If this year’s presidential candidates have their way, lots of income will no longer be subject to federal tax. Donald Trump would exempt overtime pay from tax. Kamala Harris and Trump both agree that tips should be exempt. To be fair, there are lots of tax exclusions in the code already. But this form of tax subsidy is especially costly, regressive, and prone to abuse.

Fortunately, better alternatives are available. For example, a flat 15 percent subsidy would do far more for low- and middle-income workers than a tax exemption that would help high-income workers most.

Some tax basics

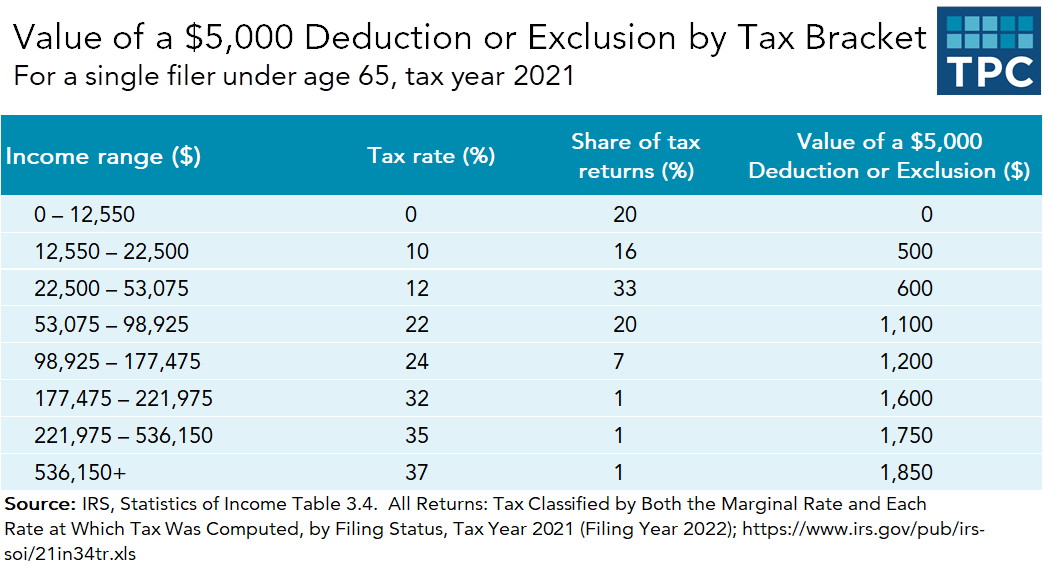

An income tax exclusion or deduction is worth much more to high-income than low-income taxpayers because the tax benefit is proportional to marginal tax rates, which rise with income.

Imagine you are a taxi driver who earns $5,000 in tips. Under either candidate’s proposal, your tips would be exempt from income tax. Deducting $5,000 sounds good, but it wouldn’t affect what you owe in taxes at all if you’re one of the 20 percent of filers in the zero bracket (earn less than the standard deduction) (see table), or if you do not file a tax return at all (not shown in the table). If you’re one of the 69 percent of filers in the 12-percent or lower tax brackets, excluding $5,000 would save you at most $600.

But if you’re one of the seven percent of filers in the 24 percent bracket—say you’re married to someone earning a lot more than a cabbie—the tax break would be worth $1,200. And if you’re lucky enough to be in the top (37 percent) bracket, excluding the tip income would save you more than three times what low-bracket filers would save.

The details of either candidate’s exclusion or deduction proposals are largely unknown, raising further questions.

If tips are excluded from payroll taxes as well as income taxes, the immediate benefits would be somewhat less regressive because most low- and middle-income people face higher payroll than income tax rates. But some of those people would get lower Social Security benefits when they retire, and lost payroll tax revenue would accelerate the depletion of the Medicare and Social Security trust funds.

If excluded from income tax, the money would never show up in Adjusted Gross Income (AGI). Some lower-income parents could end up receiving smaller earned income tax and child tax credits, both of which phase in with earnings.

Tip or overtime income might instead be deductible from taxable income, but not AGI. This would keep low-income workers from losing valuable tax credits, but it would still be regressive, and a little more complicated for tax filers.

The candidates might attempt to limit the regressivity and cost of their proposals by phasing out a deduction at higher AGI levels. Harris is said to be considering this option. But this would make the tax code even more complex and could introduce new marriage penalties. A tipped worker, for example, might owe much more income tax if marrying suddenly made their exempt tip income taxable.

TPC estimates that exempting tip income could cost between $3 and $14 billion per year depending on whether the income were exempt from payroll tax as well as income tax and whether there were an income limit on eligibility, but that assumes no tax avoidance behavior.

Any time the tax code exempts one form of income from tax, it gives taxpayers a strong incentive to convert other forms of income into the tax-exempt form. This makes the provision even more expensive and inequitable. Policymakers can try to stem such avoidance, but not without creating new complexities and inequities.

Rather than exempt income in any way, policymakers have a somewhat better option. An alternative subsidy mechanism, such as a flat-rate refundable tax credit of, say 15 percent, could help more workers than an exclusion or deduction. The credit could be capped to limit the incentive to convert other income into the tax-favored form.

But if policymakers reward one kind of income in the tax code—whether tips or overtime or some giveaway yet to be announced—they can expect earners of other kinds of income to demand similar treatment. Given the national debt is already verging on 100 percent of gross domestic product, tax exclusion creep might be the most worrisome aspect of election-year giveaways.