Corporate tax reforms introduced by the 2017 Tax Cuts and Jobs Act (TCJA) encouraged foreign-owned US companies to reinvest more of their earnings here, according to a new TPC study. The study also finds a positive relationship between the TCJA tax cuts and foreign-owned companies’ investment in US tangible assets.

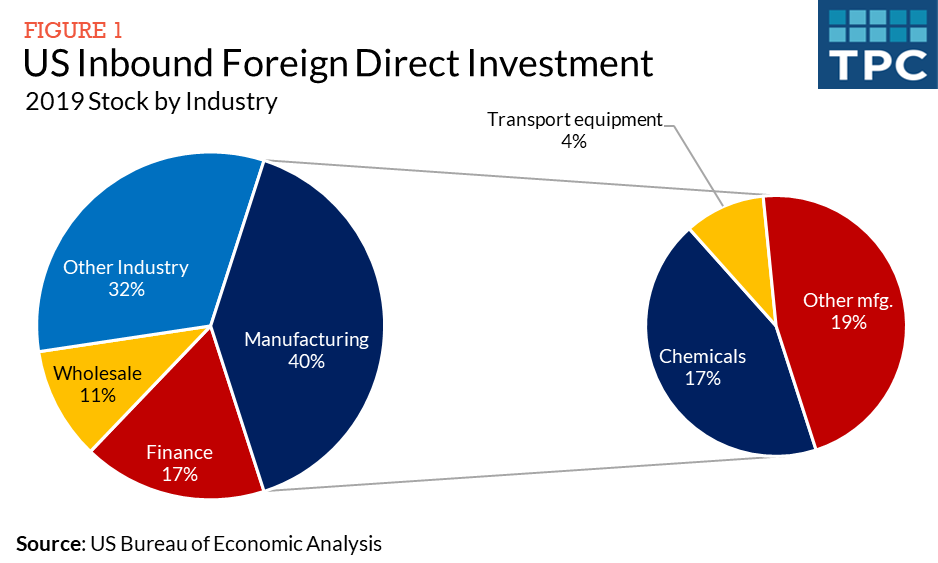

Foreign investment accounts for about 15 percent of US private business capital investment, research and development spending, and corporate tax revenues. It is heavily concentrated in manufacturing, particularly pharmaceutical chemicals.

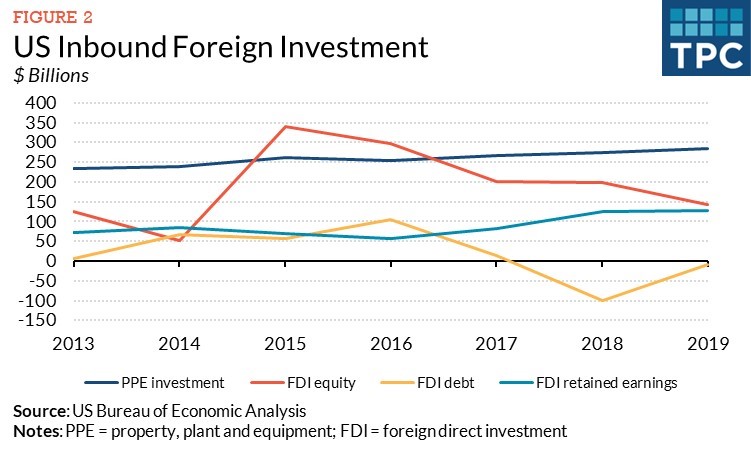

TPC evaluated two measures of foreign investment: Inbound foreign direct investment (FDI) measures financial inflows from foreign investors with minimum ownership stakes in US companies, which can be financed with new equity, loans, or retained earnings. Investment in property, plant, and equipment (PPE) measures foreign-owned US companies’ investment in tangible assets.

TCJA made sweeping changes to the US corporate income tax that sharply lowered its overall burden. TCJA cut the US corporate tax rate from 35 to 21 percent, and the foreign derived intangible income (FDII) regime reduced the tax rate on excess returns from exports to about 13 percent. Temporary full expensing of most equipment investment (“bonus depreciation”) also narrowed the corporate tax base. Conversely, TCJA broadened the tax base by limiting interest expense deductibility and introducing the base erosion anti-abuse tax (BEAT), which disallows some deductions to foreign related parties.

