A key provision of 2017 Tax Cuts and Jobs Act (TCJA) was the elimination of the personal exemption. The change has a major effect on both federal tax filers and those who pay state income taxes. But the way Congress eliminated it created confusing questions about what actually changed in some states. Questions that still linger a full year after the law passed and weeks before people start filing their federal and state taxes under the new law.

The personal exemption itself is a relatively simple concept—you deduct a specified amount of money for every eligible member of your household when computing taxable income. Because every state with its own income tax links in some way to the federal code, the TCJA caused numerous changes in state income taxes, as we’ve noted throughout the past year. But this personal exemption conformity issue is possibly more complex than even those confusing examples.

Here’s the problem: The TCJA didn’t exactly eliminate the personal exemption. Rather it kept the exemption on the books and set its value at $0. This change was relatively simple in the nine states that used the federal personal exemption amount in their tax calculations prior to the TCJA, as these state exemption amounts also fell to $0. My colleague Elaine Maag and I explained the repercussions from that change (and subsequent state responses) in a recent paper.

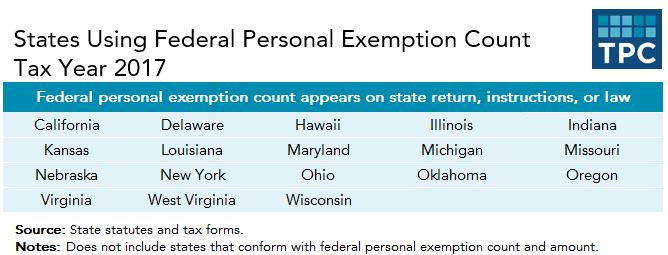

But another 18 states faced a more complicated issue. They used the number of personal exemptions reported on federal returns in their state tax calculations, but set their own independent amounts for their exemptions or credits. For example, the Illinois 2017 tax return simply asked filers to multiply the number of personal exemptions on their federal return by the state’s $2,175 exemption (no lists or other calculations).

Delaware, Indiana, Michigan, Missouri, Nebraska, Oklahoma, Virginia, and Wisconsin had similar instructions on their forms. Other states, such as Ohio, asked filers to list dependents on the state form but still used the personal exemption number listed on the federal form for the state calculation. California and Hawaii did not instruct filers to use the federal count but referenced the federal law in their statutes.

What’s the status of these state exemptions?

Had the TCJA repealed the federal personal exemption it also would have eliminated these state exemptions. But the federal exemption remains in the code: Section 151. So it’s there.

The IRS did not include a line for the number of personal exemption in the updated 1040. Instead, it only asked filers to list their dependents (as it did in prior years).

How confusing is this? In Michigan, a senior state economist for the legislative fiscal agency argued the $0 federal personal exemption eliminated the state’s exemption while a former deputy budget director insisted it did not. Both also readily admitted they could be mistaken.

Fortunately, there is a simple and better solution: A state can change its statute to define its personal exemptions as the sum of the federal filer, the filer’s spouse, and dependents (which still are included on the federal 1040). That would provide the same count as adding up the old federal personal exemptions. Maryland, Michigan, and Wisconsin already have taken this step.

Other states have tried other fixes. Nebraska used the federal child tax credit count plus the filer and spouse to compute its personal exemption count. Ohio no longer requires that the number of exemptions on its tax returns match the federal personal exemption count. Missouri eliminated its personal exemption as part of a larger tax overhaul. Hawaii and Indiana went in a more complicated direction. They retained the pre-TCJA federal exemption rule when they reworked their code to conform with the new federal law (states can pick a specific date for conforming to the federal code).

The other affected states—California, Delaware, Illinois, Kansas, Louisiana, New York, Oklahoma, Oregon, Virginia, and West Virginia—have not made legislative changes to their personal exemptions or credits. But representatives from their tax and budget departments told me they expect to retain personal exemptions and credits. Some anticipated that personal exemptions will remain on the federal forms while others said they would update their state forms and instructions.

Maybe they’re right and maybe that’s enough. But it would be more prudent for states that want to keep personal exemptions to follow the lead of Maryland, Michigan, and Wisconsin and to make their statutes consistent with the new federal tax code. Or better yet, they could replace their exemptions with child tax credits. There’s no reason taxpayers in these states should be as confused as I am about all this.