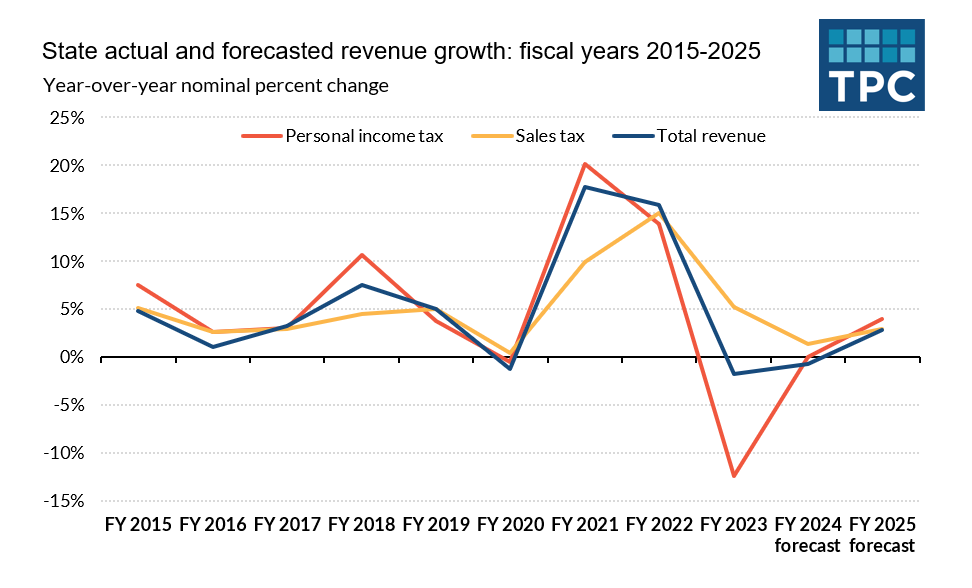

High inflation appears to be giving way to an economic “soft landing,” alleviating concerns state forecasters had heading into the current fiscal year. States now anticipate weak revenues in the remainder of fiscal year 2024 followed by modest growth in fiscal year 2025 across all major tax categories.

This expected stabilization suggests a recovery from the erratic revenue swings since the onset of the COVID-19 pandemic. However, the longer-term revenue picture is murky, with an upcoming presidential election and significant federal tax policy changes on the horizon.

How we got here

State revenue collections surged in fiscal years 2021 and 2022, primarily driven by temporary factors related to the pandemic and recovery. But state revenues weakened substantially in fiscal year 2023. This downturn was partly due to several states implementing tax rate cuts or issuing rebates to taxpayers. These policies led to an estimated $16 billion revenue reduction in fiscal year 2023.

State tax legislation is projected to lower state revenues by an additional $13.3 billion in fiscal year 2024, with $5.4 billion of these cuts being non-recurring or one-time policies. Taken together, these are the largest estimated reductions on record resulting from legislative adjustments. Depending on how the tax cuts were structured, some states will face a bumpier fiscal path ahead.

Revenue picture for the remainder of fiscal year 2024

During the first half of fiscal year 2024, spanning July to December 2023, many states saw decelerating revenue growth. Median state tax revenues edged up by just 0.5 percent in nominal terms during this period.

Personal income tax collections in the median state saw a year-over-year drop of 0.7 percent, while sales and corporate income tax revenues demonstrated more resilience, growing at 1.6 percent and 2.3 percent, respectively.

Along with more traditional tax cuts, elective pass-through entity taxes led to declines in state personal income taxes. In addition to lowering federal taxes for taxpayers with pass-through income, these workarounds also reclassify personal income as corporate revenue in some states.

For the remainder of fiscal year 2024, state revenue forecasters anticipate subdued revenue performance. Personal income tax revenues are forecasted to remain flat at fiscal year 2023 levels; sales tax revenues are forecasted to rise modestly by 1.4 percent. Overall, total tax revenues are projected to decline by 0.7 percent.

While actual tax revenue collections for fiscal year 2024 may deviate from these forecasts, discrepancies are likely to be minimal.