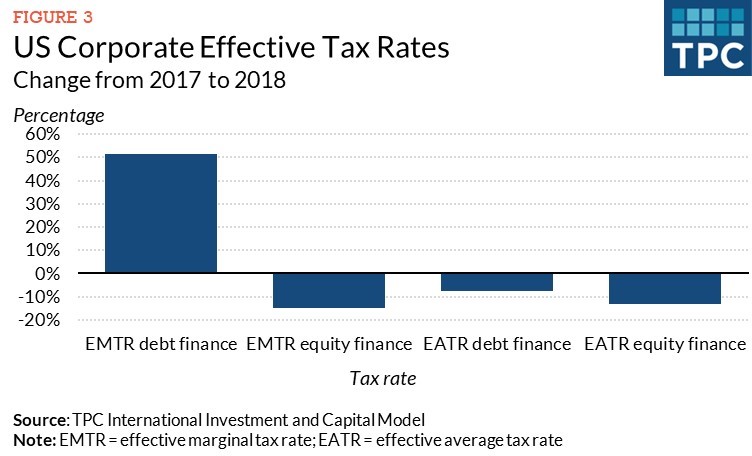

TPC’s study captured both rate and base changes by focusing on effective tax rates calculated using its international investment and capital model (IICM).

The effective marginal tax rate (EMTR) measures the share of taxes in the gross return on an investment that just breaks even after taxes. The EMTR on equity-financed investment fell from 28 percent to 14 percent in 2018. However, the reform raised the negative EMTR on debt-financed investment even more sharply, from about -80 percent to -30 percent.

The effective average tax rate (EATR) is the ratio of the present value of tax liability from a profitable investment to the present value of its pretax earnings. The EATR is particularly relevant to cross-border investment decisions, where firms decide among alternative jurisdictions where to locate a project based on overall tax burden. For a project earning a 20 percent rate of return, both debt and equity EATRs fell by about one third in response to TCJA.

The IICM allows calculation of EMTRs and EATRs at the country level, differentiated by country-specific corporate and cross-border withholding taxes, and at the industry level, differentiated by asset composition.

Estimates indicate that FDI financed with retained earnings rose in response to the cut in US EMTRs and EATRs, even when controlling for GDP growth and dollar exchange rates. On average, retained earnings rose about 0.5 percent in response to each percentage-point fall in the EMTR and 3 percent in response to each one-point fall in the EATR. The investment response to the change in EATRs is similar to that found in in other economic studies.

Investment in PPE also rose following the TCJA tax cut, but less strongly. On average, about 0.35 percent for each percentage point decline in the EMTR and 0.75 percent for each percentage point decline in the EATR. However, the relationship between tangible investment and tax rates weakened when macroeconomic controls were introduced.

TCJA tax cuts thus appear to have spurred investment in tangible assets mainly through their stimulative effect on aggregate demand. This finding corroborates other early empirical studies of TCJA by Bill Gale and Claire Haldeman and the International Monetary Fund.

TPC does not find evidence that foreign direct investment (FDI) financed with new equity or debt responded to the tax reform. Debt-financed FDI dropped sharply in 2018 but then rebounded the following year. Since foreign-owned US companies also borrow in US capital markets, they may further have adjusted their leverage through that channel.

Equity-financed FDI, which is largely driven by acquisitions of existing US companies, fell following TCJA. TPC finds that the decline in equity-financed FDI was driven by the boom and bust of “inversions”: transactions in which a US corporation becomes a foreign-owned corporation, typically through merger or acquisition. These transactions, which generate an FDI inflow to acquire US stock, peaked in 2015 and then declined due to tighter US Treasury regulations as well as the TCJA reform.

In sum, we find TCJA’s large reduction in effective tax rates induced foreign investors to retain more earnings in the US. Lower corporate taxes also supported foreign investment in tangible assets.