A few weeks into their 2022 legislative sessions, the question in most state capitols across the country—from Connecticut to Utah—is not whether to cut taxes but how.

The how is critical. As I explain in a new report, income tax rate cuts and refundable tax credits provide different benefits to different people. In general, tax rate cuts overwhelmingly benefit high-income (and mostly white) households, while state earned income tax credits (EITCs) target tax relief at mostly low-income households with children—particularly Black and Latino households.

Each state’s tax proposal should be judged on its own merits as well as the state’s fiscal situation and values. However, in 2022, state policymakers may want to consider two key factors when evaluating possible tax cuts:

- The pandemic’s economic effects were unequal, with low-income workers—and particularly Black and Latino workers—faring far worse than high-income workers. In fact, the unequal recovery is one reason states are enjoying higher than anticipated tax collections (because rich people pay more tax).

- Unprecedented federal spending contributed significantly to the current surge in state tax collections. But that spending largely has ended and future state revenue growth is highly uncertain. Current surpluses are sizeable but not the product of sustained economic growth.

Thus, a long-term commitment to revenue reductions (or spending increases) might not be prudent. Instead, states might want to target tax cuts at those most harmed by the pandemic.

(Quick interlude: Didn’t the American Rescue Plan prevent states from cutting taxes? Short answer, no, states can still cut taxes if they have sufficient revenues and most do. For the long answer, see here.)

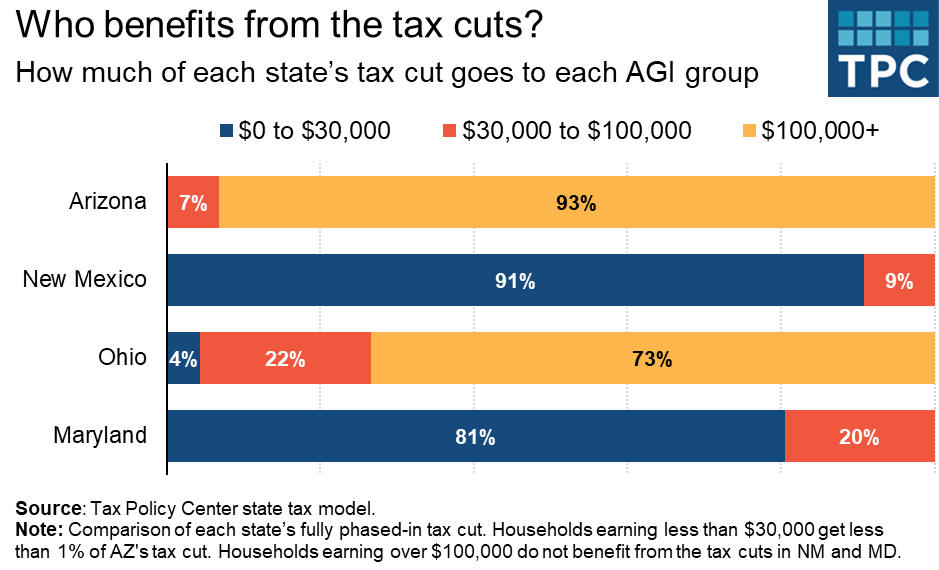

The new report focuses on four states that cut taxes in 2021: Arizona (income tax rate cut, relatively large Latino population), New Mexico (refundable EITC, relatively large Latino population), Ohio (income tax rate cut, relatively large Black population), and Maryland (refundable EITC, relatively large Black population).

In Arizona and Ohio, households earning more than $100,000 received an overwhelming share of the tax cut benefits. In stark contrast, by expanding their state EITC (and making a few other changes), New Mexico and Maryland distributed nearly all their tax relief to households earning less than $30,000.

My Tax Policy Center colleagues and I also created representative households (using race and ethnicity, family characteristics, and the median wage for each group) in these four states and ran them through the Tax Policy Center state tax model.

In general, representative white households saw the largest tax cuts in Arizona and Ohio. Why? Because, across household types, the median wages of white households were higher than Black and Latino households. In fact, Black and Latino households earning median wages for their household type in their state often did not earn enough taxable income to see any benefit from the tax cuts in Arizona and Ohio.

In contrast, representative Latino households in New Mexico and representative Black households in Maryland saw equal or larger tax cuts than comparable white households in those states. This is because a refundable state EITC provides benefits to households with low or no taxable income.

For example, a Latino single adult with two children, earning the median wage for her group in her state, did not get a tax cut in Arizona (no taxable income) but received a $459 tax cut in New Mexico. Similarly, a Black single adult with two children, earning the median wage for her group in her state, did not get a tax cut in Ohio (again, no taxable income) but a similar household at the median wage for that group in Maryland received a $500 tax cut. The full report breaks down how the tax cuts affected representative single adults with no children, single parents, and married couples with and without children in all four states.

Additionally, the annual costs of the income tax rate cuts ($1.6 billion in Arizona and $800 million in Ohio) far exceed the costs of the expanded tax credits ($170 million in New Mexico and $370 million in Maryland).

Some tax rate cut supporters in Arizona and Ohio said their tax cuts would attract high-income workers and businesses and this would help all residents. The ability of tax cuts to lure high-income workers and spur economic growth is debatable, but those groups did benefit. However, prominent lawmakers in both states also touted the direct benefits of their tax cuts for average families, and on that metric these tax cuts fail.

No one tax policy change can achieve every policy goal but enacting or expanding a state EITC can deliver significant economic assistance to the households most harmed by the pandemic in a fiscally responsible way. Tax cuts are a legitimate tool in the post-pandemic environment, but states should be aware that different designs have very different effects.