The Federal Reserve Board’s 2019 Survey of Consumer Finances (SCF) helps us understand US wealth disparities prior to the COVID-19 pandemic that has disproportionately harmed Black and Hispanic or Latino households. The SCF is regarded among the most comprehensive data sources on household wealth, and it documents significant racial disparities in wealth and debt over time.

Here are three takeaways from the latest data:

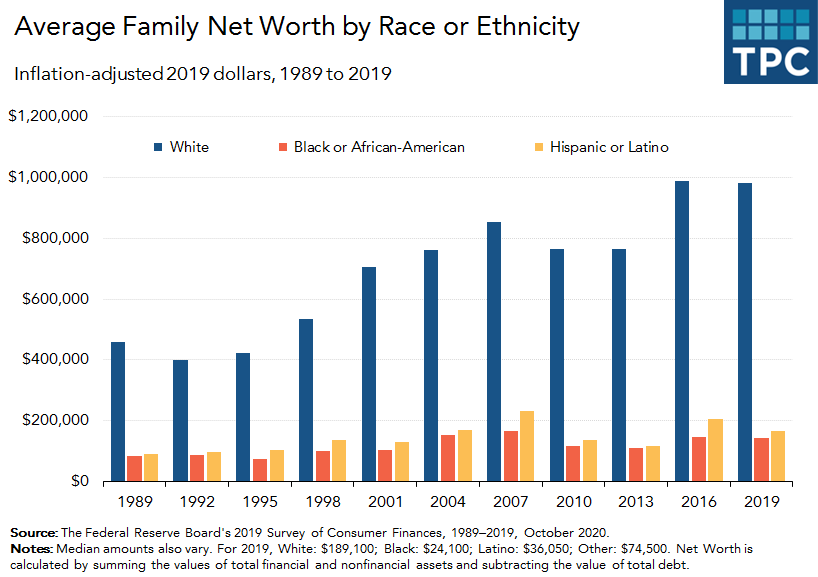

1. The average net worth of White households is six to seven times higher than that of Black and Hispanic or Latino households

The average household net worth (total assets less debt) for Black households was $142,000 in 2019, compared with $166,000 for the average Hispanic or Latino household and $981,000 for the average White household. [The SCF aggregates data for Asian, Native American, and other race households into an "Other" category.]

These disparities have generally widened over time and persist throughout the distribution of household income, age, and education; in fact, Black households with significantly more education have lower average net worth than less educated White households. White households also receive significantly more financial support from gifts and inheritances than Black and Hispanic or Latino households, which contributes to rising racial wealth gaps across generations.

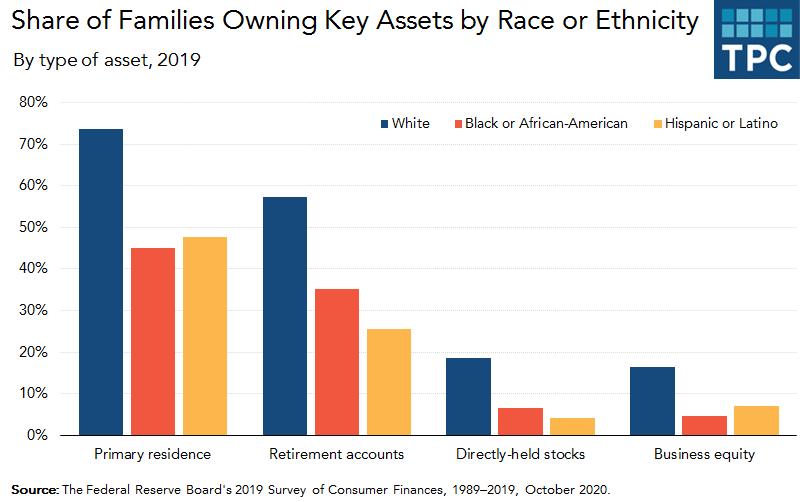

2. More White households own housing, retirement accounts, and other tax-preferred assets than Black and Hispanic or Latino households

In 2019, 45 percent of Black households owned their primary residence, compared with 48 percent of Hispanic or Latino households and 74 percent of White households. Thirty-five percent of those in Black households owned retirement accounts, compared with 26 percent for Hispanic or Latino households and 57 percent for White households.

Homes and retirement accounts are crucial tools for wealth accumulation. The income tax code plays a role in this: for example, contributions to and earnings from assets in retirement saving plans are generally subject to preferential tax treatment. Similar provisions exist for homeownership and capital gains from stocks and business equity, which likely disproportionately benefit higher-income and higher-wealth White households.

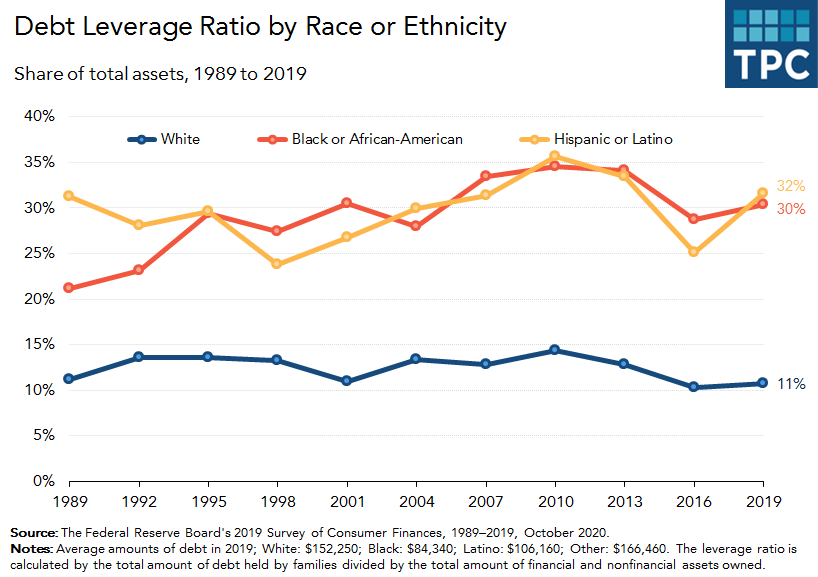

3. White households hold more debt on average but are more likely than Black and Hispanic or Latino households to have the resources to pay down their debt

The average debt held by Black households was $84,340, compared with $106,160 for Hispanic or Latino households and $152,250 for White households in 2019. However, the ratio of debt to total assets for Black and Hispanic or Latino households exceeded 30 percent, compared to a ratio of 11 percent for White households. Over the past 30 years, the average debt of White households has never exceeded 15 percent of assets.

Discrimination in credit markets, in the form of loan denials, predatory lending practices, and redlining has limited the ability of many Black households to build generational wealth and pay down debt. Black and Hispanic or Latino students with student loan debt also have lower lifetime earnings and fewer assets to draw from to service their debt, which raises the costs for future borrowing and the probability of defaulting.

The federal government, with the help of state and local governments, can play a key role in reducing racial wealth inequalities, whether through tax policy or direct spending. In fact, President-elect Joe Biden has acknowledged the importance of using economic and social policy levers to advance racial equity.

The economic hardships resulting from COVID-19, including lost employment income, food insufficiency, and difficulties making rent and mortgage payments, are currently worsening racial inequities. Unless active steps are taken to reduce these inequities, post-pandemic data releases will show worsening racial wealth gaps.