Many families find child care expensive and difficult to access. Senators Tim Kaine (D-VA) and Katie Britt (R-AL) have proposed legislation that would expand the child and dependent care credit, offering families a larger tax subsidy to offset some of their care expenses. The proposal makes important improvements to the credit, but additional changes could help more low-income families.

How does the child and dependent care credit work for families today?

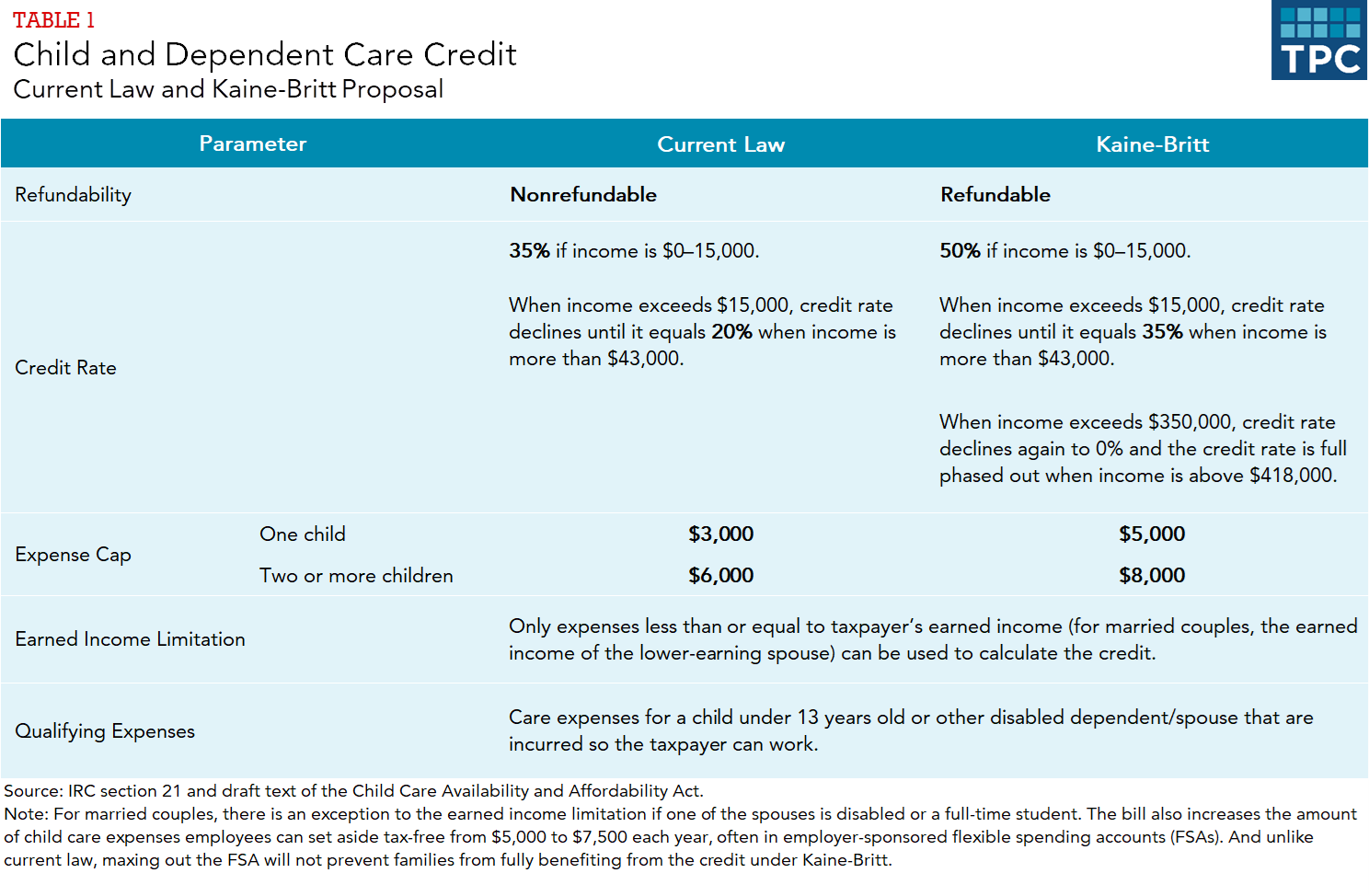

The child and dependent care credit is designed to partially offset child care expenses of working families. TPC estimates that 13 percent of families with children claimed the credit in 2022, reducing their taxes by an average of $625.

The credit is determined by multiplying the amount of qualifying care expenses by an income-dependent credit rate between 20 and 35 percent. And the credit is nonrefundable, meaning it cannot be more than what the family owes in income taxes.

As a result, the maximum credit amount available to families is about $700 if they have one child and $1,400 if they have two or more children, although most families are eligible for a maximum credit of $600 and $1,200, respectively.

A parent who needs care for a child under 13 while working can claim care expenses. A person can also claim expenses for care for eligible older dependents, which often means the person is a caregiver providing financial support.

Care expenses cannot be more than earnings under the program, so a single parent must work to be eligible for the credit. Both spouses in a married couple must work unless one spouse is a full-time student or faces a disability.

