Former President Trump’s proposal to repeal the $10,000 cap on the state and local tax (SALT) deduction would cut 2025 taxes by an average of more than $140,000 for the highest-income 0.1 percent of families but provide little or no help to low- and middle-income households, according to a new Tax Policy Center analysis. Those making $430,000 or more would enjoy nearly three-quarters of the benefit of Trump’s proposal.

Trump vows to end the SALT cap, which was a key provision of his signature 2017 Tax Cuts and Jobs Act (TCJA). At that time, many Republican lawmakers wanted to go even further and eliminate the SALT deduction entirely. Without congressional action the cap will expire and the full deduction will be restored on January 1, 2026.

Compared to extending all the individual provisions of the TCJA, including the SALT cap itself, eliminating the cap would add about $1.2 trillion to the costs over the next decade, according to the Committee for a Responsible Federal Budget.

Who Would Benefit?

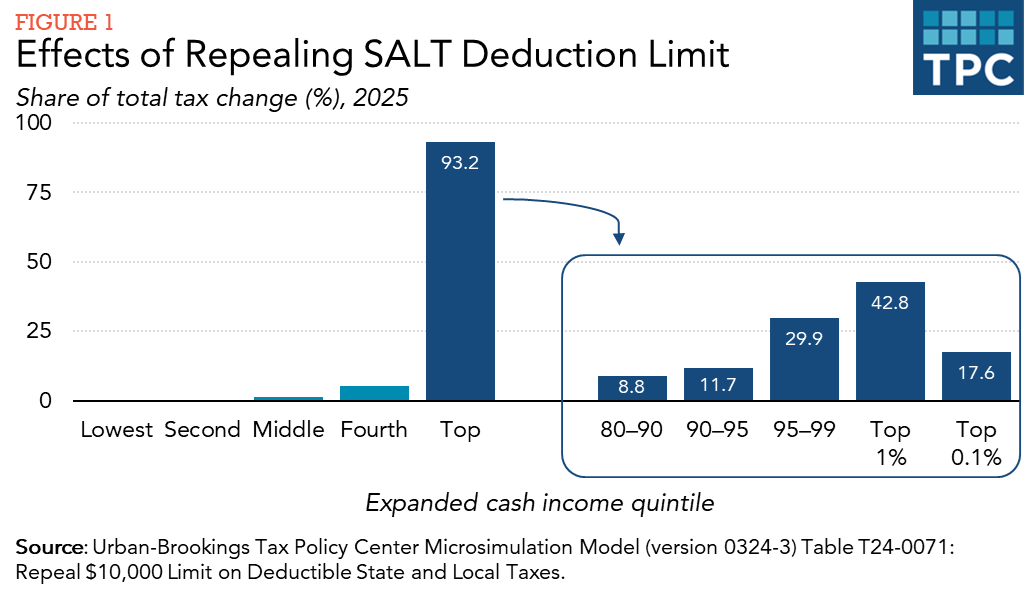

TPC estimated that households making about $63,000 or less (those with the lowest 40 percent of income) would get no tax cut on average. Fewer than 1 percent of them would get any tax cut at all.

About 5 percent of middle-income households, those making between about $63,000 and $113,000, would benefit from the SALT cap repeal. Among all households in that income group, their average 2025 tax cut would be $30.

Low- and middle-income households would hardly benefit because their state and local tax bills are relatively low and because the TCJA greatly increased the standard deduction. As a result, more than 90 percent of households claim the standard deduction and do not itemize their deductions.

Allowing a full deduction for state and local taxes would encourage some of those households to itemize, but very few. That would be especially true if Congress extends the TCJA’s higher standard deduction.

High Income Households

The story would be quite different for those with higher incomes.

Already, many high-income business owners avoid the cap by paying their state and local taxes through their firms and fully deducting the cost as a business expense. However, many high earners remain subject to the cap.

As a share of after-tax income, the biggest winners from repealing the cap are households in the top 1 percent of the income distribution, those making about $1 million or more annually. Their after-tax income would rise by about 1.6 percent, or roughly $35,000. And they’d get about 43 percent of all the benefit of lifting the cap.

Those in the top 0.1 percent, who make $4.7 million or more, would see their after-tax income rise nearly as much, by 1.5 percent. Their average tax cut: nearly $141,000.

The biggest winners would be high-income households who live in high-tax states, such as New York, Connecticut, and California. Their windfall would be magnified even more since Trump has not suggested restoring the pre-TCJA Alternative Minimum Tax, which limited the benefit of the SALT deduction.

Alternatives

Lawmakers of both parties of been trying to kill the SALT deduction cap almost since the day it passed. But there is no way around it: Repealing the cap without making other changes in tax law would be enormously expensive and a highly regressive windfall for the highest income households.

Eight years ago, my colleagues at TPC suggested several ways to reform the SALT cap in ways that are both more progressive and less costly. Others have proposed replacing the SALT deduction with a fund to directly assist state and local governments in economic downturns. But, sadly, these ideas have gone nowhere. Perhaps that’s because “Repeal the cap” fits better on a campaign bumper sticker.