Benefits from safety net programs such as the Supplemental Nutrition Assistance Program (SNAP, formerly food stamps) and tax programs such as the Earned Income Tax Credit (EITC) can help support low- and moderate-income families. But confusion about how safety net programs, earnings, and tax benefits interact can make it difficult for families to manage their finances and plan for the future.

In a previous Urban Institute study, researchers spoke to parents with low incomes about how these dynamics affected their lives. We found that when families anticipate an increase in earnings, they tend to focus on the prospect of losing benefits rather than gaining access to tax credits.

Losses feel scary for people, as benefits are something they have relied on to support their household. Many families do not have a good understanding of how their benefits will change as their income changes. This often leaves them in a state of uncertainty about their income that limits their ability to plan their lives.

For example, one mother who had temporarily stopped working shared these thoughts on the relationship between income from work and benefits:

“I don’t know how it’s going to work when I start to make money. You know what I mean?… That’s a new area that I’m going to be navigating because I don’t know how much money I’m actually going to be eligible for or how much benefits once I start to work. I know that the minute you start working, it probably all goes away. I don’t know exactly how it works technically, but I know that once work starts…they don’t give you a long buffer period between when you get benefits and when you lose them, or when you get a job and lose your benefits, so that’s an issue.”

The same study found that tax credits, which can boost earnings substantially, end up being largely unpredictable. Almost none of the parents had a basic understanding of how tax programs worked, which programs they qualified for, or how much they would receive after filing their taxes. A mother described her limited knowledge:

“Yeah. Honestly, I have absolutely no idea. I see the [EITC] or whatever that tax credit—I always see it. I’ve heard of it, but I have no idea. Last year, I didn’t really think anything of it again because I was working. I filed taxes because I knew I made enough, and so I really just don’t know much of anything about it, honestly.”

For families with incomes below the poverty level, tax credits average just over 20 percent of annual income in a typical year. Among families with incomes between the poverty level and up to double that amount, tax credits contribute an average of 14 percent of annual income.

But most of these families won’t see that benefit until they file a tax return. That’s because for low-income families, these tax credits exceed the amount of taxes owed and can only be delivered as a tax refund. (In contrast, high-income families have more flexibility to alter their withholding to receive tax benefits throughout the year.)

