Next month, many state governors will release their budget proposals for the upcoming fiscal year. After post-pandemic tax cuts in nearly every state, there are signs of trouble ahead— including slowing revenue growthand potential shifts in federal policy that could reverberate to the states.

To help ensure fiscal stability next year and beyond, policymakers will need to closely monitor economic conditions and use budget reserves or stabilization policies to manage risk.

The COVID-19 personal income tax rollercoaster

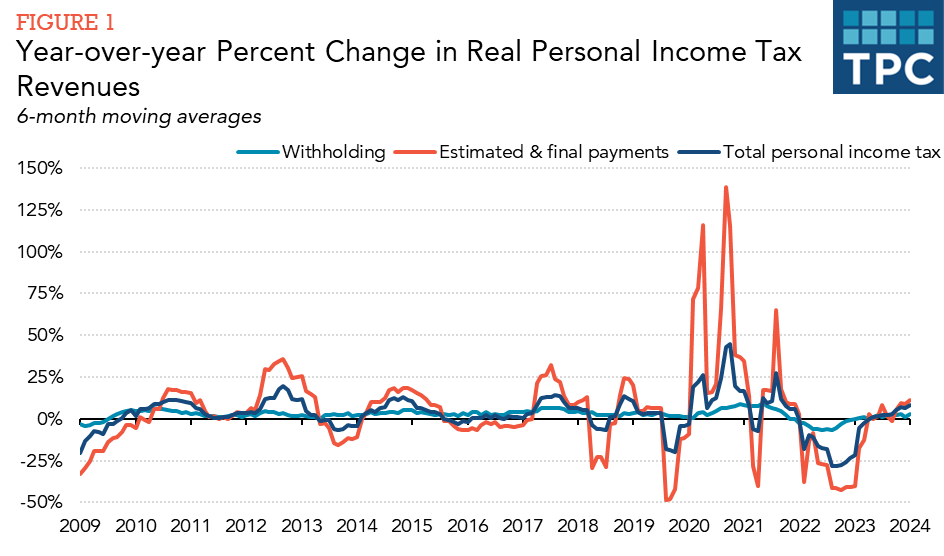

Swings in state personal income tax collections intensified during the COVID-19 pandemic. Generally, revenue trends are influenced by economic conditions, stock market fluctuations, policy changes, and shifts in taxpayer behavior.

Examining top-line personal income tax collections over this period, along with their components, reveals which factors mattered and why.

Consider fiscal years 2021 and 2022. Personal income tax revenues surged in states, primarily fueled by federal fiscal aid (Figure 1). But in fiscal year 2023, there were double-digit declines, with only modest growth returning in FY 2024.

Compare that to withholding tax by states—a key barometer of job and wage growth. From the end of the Great Recession through the pre-COVID era, it climbed unabated, reflecting the period’s stable job and wage growth.

