Both Democratic presidential nominee Kamala Harris and Republican presidential nominee Donald Trump have pledged to exempt tip income from taxes if elected. Our TPC colleague Howard Gleckman has written about how these plans raise design and administration issues. Another question is who would benefit and how that varies by state.

Tipped workers make up different shares of each state’s labor force, and each state has different rules for paying tipped workers. And in 41 states with income taxes, legislatures would need to decide whether to exempt tips from state income taxes if Congress enacted a federal tip exemption.

Which states have the highest shares of tipped workers?

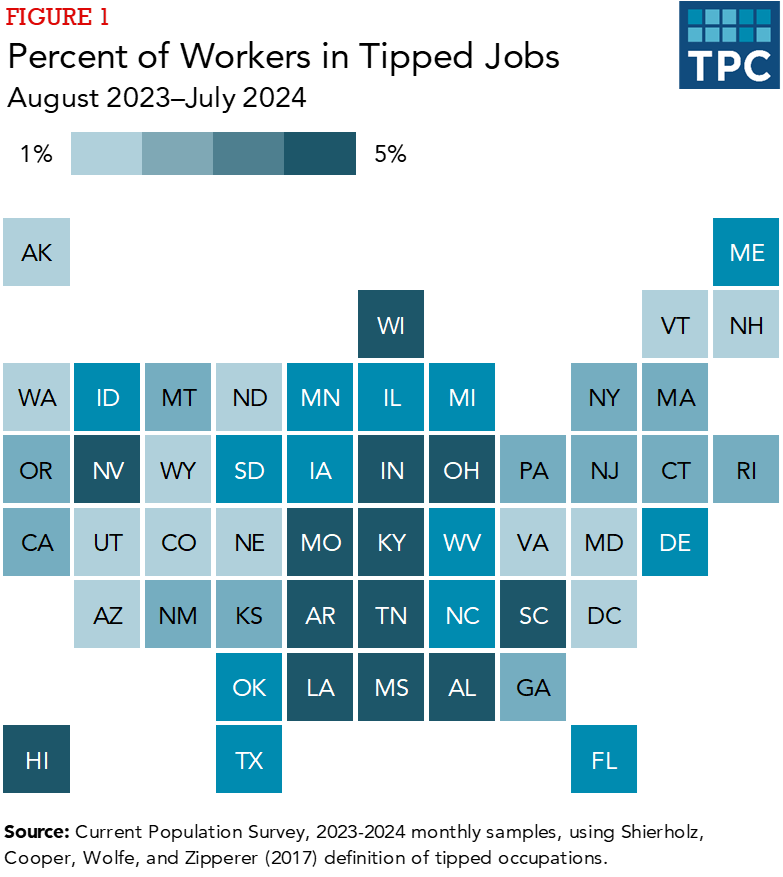

Ernie Teshechi of the Yale Budget Lab estimates that about 2 percent of workers across the country work in jobs that regularly receive tips. While a variety of workers in different sectors receive tips (like hairstylists or dogwalkers), most tipped workers are in the hospitality industry.

However, shares of tipped workers vary by state. Tipped workers account for more than 5 percent of workers in Nevada, but represent less than 1 percent in Washington, DC, and Colorado. Nevada, with its notably large leisure and hospitality sector, is a regional outlier, but generally, tipped workers make up larger shares of the workforce in Southern states.

Across the states, women are more likely than men to be tipped workers. With the exception of Washington, DC, women represented more than 71 percent of tipped workers nationally in June 2024, despite representing 47 percent of total workers. Women of color are especially likely to be tipped workers, making up more than 29 percent of all tipped workers.

How do tips interact with minimum wage laws in each state?

