Democratic presidential nominee Kamala Harris has vowed to make permanent temporary expansions to the child tax credit (CTC) and earned income tax credit (EITC) enacted by 2021’s American Rescue Plan (ARP) Act. Alone, these expansions would provide valuable resources to many low-income families, reducing poverty and material hardships in the short term, as well as improving education outcomes and future earnings in the longer term.

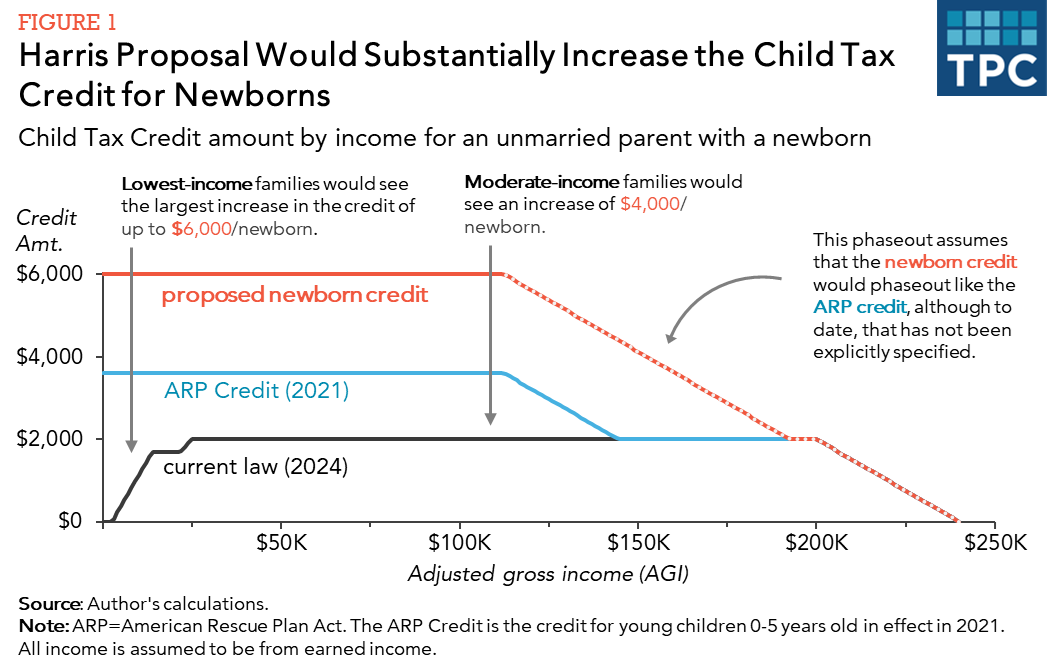

Grabbing the most attention, however, is Harris’s proposal for a larger CTC for families with newborns. Parents would receive up to $6,000 for their newborn—a $2,400 boost on the $3,600 ARP child credit for young children under 6 years old. The boost could help low-income families, especially if planned and administered well.

Assuming these provisions went into effect in 2025, the Tax Policy Center estimates that reinstating the 2021 expansions of the EITC and CTC plus a larger CTC for newborns would cost $105 billion for that year. After 2025, the cost would increase substantially compared to current law because CTC enhancements enacted through the 2017 Tax Cuts and Jobs Act are scheduled to expire.

Overall, low-income families with children would gain $2,750 on average from the combination of the expanded CTC and the additional credit for newborns.

The families of virtually all newborns in 2025 would receive a larger credit compared to current law, with the largest increases benefiting the nearly 3 out of every 10 newborns whose families’ incomes are too low to receive the full benefit under current law.

Figure 1 shows how a larger credit for newborns would work.

A $6,000 credit would triple the CTC received by most families today. The credit would be even larger for low-income families who currently receive less than the maximum amount of the credit because they don’t earn enough money.

A larger CTC for newborns would provide a meaningful investment in children at a crucial moment in their lives. Research indicates that income supplements received when a child is young can improve a child’s future health and education outcomes and future earnings.

Any parent can attest to the high costs associated with newborns—buying diapers, clothes, bottles or formula, to say nothing of car seats and cribs. But families often incur these expenses just as parental income falls, when parents must take time off of work or cut back on their hours to care for their new child. A larger CTC for newborns will boost income when it is needed most.

But how would this benefit be delivered? Policymakers need to take care in establishing a CTC that reaches families in a timely, efficient fashion, minimizing administrative challenges.

Typically, families receive the CTC annually, after they have filed their tax return. In many cases, families must wait months after the birth of their child to receive any tax benefit. If a family had a child in January 2024, for example, they could receive the CTC for that child the following year, perhaps by late February or early March 2025. And for many families who aren’t familiar with the tax system, including immigrant families, filling out a tax return to get the child credit can be a challenge.

Under Harris’s proposal, policymakers would have to decide if they want the $2,400 newborn bonus administered separately from the $3,600 CTC for young children. If so, they could provide the $3,600 monthly (or provide a share monthly and the remainder claimed on a tax return, as they did in 2021) and provide the $2,400 separately, such as a lump sum payment as soon as possible after a baby’s birth. That could provide a valuable boost in income to help families afford large purchases for their newborns, like car seats and cribs.

They should also detail other aspects of sound administration. What kind of information would the IRS need, and what infrastructure will allow quick and accurate delivery to families? How might the IRS help families who may be unfamiliar with filing a tax return?

For some families, simplified filing tools may be helpful. Others may benefit from additional support using a trusted navigator to ensure they get the benefit.

With focus on the administration of this new benefit, including the resources the IRS would need to issue the CTC quickly and accurately, a newborn credit could be a valuable resource for families when they most need it.