Families face changes in taxes and benefits as earnings rise

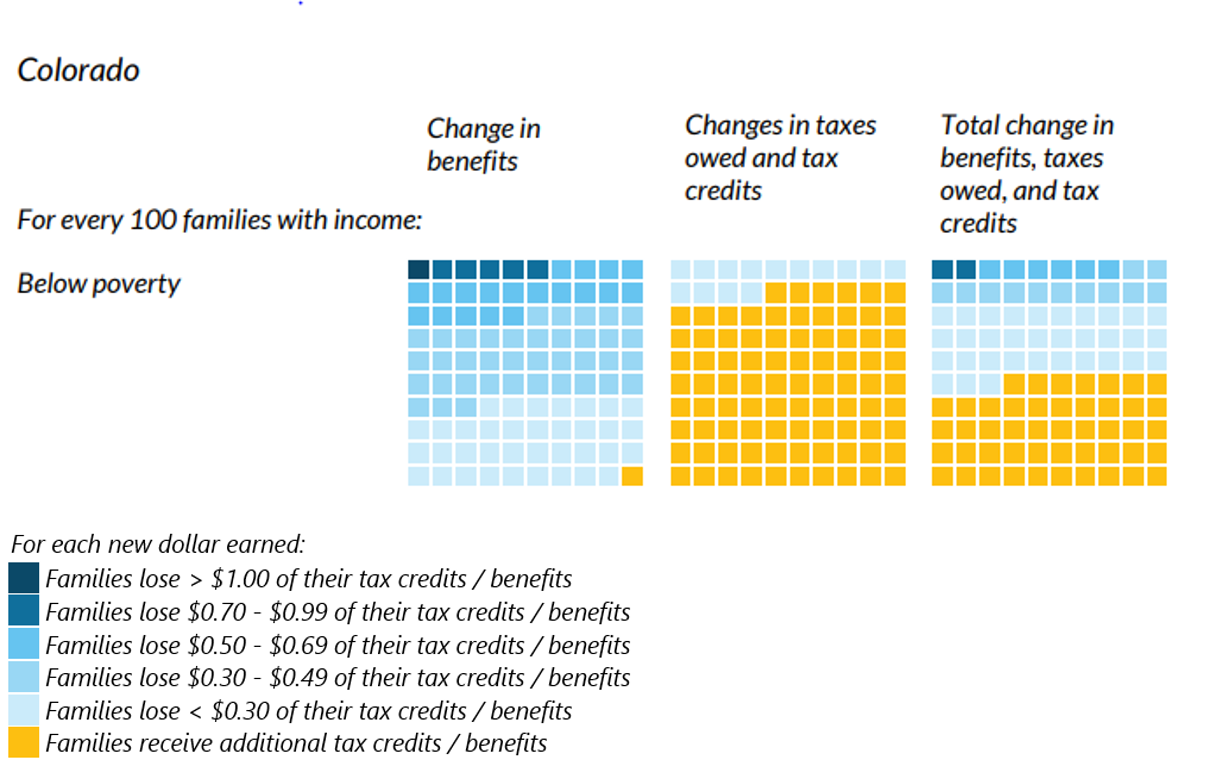

As an example of the uncertainty families face, we analyzed what would happen if parents in Colorado who had incomes below the poverty line and who received Temporary Assistance for Needy Families (TANF) earned about $2,300 more from wages (see this paper for additional examples).

When factoring in the potential drop in benefits from SNAP, TANF, and housing subsidies – a dollar of earnings could mean that some families lost more than a dollar in benefits (darkest blue box) while many would lose smaller amounts of benefits (lighter blue boxes, first column).

But factoring in new higher tax credits tells a different story. Almost all families would see their income rise by more than $2,300 (yellow boxes, second column).

Considering changes in both benefits and tax credits, about half of families who earned an additional $2,300 in wages would see their annual income grow by less than that (blue boxes, third column) and the other half would see their income grow by more than the $2,300 they earned (yellow boxes, second column).

The complexity of tax and benefit systems can make navigating them confusing, potentially reducing the effectiveness of the programs. Families have to navigate differing eligibility criteria among various benefits and tax credits, administrative challenges accessing those benefits and tax credits, and benefits and credits that phase out at different income levels.

Ultimately, the system that is supposed to compensate benefit losses and encourage work contributes to the confusion and uncertainty felt by people intended to benefit from these programs.

This mental stress creates a “scarcity mindset” that can compound financial challenges. Dealing with scarcity affects families financial security and beyond in many ways. The U.S. Financial Diaries project found that, "Dealing with illiquidity took scarce time, created anxiety, added financial costs (through late payments, utility disconnections, and overdraft fees), and could mean delays in making important purchases."

Household support systems are overdue for an update

In many ways, tax refunds can be empowering. Tax credits delivered as part of a tax refund can help people build savings or purchase large items.

However, there are trade-offs. On the one hand, receiving the full credit a person qualifies for at tax time helps them cover larger expenses. But if tax credits were delivered as smaller, monthly payments instead, families can rely on them to meet ongoing expenses.

From July to December 2021, the IRS delivered a monthly enhanced Child Tax Credit (CTC) to qualifying families. This provided a reliable source of income to help families plan better financially. Urban Institute research found that 45 percent of nonelderly adults who received the advanced CTC funds preferred the monthly credit as opposed to receiving the credit as a single payment at tax time. Families with lower incomes were more likely to prefer a monthly payment than families with higher incomes.

Reviving the monthly expanded CTC could supplement the annual EITC, potentially striking a balance between having a consistent income source (largely unaffected by changes in earnings) and a less predictable, but still robust, tax refund that can facilitate large purchases or present an opportunity for growing savings. The President’s 2024 budget includes a proposal along these lines.

Additionally, financial service providers can help people manage their benefits and tax credits by expanding access to bank accounts, offering budgeting and financial management tools, and supporting VITA programs that can demystify the tax filing process. Matched savings programs could be used to further support families with low incomes to help build savings. Matched savings programs can offer more control and predictability than an annual tax refund.

Above all, the system of support programs for families is overdue for simplification and streamlining.