This blog post was updated on July 10, 2024, to account for which corporate tax changes were included in TPC’s estimates and to clarify that the bonus depreciation began phasing down in 2023.

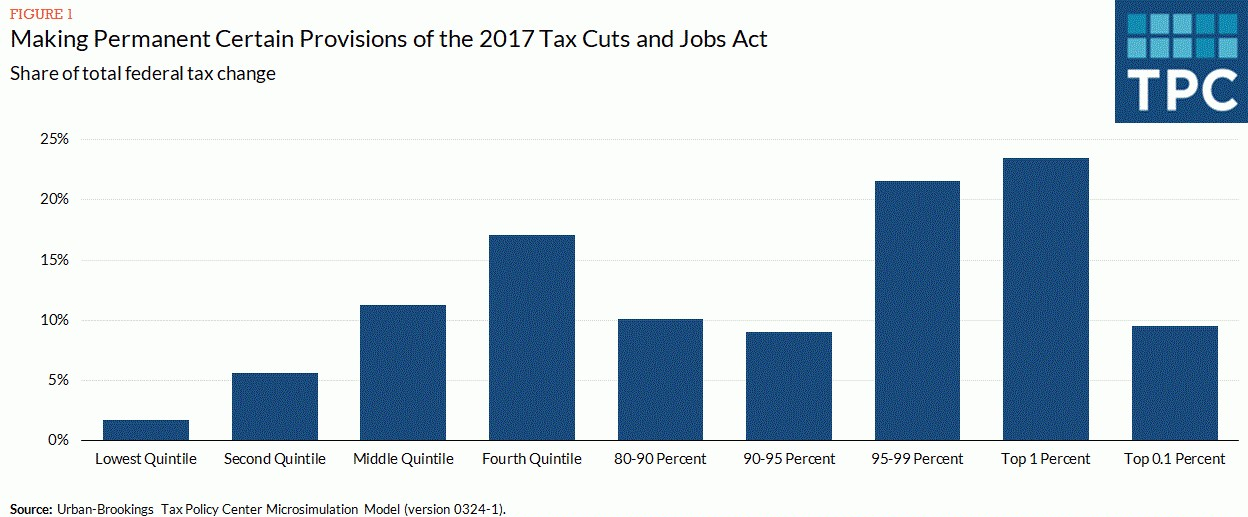

Households making about $450,000 or more would receive more than 45 percent of the benefits of extending key provisions of 2017 Tax Cuts and Jobs Act (TCJA), according to a new analysis by the Urban-Brookings Tax Policy Center (TPC).

The TCJA’s individual income tax provisions are due to expire by the end of 2025. Making them permanent and maintaining certain business tax provisions would cut taxes for the highest income 1 percent of households (those making $1 million or more) by 3.2 percent, or an average of about $70,000 in 2027. The top 0.1 percent, who will make $5 million or more, would receive an average tax cut of nearly $280,000, or 3 percent of their after-tax income. Middle-income households, by contrast, would see their taxes decline by about $1,000 or 1.3 percent of their after-tax incomes.

TPC modeled the extension of the TCJA’s individual income tax and estate tax provisions, as well as maintaining the original versions of bonus depreciation and international business tax provisions scheduled to change under current law.

Stark Contrast Between Trump and Biden

Extending the law would increase the national debt by more than $4 trillion over the next 10 years. And it is a critical point of disagreement between former president Donald Trump and President Biden.

Trump has made extending the TCJA an important piece of his economic agenda. Biden has said repeatedly that he’d address the expiring law in a way that does not raise taxes for those making $400,000 or less, though he has not specified how. His fiscal 2025 budget includes some tax cuts for low- and moderate-income families and several proposals aimed at raising taxes on high-income households and businesses.

The contrast between these two ideas could not be more stark.

Winners and Losers

Extending the TCJA would cut taxes for about three-quarters of households but raise them for about 10 percent. In 2027, about 45 percent of the benefit of all the tax cuts would go to those making roughly $450,000 or more.

It also would create winners and losers within income groups. For example, TPC found that while about 86 percent of middle-income households would get a tax cut, about 13 percent would see their taxes rise. Among the top 1 percent, taxes would fall for about 81 percent, while they’d rise for 19 percent.

If Biden holds to his $400,000 promise and allows TCJA provisions to expire for higher-income households, he’d cut taxes or leave them the same for about 95 percent of households, depending on how you measure income. But he’d substantially raise taxes on corporations and households making more than $400,000—the very people who would receive a large share of the benefit of extending the TCJA.

How Households Benefit

Different income groups would be affected by extending different provisions.

For example, the lowest income households would benefit most from retaining the TCJA’s higher standard deduction and its more generous Child Tax Credit (CTC), compared to the prior law. Those tax cuts would be somewhat offset by not restoring personal exemptions, which the TCJA repealed.

For middle-income households, much of the benefit would come from the higher standard deduction and CTC, as well as lower income tax rates. Some of their tax cuts also would be offset by the continued absence of personal exemptions.

The world would be very different for higher-income households. The top 0.1 percent would benefit most from continued low income tax rates, the special 20 percent tax deduction for closely-held businesses such as partnerships, and several other business tax changes. TPC and most other analysts assume that workers and owners of capital ultimately pay business taxes.

The biggest downside for those very high-income households: Extending the TCJA’s limits on itemized deductions.

Excluding A Windfall

While TPC modeled the effects for years 2026, 2027, and 2034, I’ve focused on 2027, largely because making the TCJA permanent creates a one-time 2026 tax windfall for Opportunity Zone (OZ) investors.

The original law allowed investors to defer tax on capital gains only until December 31, 2026. But that deadline could disappear if the TCJA is extended or made permanent, allowing those investors to avoid that tax in 2026 and perhaps forever.

This barely would matter to the vast majority of households, few of whom invested in OZs. But including that 2026 windfall reduces taxes for the top 0.1 percent by about an additional $80,000 compared to 2027. The top 1 percent would receive an extra $12,000 on average.

The Biggest Winners

TPC estimated that extending the TCJA would lower taxes by an average of about $2,000 in 2026. But nearly half the benefit would go to the highest-income 5 percent of households, those making about $450,000 or more.

The pattern is roughly the same for individual tax changes only, since only a relatively small number of business provisions are due to expire. Excluding those business changes, high-income households would get slightly smaller tax increases.

There is much we still need to learn about how the candidates would address the looming expiration of many key provisions of the TCJA. But one thing is clear: While extending the law as is would benefit most taxpayers, the biggest winners would be those making $450,000 or more.