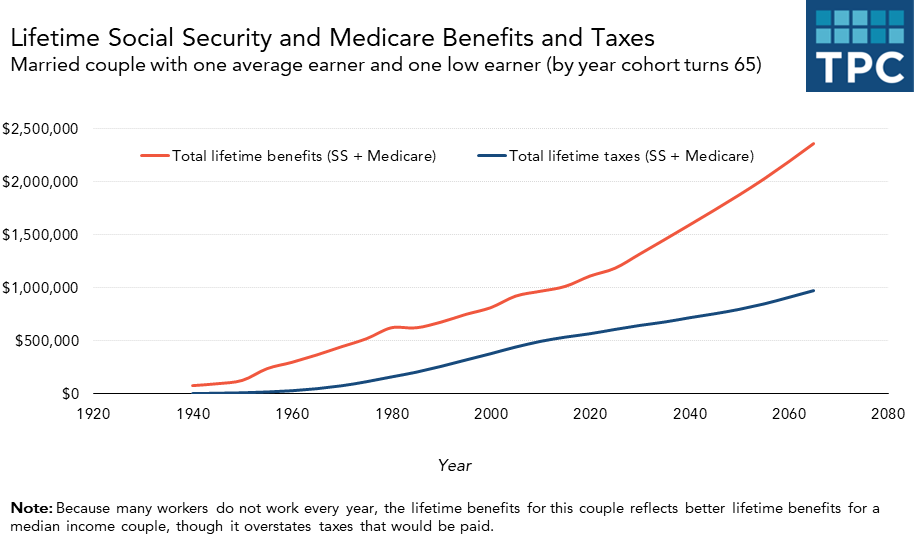

Typical millennial couples born in 1995 who retire in 2060 are scheduled to receive about $2.2 million in lifetime Social Security and Medicare benefits, approximately double the $1.1 million that a typical couple retiring this year will receive, according to our latest analysis. And some higher-earning couples will get more than $3 million in lifetime benefits. Total benefits will rise even more for generations born after 1995, if the programs continue to pay their scheduled benefits.

Our new annual report, “Lifetime Social Security and Medicare Benefits and Taxes” is based on the 2020 trustee reports for the Social Security and Medicare trust funds, along with estimates from the Center for Medicare and Medicaid Services on projected health costs. We project that a single male who earns average wages and works every year and who retires this year at age 65 is scheduled to receive combined lifetime benefits of about $570,000. A couple retiring this year where one spouse earns average wages and one earns low wages (45 percent of the average) will receive about $1,113,000.

As Social Security and Medicare benefits continue to rise, the gap between those benefits and the payroll taxes workers owe will continue to grow. In part, this is because the low Medicare tax was designed to cover only hospital costs, and the program now covers doctor visits, outpatient procedures, prescription drugs, and other costs. And hospital costs themselves are rising faster than the revenues required to fund them.

Benefit amounts are further scheduled to increase significantly for future retirees because Social Security benefits rise with real wages and Medicare expenses increase as prices rise and new health services are covered. At the same time, longer life expectancies mean future retirees will receive more years of benefits. Already, an average individual is projected to live close to two decades at age 65, and the longer-living spouse of a couple will live for nearly three decades after retirement.

While these trends in benefits and taxes for typical families are shown in the accompanying graph and the full report, it does not deal with a major source of the financing gap between benefits and taxes: the significant decline in the birth rate starting in the mid-1960s. The resulting shrinking number of workers relative to retirees has special force in the period where the Baby Boomers start collecting benefits between 2008 and the mid-2030s.

All of these issues will soon come to a head as the Congressional Budget Office projects that the government will not be able to pay full benefits out of the trust funds in Social Security by 2031 and in Medicare Part A, Hospital Insurance by 2024.

President-elect Biden has recommended further benefit increases for retirees—about 9 percent on average by 2065—and a significant increase in the Social Security tax base for higher-income workers. Further Urban Institute work shows that these changes would extend the life of the Social Security trust funds by only about five years. The benefit line in the chart for the hypothetical couple with roughly average income would increase; their taxes would not since their earnings would be below the $400,000 level at which tax increases began.

Most current workers, regardless of income level, still face an implicit trade-off. Even as government promises them increased Social Security and Medicare benefits in old age, it has scheduled a smaller share of its budget to younger people and working families as spending on children falls, student loan balances rise, and most government programs other than for retirement and health decline in relative importance. Only large-scale budget reform would reverse this trend.

Our new report makes it possible for policymakers, analysts, and ordinary citizens to visualize across generations some of the issues involved in bringing retirement and health benefits and the taxes that fund them back into balance.