The Kaine-Britt proposal would provide a bigger subsidy for care expenses

For many families with a lot of child care expenses, the Kaine-Britt proposal would more than double their child care credit, primarily due to three major changes (see Table 1):

- An increase in the maximum amount of allowable care expenses that can be used to calculate the credit

- An increase in the credit rate for all but the highest-income families

- Making the credit refundable

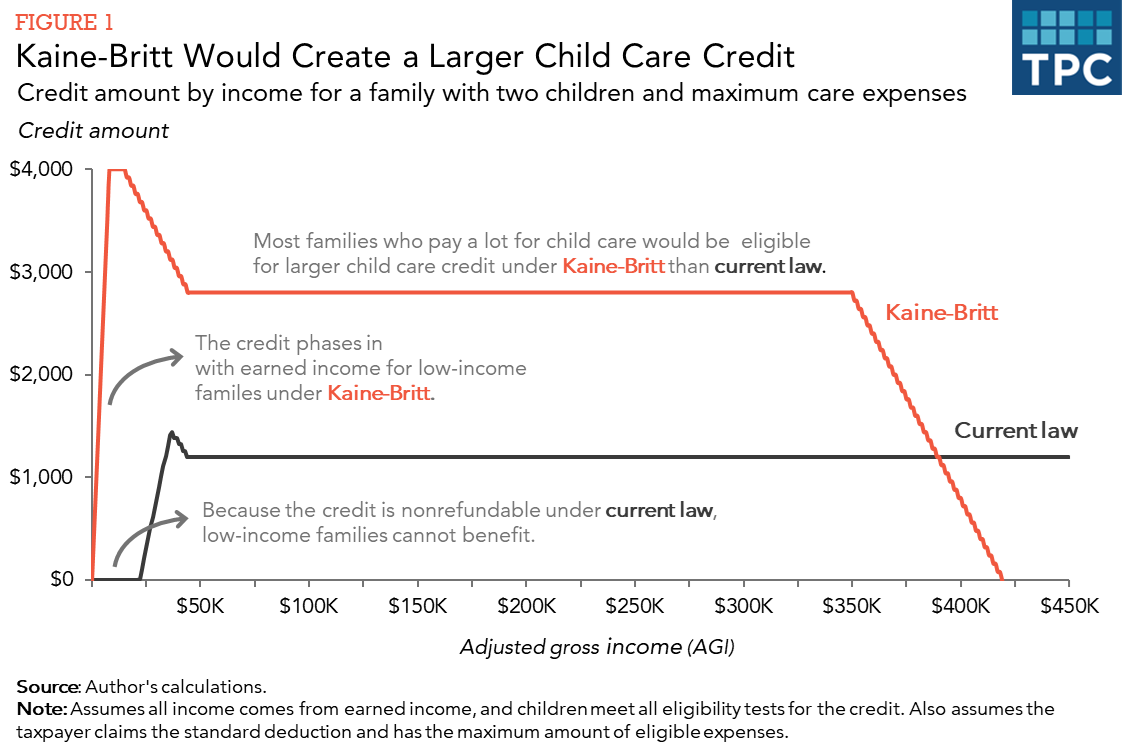

Figure 1 shows how refundability in particular would increase the credit for families at different income levels.

For low-income families, the maximum credit would jump to $2,500 if they had one young child and $4,000 if they had two or more children under the Kaine-Britt proposal.

But even with these improvements many families, especially low-income families, may still not fully benefit from the credit.

Many don’t have the same level of eligible out-of-pocket expenses as higher-income families. These working parents may struggle to find child care by cobbling together informal care from friends, neighbors, and family members. Informal care tends to cost less than center-based care and may not always qualify for the credit.

The child and dependent care tax credit can be further modified to help more families

If Congress takes up the Kaine-Britt legislation, they might consider modifications to make the credit more accessible to more people.

For example, they could make this credit available to student parents with limited or no earnings who receive little to no benefit from the credit. Congress could do this by relaxing the earned income requirement for single student parents with little to no earnings or married student parents who don’t earn much.

They could also extend the benefit to include care for elderly parents, many of whom financially support themselves with retirement and Social Security income. Data from the IRS indicate that this credit is used almost exclusively for the care of children. However, taxpayers often spend money to care for their elderly parents, and some do so while also caring for children.

Policymakers could also make the credit more accessible to families who rely on informal care. An existing tax code provision called “deeming” allows parents to claim a certain credit amount, regardless of what their actual expenses are, as long as a parent and/or child meets certain criteria. Under a modified proposal, for example, if a parent worked and had a child under age three, their care expenses could be “deemed” sufficient to receive the maximum credit, regardless of their actual expenses.

This could give many working parents with young children a valuable benefit without making them jump through hoops of collecting all their care providers’ information and making sure care qualifies. Deeming is already used in the child care credit for married couples where a non-working spouse is a student or faces disability, and it’s also used in the adoption tax credit for adoptions from the foster care system.

Of course, Congress could take a different approach and help families with informal care expenses (especially those with low incomes) by providing a larger child tax credit for younger children like they did in 2021.

The Kaine-Britt bill makes important steps in expanding the value of the child and dependent care credit. But other changes could broaden the credit’s availability to many low-income working parents with low incomes who tend to receive little benefit from child care tax benefits.