Revenue forecasts for fiscal year 2025

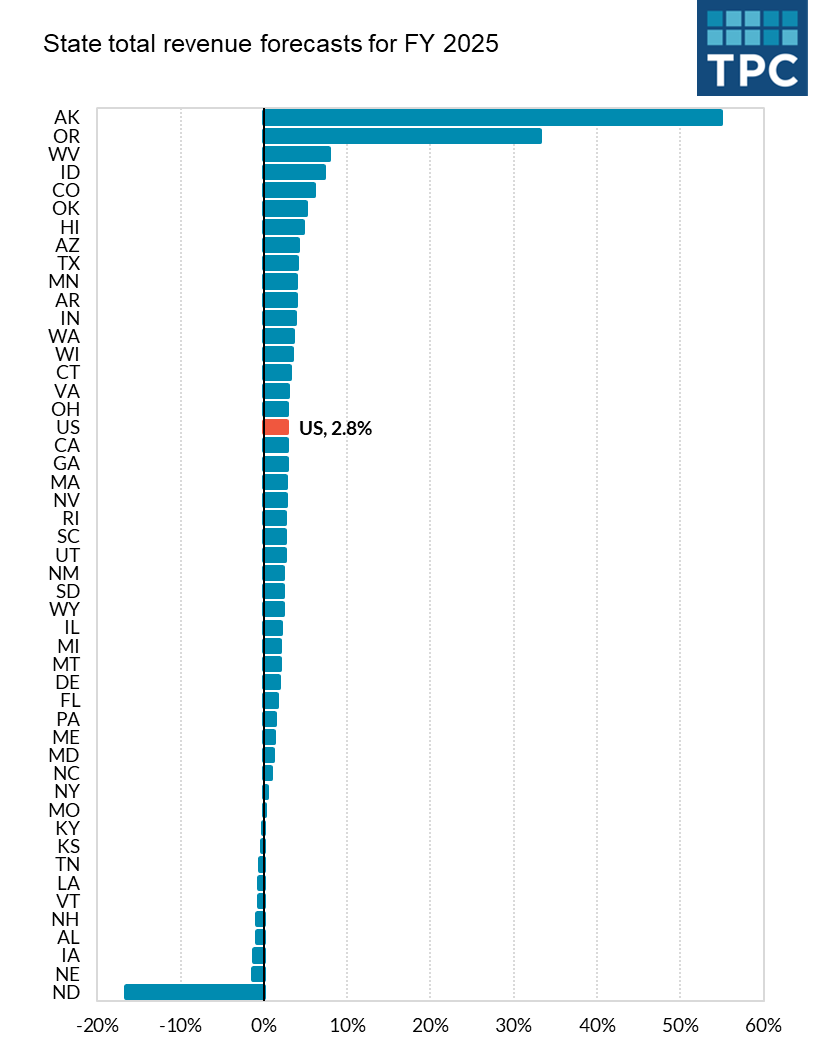

States are expecting a return to normalcy with modest revenue growth in fiscal year 2025 across all major tax categories. Projected year-over-year growth for total state revenues is 2.8 percent. Both personal income and sales tax revenues are forecasted to increase, at 3.9 and 2.9 percent, respectively.

A majority of states, 38 in total, anticipate an uptick in overall revenues. Conversely, 10 states project revenue declines, though for most, these declines are relatively modest, not surpassing 1.3 percent. (We still do not have complete data for two states: Mississippi and New Jersey.)

Notably, North Dakota stands alone in forecasting a significant revenue contraction, which is partly due to legislative changes, including significant income tax cuts.

The largest projected revenue growth is anticipated in Alaska, driven by an expected rebound in investment income—which constitutes a significant portion of the state's total revenues—and by projected increases in oil production.

Revenue growth for fiscal year 2025 is also projected to be strong in Oregon. This reflects an expected increase in personal income tax revenues after fiscal year 2024’s "kicker" credit. The credit, a unique feature of Oregon's tax system, is issued when actual revenues exceed forecasted amounts by at least 2 percent. This mechanism can lead to substantial fluctuations in year-to-year state revenues, as evidenced by the projected decline this year followed by a rebound next year.

These are preliminary forecasts, and many states will finalize their revenue projections for fiscal year 2025 in the coming weeks, particularly following Tax Day.

State governors and legislators are currently debating their fiscal year 2025 budgets. They will be aided by economic and revenue forecasts that are more optimistic than in prior years. But the upcoming presidential election, geopolitical conflicts, and each state’s mix of economic activity are among many factors state forecasters continue to monitor closely.