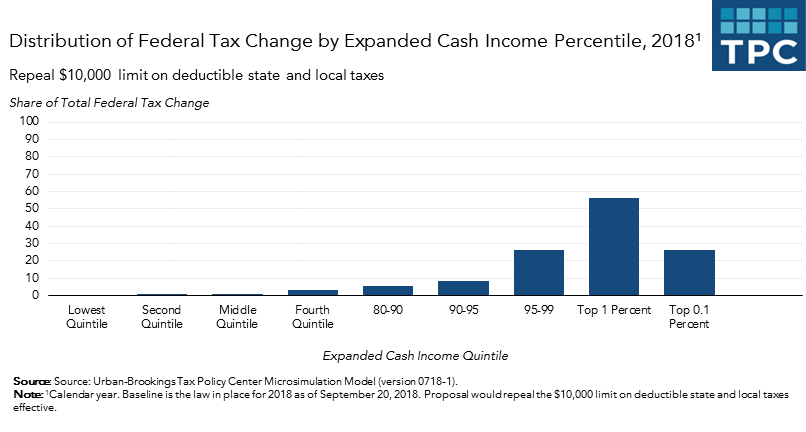

Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Act’s (TCJA) $10,000 cap on the state and local property tax (SALT) deduction, and more than 96 percent of the tax cut would go to the highest-income 20 percent of households, according to a new analysis by the Tax Policy Center. The top 1 percent of households, those making $755,000 or more, would receive more than 56 percent of the tax cut. TPC estimated repeal would reduce federal tax revenues by $620 billion between 2018 and 2028.

TPC found about 45 percent of households in the top 20 percent of the income distribution (who make $153,000 or more) would get a tax cut if the SALT cap is repealed, as would more than 9 of every 10 households in the top 1 percent. By contrast, only about 3 percent of middle-income households (who make between $49,000 and $86,000) would pay less in taxes than if the SALT deduction cap is retained.

Repealing the SALT deduction cap would cut taxes by an average of about $370, but that’s largely because so many households would get no benefit at all. Among all those whose taxes are reduced, the average tax cut would be about $4,100. For all middle-income taxpayers, the average tax cut would be $10. Those in the top 1 percent would pay an average of $31,000, or 2 percent of after-tax income, less. Among those who get a tax cut, middle-income households would pay an average of $360 less while those in the top 1 percent would pay an average of about $34,000 less.

By allowing taxpayers to take the full SALT deduction, Congress would also increase the number of itemizers, which was cut sharply by the TCJA. This year, about 17.9 million households are expected to itemize. If the SALT cap is repealed, 21.9 million would do so. That would rise to 29.2 million by 2025.

By 2025, about 12 percent of all households would get a tax cut if the SALT cap is repealed. About 5 percent of middle-income households would get a tax cut, roughly twice as many as in 2018. But the basic pattern would remain unchanged. Nearly 95 percent of the benefit would go to the top 20 percent of households and about half to the top 1 percent.

As you look at these estimates, keep in mind that if Congress does nothing nearly all the individual tax provisions of the TCJA, including the SALT cap, expire after 2025.

But repealing the cap now would create an added benefit for many high-income households. The TPC analysis compared repeal of the SALT cap to current law. However, upper-income households would do especially well if the SALT cap is killed because the TCJA also significantly weakened the individual Alternative Minimum Tax and repealed the limitation on itemized deductions (called Pease, after the congressman who proposed it).

The AMT and Pease both limited the federal tax subsidy for state and local tax payments by high-income households. If the SALT cap is ditched and the old Pease and AMT provisions are not restored, many of those households would pay much less in taxes, relative to what they would have paid under the pre-TCJA law.

Blue state Democrats insist that the SALT cap is unfair to their residents. And on one level they are right: Largely because of that provision, upper-income households in high-tax states tend to benefit less from the TCJA than those who make the same income but live in low-tax states. And some even pay higher taxes than under the old law. For more details, see TPC’s analysis here.

As a result, several states sued the federal government to try to reverse the cap. They’ve also tried to adopt work-arounds to assist households with high state and local tax bills. Last month, Treasury rejected the most common solution—an effort to turn state and local tax payments, which are now only partially deductible, into charitable gifts to state-sanctioned charities, which remain fully deductible.

Republicans, by contrast, argue that repealing the SALT deduction would mostly benefit high-income taxpayers, a claim largely supported by TPC’s analysis.

The story is more complicated, however. TPC analyzed only the direct effects of repeal on the after-tax income of households. It did not look at what will happen to state budgets if high-income residents resist tax increases that are now less subsidized by the federal revenue code.

With the SALT deduction cap in place, will those high-income households be more likely to oppose taxes needed to fund state programs that largely benefit low- and middle-income households? If they do, repealing the SALT cap may indirectly benefit low- and moderate-income households more than the TPC study shows. Telling that story is much more complicated for blue states, but it may be a more appropriate argument.

All "Repeal $10,000 State and Local Tax (SALT) Deduction Limitation (Sep 2018)" tables are posted here.