The IRS has reportedly begun to lay off thousands of employees this week, the latest step in a Department of Government Efficiency (DOGE) push to trim the federal workforce. As at other federal agencies, IRS cuts so far focus on relatively new hires, or over 6,000 probationary employees.

DOGE might assume that these employees are expendable, but they are not. Probationary employees bring new energy, ideas, and cutting-edge skills to the IRS, improving taxpayer service and tax administration. Dismissing them and their contributions would be a severe setback to recent IRS reforms that have been shown to deliver tangible benefits to taxpayers and the nation’s financial well-being.

The IRS is now better able to respond to taxpayers

According to the National Taxpayer Advocate, an independent organization within the IRS, hiring those new employees has improved taxpayer services. That means shorter call wait times, more calls answered and more in-person services and extended hours at taxpayer assistance centers across the nation. The Advocate also noted that new staff have played critical roles in implementing improved technology, leading to many new digital services. That includes a highly successful launch of Direct File, which allows eligible people to file their taxes more easily, online, and for free.

Probationary employees are transforming the way the IRS works

Among those slated to lose their jobs are dedicated data scientists, including economists, statisticians, and computer specialists; the Research, Applied Analytics and Statistics Division is losing more than 10 percent of its staff. Using data and statistical methods including artificial intelligence (AI), they are improving the taxpayer experience, reducing the burden on taxpayers from unnecessary audits, producing statistics critical for understanding the tax system and economy, and helping make all IRS employees more efficient.

They are protecting taxpayer identities, data, and dollars

New employees are protecting our tax system from fraudsters and identify thieves. In FY2024 these employees helped protect more than $1 billion from tax scams perpetrated by unscrupulous promoters. Improper refund requests claimed by identify thieves are also a major ongoing threat to our tax system.

The sophistication of these schemes increases every year, and IRS data scientists are using new methods, such as machine learning, to annually stop billions of dollars in fraudulent claims before they are paid. In addition, data scientists are improving IRS efficiency by using generative AI to automate repetitive functions, assist in notice design and document translation, and provide real-time information to taxpayers and IRS phone assistors.

Keeping new employees would assure continued IRS reforms and improvements

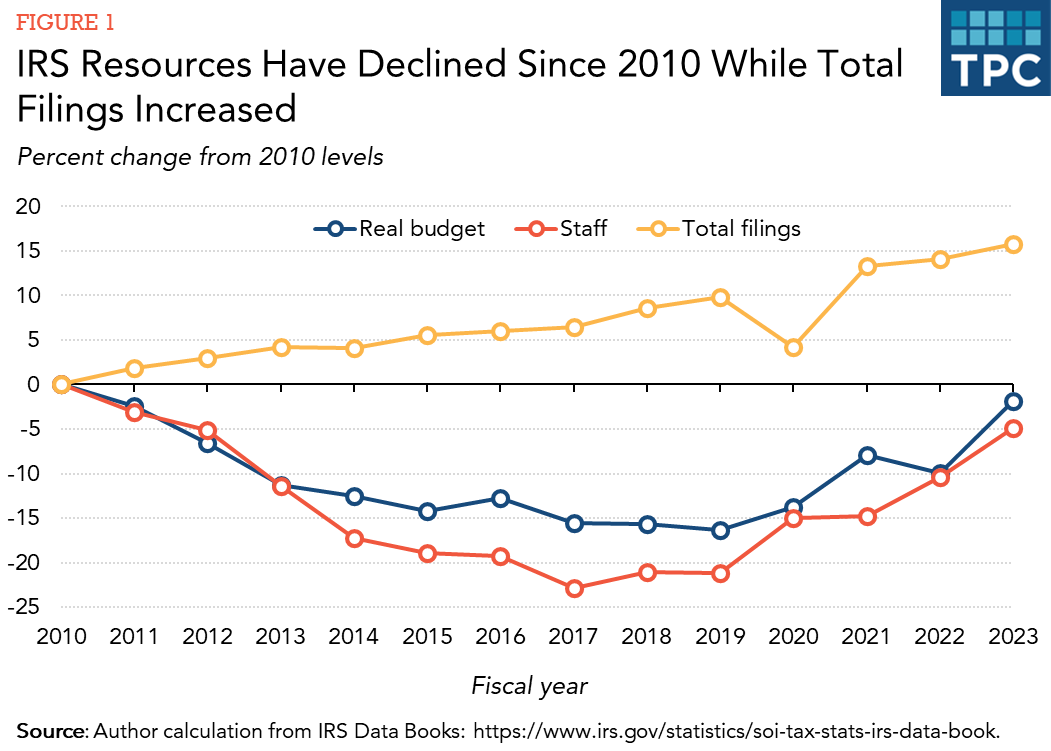

Consider the state of the IRS just a few years ago, before the agency hired these probationary employees. Between 2010 and 2021, the IRS’s overall budget decreased 15 percent in real terms. At the end of FY2021, the IRS had just over 80,000 employees—a drop from 94,346 in 2010 even as the total number of filings jumped by 13 percent (Figure 1). In addition, long-term hiring restrictions left the agency with an aging workforce: More than 60 percent were eligible to retire within six years.

In March 2022, then-IRS Commissioner Charles Rettig, appointed by President Trump in 2018, noted that appropriate and consistent multi-year funding was essential to enhancing the taxpayer experience, improving tax compliance, and modernizing information technology systems.

The Inflation Reduction Act (IRA) was designed to address these problems, providing nearly $80 billion over the next decade on top of the agency’s annual appropriations. Last year, the IRS anticipated that staffing would rebound to about 90,000 in Fiscal Year 2025. The Congressional Budget Office estimated that depending on the amount of rescinded IRA funds for tax enforcement, rescission would reduce federal revenues by between $5.2 billion and $54 billion.

The IRS needs its staff; it collects 96 percent of US revenue. Firing probationary staff to achieve short-term savings would ignore the long-term financial cost. To improve the nation’s bottom line, we should retain probationary employees and create the tools to build an effective, efficient IRS.

Barry Johnson, a Nonresident Fellow at the Tax Policy Center, worked with the IRS from November 1987 until January 2025. He most recently served as its Chief Data and Analytics Officer.