For now, a smoother ride

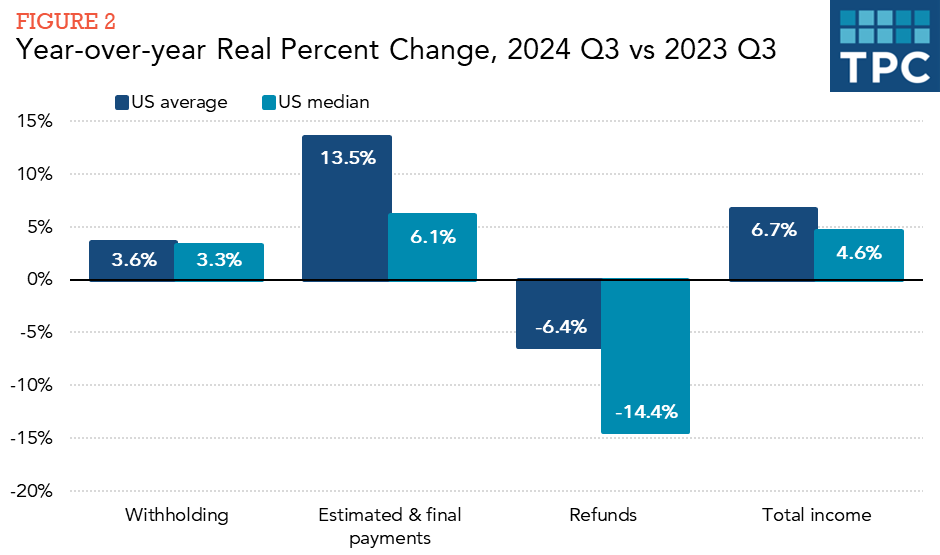

States have reason for cautious optimism in the current fiscal year (which began on July 1, 2024 in 46 states): Income tax revenues are showing signs of stabilization (Figure 2).

Total personal income tax revenues grew by 4.6 percent in the median state in the third quarter of 2024, compared to that period last year, in inflation-adjusted terms. By contrast, withholding saw more modest real growth of 3.3 percent in the median state.

High-income earners often make estimated tax payments on income not subject to withholding taxes. This type of income typically comes from investments—such as capital gains realized in the stock market—or earnings from self-employment and business ventures.

Estimated and final tax payments drove much of the overall income tax revenue increase, surging by 6.1 percent in the median state. Strong stock market performance since mid-2023 likely contributed to higher capital gains realizations, boosting revenues.

But given last year, the ride won’t be smooth for long

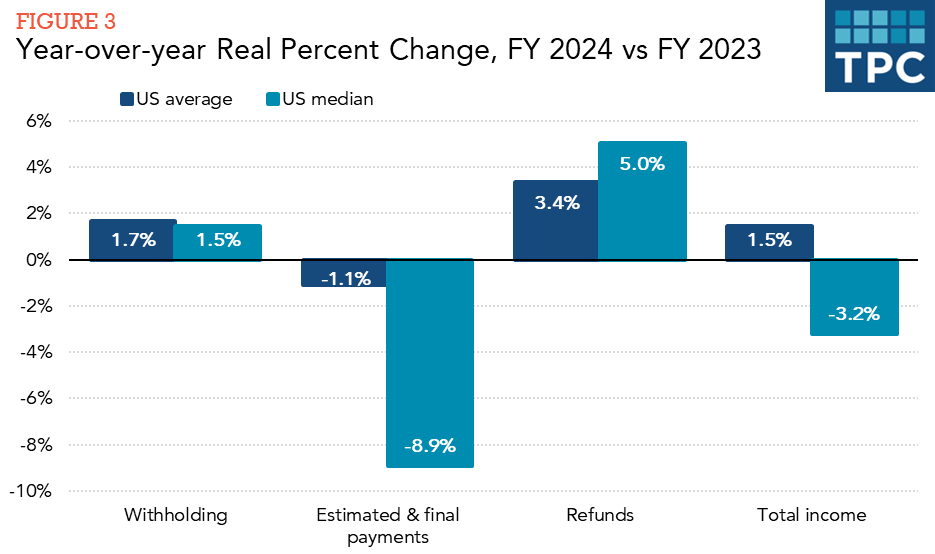

The overall real growth in state personal income tax revenues (1.7 percent) in fiscal year 2024 masks significant variability across states (Figure 3). Some states are benefiting from robust stock market performance and wage growth, but others are grappling with the impacts of recent tax cuts.

For the median state, revenues declined by 3.2 percent. (It is important to look at the median state because California's delayed tax filing deadline skewed the US average, since its reported revenues in 2023 were lower and 2024 figures were higher.) Tax withholding grew modestly by 1.5 percent, estimated and final payments dropped sharply by 8.9 percent, and refunds rose by 5.0 percent.

Despite several reasons to exercise fiscal caution, 24 of 41 states with broad-based income taxes enacted tax cuts over the past four years, with several spanning multiple years. These cuts primarily targeted higher tax brackets in states with progressive income tax structures, disproportionately benefiting wealthier taxpayers. Coupled with stock market fluctuations, these tax cuts could exacerbate the volatility of income tax revenues, heightening uncertainty in states' fiscal outlooks.

