As states navigate an uncertain fiscal future, a lot of budget commentators will justifiably note that nearly every state cut taxes during the last few revenue boom years. But most states also stocked a lot of money into their savings accounts over the past three years – and this may help them weather forthcoming budget storms.

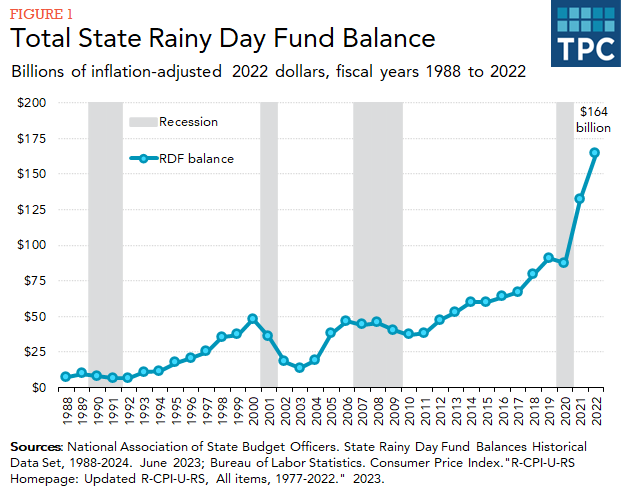

According to the latest data from the National Association of State Budget Officers (NASBO), state rainy day funds reached an all-time high of $164 billion in fiscal year 2022. Similar to state tax cuts, the record savings reflect historic revenue growth, in part due to the federal pandemic relief.

A healthy rainy day fund balance can help states avoid sharp cuts in spending or sharp tax increases when they are hurting economically, such as during the Great Recession and the peak of the COVID-19 pandemic. For example, in the summer of 2020, Nevada transferred its entire rainy day fund balance to its general fund to avoid major budget cuts due to the pandemic-fueled drop in hotel and gambling taxes.

Despite many states dipping into these accounts just a few years ago, most have already stocked away significant amounts to prepare for the next downturn.

Rainy day funds, also known as budget stabilization or budget reserve funds, allow states to set aside surplus revenue for use responding to unanticipated deficits. This can be especially important because, unlike the federal government, all states except Vermont have requirements to balance their operating budgets on an annual or biennial basis; most also disallow carryover of deficits.

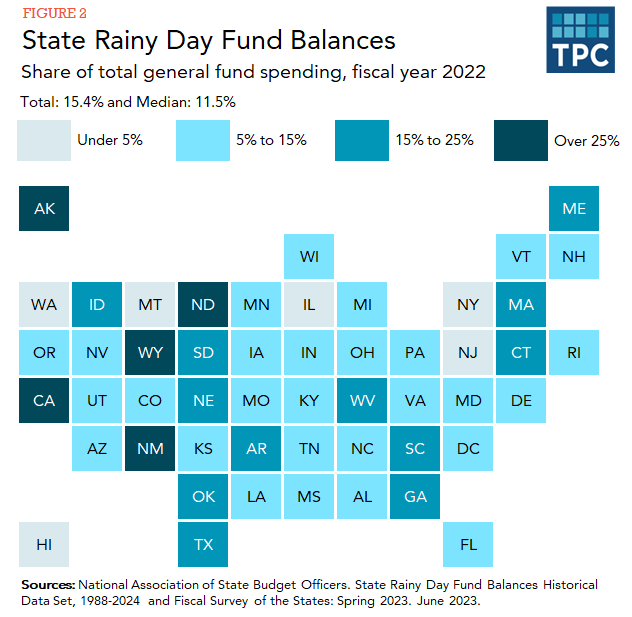

Every state has some type of rainy day fund, though deposit rules vary considerably and some states have more than one fund. For example, many states, including Georgia, New York, and Ohio, simply deposit a portion of their year-end surpluses into their savings account. Meanwhile, Alaska, Texas, and Wyoming require depositing and saving some funds from severance taxes (such as from oil extraction); California deposits some of its volatile capital gains tax revenues into a fund. Those relying on inherently volatile revenue sources typically have very high fund balances, including in 2022. Other states, like Idaho and Virginia, tie their deposits to revenue or economic growth, while Florida and Iowa require a minimum balance no matter the economic or fiscal circumstances.

California ($76 billion) had the highest state rainy day fund balance in 2022; its balance alone contributed 46 percent of the nation’s total. The next highest balances were in Texas ($11 billion), Massachusetts ($7 billion), and Georgia ($5 billion). Per NASBO, New Jersey recorded $0 in its state rainy day fund balance in fiscal year 2022; the next lowest balances were in Montana ($118 million), New Hampshire ($160 million), and Vermont ($266 million).

As a share of total general fund spending, total state rainy day fund balances have climbed steadily since the Great Recession, now totaling 15.4 percent of state spending in fiscal year 2022, the highest share ever recorded.

Measured as a share of their respective spending, Wyoming (96 percent), Alaska (48 percent), New Mexico (38 percent) and California (34 percent) had the highest state rainy day fund balances. Besides New Jersey, Washington (1.2 percent), Illinois (1.6 percent), Hawaii (3.7 percent), and New York (3.9 percent) had the lowest fund balances.

Fund balances are forecasted to decline slightly in the just-completed fiscal year 2023 for states. And, per TPC’s analysis, with half of all states forecasting slowdowns in state tax revenues in fiscal year 2024, more boosts in state saving accounts are unlikely.

For now, though, states are in a far stronger fiscal position than they were after exiting the previous two economic downturns. In real dollars, total state balances two years after the prior two economic downturns were $13 billion (2003) and $38 billion (2011), compared to $164 billion today.

So, while states may face significant uncertainty in the short term, this revenue cushion will leave them better able to respond to the next recession.