States saw robust tax revenue growth in fiscal years 2021 and 2022, largely caused by federal and state policy actions. But forecasts now look much weaker, even as many states consider additional tax cuts.

Several states cut tax rates or provided rebates to taxpayers in 2021 and 2022, which are estimated to have reduced state tax revenues by $16 billion in fiscal year 2023. This is the largest estimated reduction on record resulting from legislative changes. Depending on how the tax cuts were structured, some states will face a bumpier fiscal path ahead.

Current revenue picture

Preliminary data for the first seven months of fiscal 2023 (July 2022 through January 2023) illustrate how much revenue growth has stalled. Overall, state tax revenues declined 0.2 percent in nominal terms in that period. Personal income tax revenues saw year-over-year declines of 9.3 percent while sales and corporate taxes fared better.

There is also significant variation across the states. California and New York are reporting large declines in overall revenues, whereas many states are still reporting growth in nominal terms – albeit much weaker compared to the prior two years.

State revenue forecasters are predicting weak revenues for both the current fiscal year and for fiscal year 2024. Besides recently enacted rebate payments and tax rate cuts, a stock market decline and an end to federal stimulus funds are playing a significant role.

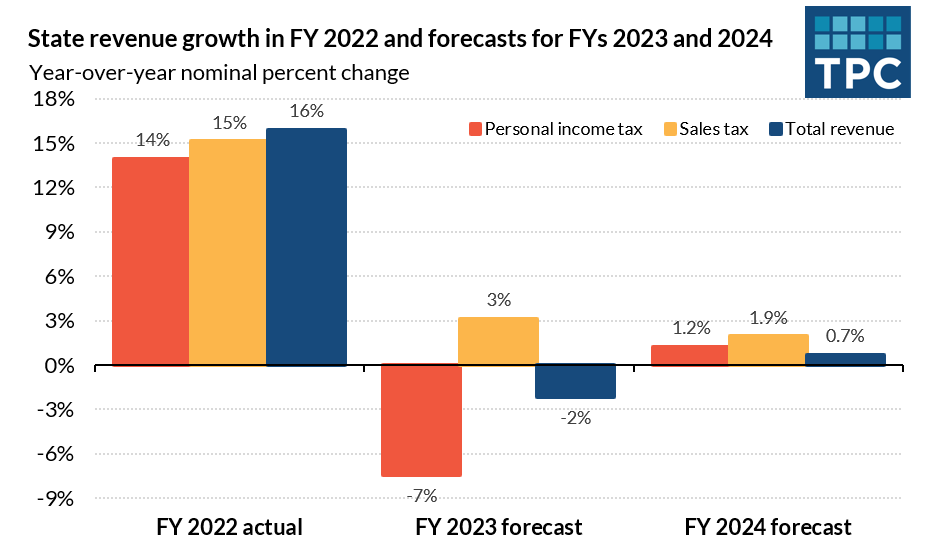

Recently revised forecasts for fiscal year 2023 are mixed across states and different revenue sources. For fiscal year 2023, nominal personal income tax revenues are expected to decline by 7 percent, while sales tax revenues are expected to increase by 3 percent. As a result, total tax revenues are expected to decline by 2.0 percent. It is possible that states might get more revenues in fiscal year 2023 than currently forecasted, but it is highly unlikely that they will see another year of revenue boom like the last two.

Revenue forecasts for fiscal year 2024

State governors and legislators are debating their fiscal year 2024 budgets under highly uncertain economic and geopolitical conditions. Employment remains strong, but continued inflation and increased interest rates are weakening housing markets. Some economists continue to forecast a recession in 2023 and consumer confidence has continued to decline.

Projected year-over-year growth for state total revenues is 0.7 percent for fiscal year 2024. Both personal income and sales tax revenues are forecasted to increase, at 1.2 and 1.9 percent, respectively.

Recent state policy actions, namely tax cuts and the introduction of elective pass-through entity taxes, are part of the reason for expected weaker growth in personal income tax. Sales tax growth is also weakening with a shift back towards consumption of services from the goods purchasing during the pandemic.

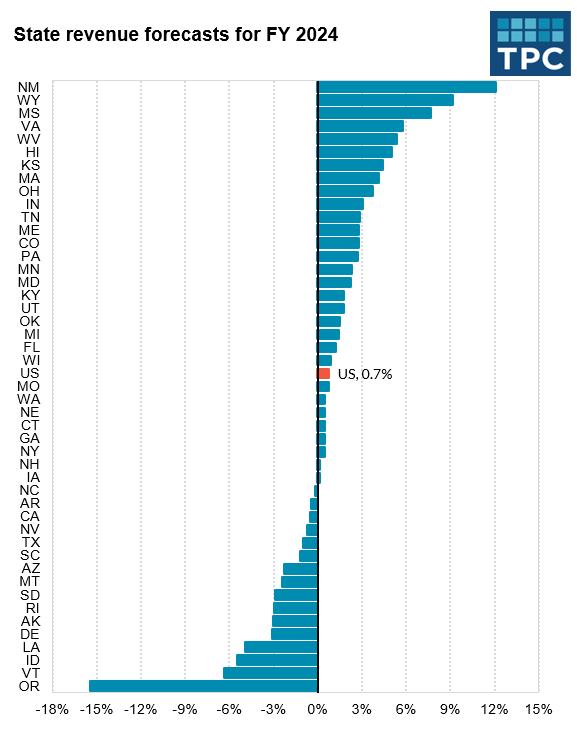

Revenue forecasts vary dramatically across states. Thirty states are projecting growth in overall revenues, while 16 states are projecting declines. Only 5 states are projecting revenue growth of over 5 percent, and these are in nominal terms. Because inflation remains high, current forecasts would translate into revenue declines in inflation-adjusted terms for most states.

Three states are projecting declines of over 5 percent in fiscal year 2024. The largest projected revenue decline is in Oregon, at 15.4 percent. Officials in Oregon warn that the recent surge in revenues were mostly driven by nonwage sources of income, which are likely to be temporary. Moreover, forecasters in Oregon are anticipating $5 billion “kicker” rebates ($3.7 billion for personal income and $1.3 billion for corporate income) in the spring of 2024, which will reduce state overall revenues.

These are initial forecasts, and many states will finalize fiscal year 2024 revenue forecasts in the next few weeks and after Tax Day.

Looking ahead

Revenue forecasters tend to be conservative, but politicians are not. Governors in several states are proposing even more tax cuts. To take a few examples: Montana Gov. Greg Gainforte (R) proposed the largest tax cut in the state’s history, including a permanent income tax rate cut and property tax relief. West Virginia Gov. Jim Justice (D) adopted $700 million in tax cuts, the largest cut in the state’s history. And Michigan Gov. Gretchen Whitmer (D) signed a $1 billion tax cut package.

In all, governors and legislators in at least a dozen states are proposing additional tax relief measures for fiscal 2024.

The last two years have been highly unpredictable, and revenues were boosted in part by unprecedented federal aid and an economy that performed much stronger than expected during the pandemic. No one should expect a repeat of the revenue overperformance of the past two years.

Bottom line: the state fiscal path ahead looks bumpy, and states should take precautionary measures for their fiscal futures.