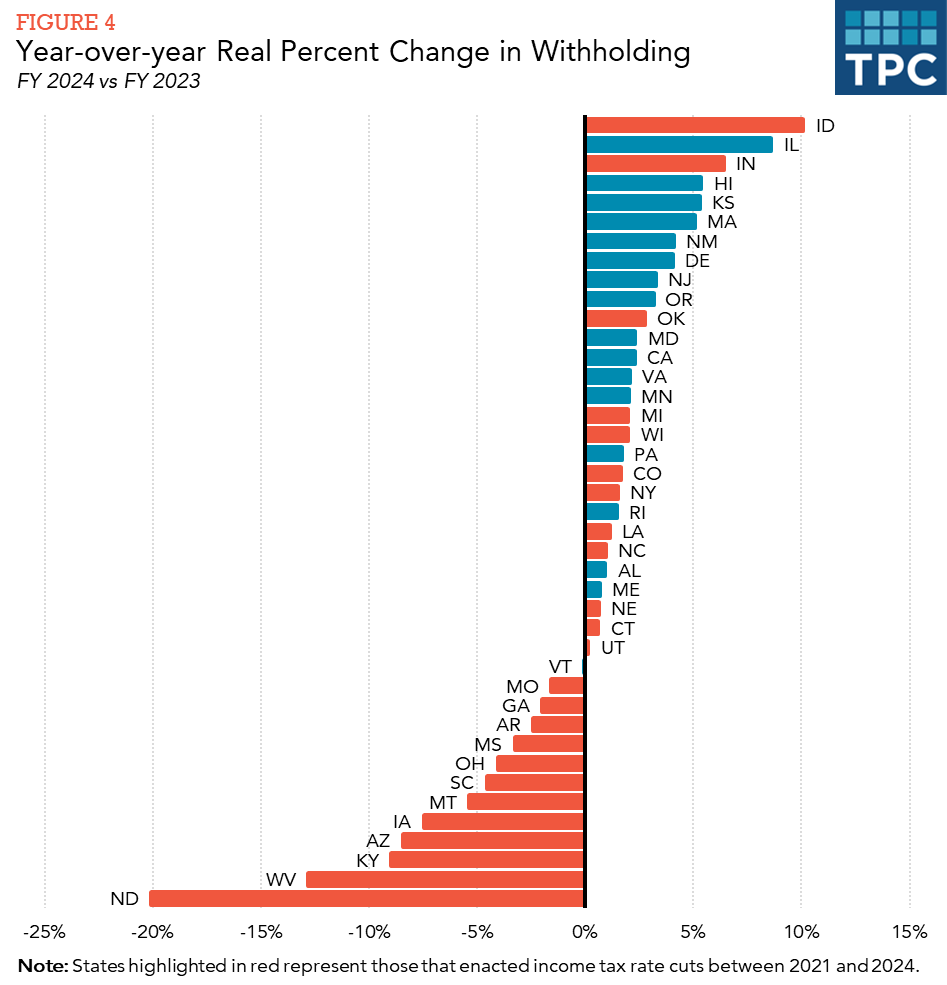

Consider the states highlighted in red in Figure 4: They all enacted income tax rate cuts between 2021 and 2024. Many of them also experienced declines in withholding in fiscal 2024, although this could reflect economic conditions and other factors in addition to tax policies.

A call for caution

Some state politicians are pushing to cut income tax rates even further, especially for higher earners. For example, effective January 1, 2025, income tax rates are set to be reduced in states such as Georgia, Iowa, Mississippi, and West Virginia. These cuts could send state revenues on an even more turbulent path.

States already relying on stock market-related income tax streams might see their budgets swing even more dramatically—surging in good times and crashing during downturns.

Potential federal changes introduce more state uncertainty, with key provisions of 2017’s Tax Cuts and Jobs Act set to expire or change at the end of 2025 and a new federal administration that may make more tax policy changes.

Fiscal rollercoasters leave states vulnerable to fiscal instability. State decision-makers should think very carefully about further income tax cuts. The data suggest it is a time for caution, not risk.