This blog post was corrected on October 29, 2024. The 20 percent-60 percent tariffs proposal would lower individual and corporate income tax collections by $1.5 trillion, not $2.5 trillion. The 10 percent-60-percent tariffs plan would raise $3.7 trillion in gross revenue, not $4.6 trillion.

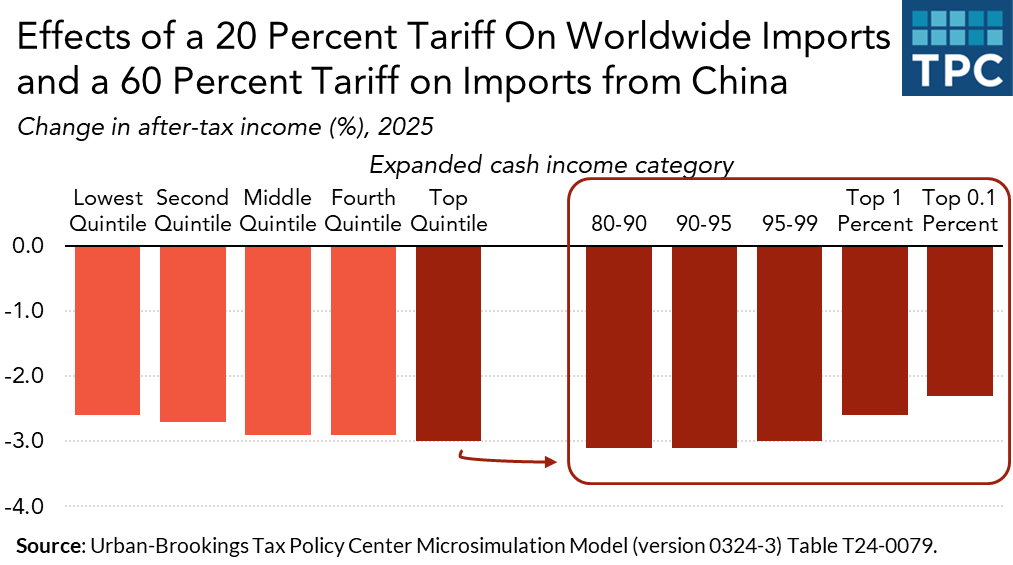

A 20 percent worldwide tariff and a 60 percent tariff on Chinese goods, one of many import tax ideas floated by Republican presidential candidate and former President Donald Trump, would increase household taxes by an average of nearly $3,000 in 2025, according to a new analysis by the Tax Policy Center. Trump’s plan would lower average after-tax incomes by 2.9 percent.

A separate Trump proposal—a 200 percent tariff on auto imports from Mexico—would raise household taxes by an average of an additional $600, or about 0.6 percent, TPC estimated.

TPC estimated the 20 percent worldwide tariff combined with the 60 percent Chinese import tax would generate net new revenue of about $4.5 trillion on the next 10 years.

Lowering Imports

The 20 percent-60 percent tariffs themselves would raise about $6 trillion in gross new revenue on top of the $1 trillion expected to be raised through current tariffs. But because the levies likely would reduce current and future US incomes, corporate and individual income tax revenues would decline by about $1.5 trillion.

Trump’s 20 percent worldwide tariff plus his 60 percent tariff on Chinese goods would reduce imports by about $9 trillion over 10 years. Imports include common consumer goods such as many fresh fruits and vegetables, clothing, medicine, appliances, and furniture. They also include materials used by US producers, such as auto makers and home builders.

Trump’s tariff on Mexican autos would raise an additional $84 billion over 10 years. It would reduce imports of those vehicles by about $800 billion.

A 10 Percent Worldwide Tariff

Earlier this year, TPC’s analyzed a smaller tariff proposed by Trump—a 10 percent tax on all imports combined with the 60 percent levy on Chinese imports. TPC found that version would raise $2.8 trillion in net revenue over 10 years and reduce average after-tax incomes of US households in 2025 by about $1,800, or 1.8 percent.

That relatively less aggressive tariff plan itself would generate about $3.7 trillion in gross new revenues. But like the 20 percent version, it also would lower projected domestic incomes and produce much less total revenue after taking into account declines in corporate and individual income tax revenues.

Both versions of Trump’s tariffs could significantly raise prices of imported goods since they’d mostly be passed on to US consumers and businesses. That would shrink both inflation-adjusted domestic incomes and income tax revenues.

The Federal Reserve could raise interest rates to offset those price increases. But that likely would reduce profits of US corporations and incomes of US workers, and lower projected corporate and individual tax revenues.

Not Counting Retaliation

None of the TPC estimates take into account retaliation by US trading partners whose exports would be hit by the tariffs. However, experience suggests those countries would respond by raising tariffs on goods and services imported from the US, which would shrink demand for US-made products and cost US workers’ jobs.

Democratic presidential candidate Vice President Kamala Harris has largely been silent on her tariff plans. Earlier this year, President Joe Biden increased tariffs on a handful of goods imported from China, including electric vehicles, some computer chips, and steel and aluminum. However, TPC calculated those tariffs have little effect on household incomes because they are so narrowly targeted. For example, almost no Chinese EVs currently are sold in the US.

Trump has insisted his new tariffs would generate enough new revenue to replace the income tax. The $4.5 trillion in net new revenue he’d raise with a 20 percent worldwide tariff and a 60 percent import tax on Chinese goods is a lot of money. But it would fall far short of replacing the $34 trillion in individual income tax revenues the Congressional Budget Office projects over the next decade. Nor would the import taxes pay for many of Trump’s other initiatives.

Trump’s 10 percent worldwide tariff and his 60 percent import tax on Chinese goods would have a significant negative impact on US consumers and businesses. Doubling the worldwide import tax to 20 percent would lower household incomes even more and do even more damage to the domestic economy.