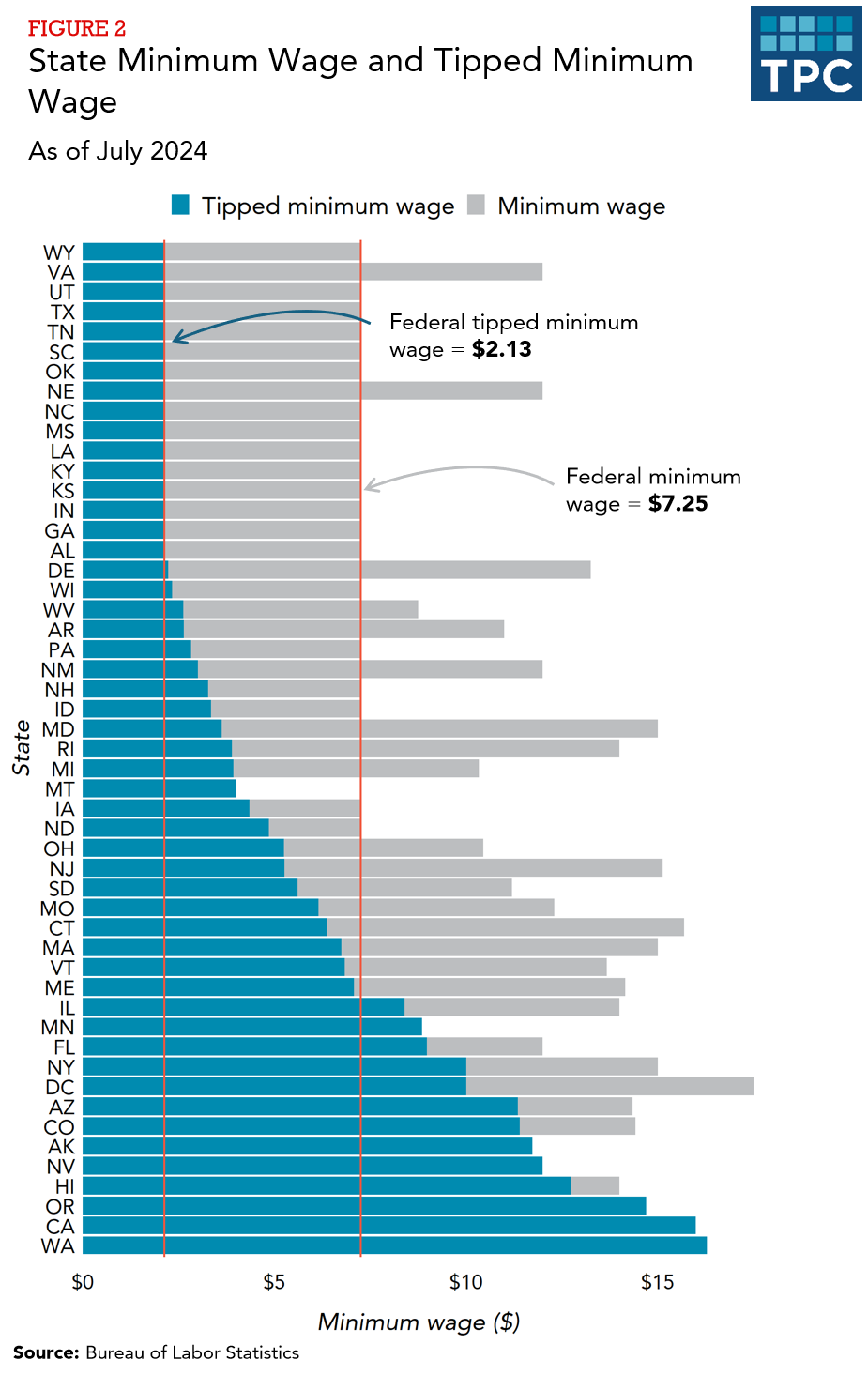

Hourly state minimum wages range from the federal minimum of $7.25 in 20 states to $16.28 in Washington state. The highest minimum wage in the US is $17.50 in Washington, DC. Some local governments within a state require a minimum wage higher than the state minimum. For example, the minimum wage in New York is $15.00, but the minimum wage in New York City and surrounding counties is $16.00.

However, in many states, employers do not have to pay the minimum wage to workers earning tips. Instead, employers can pay these employees a lower “tipped minimum wage,” to the extent that their workers make up the difference in tips. The federal hourly tipped minimum wage is $2.13. That $5.12 difference from the federal minimum wage is the “tip credit.”

Among the states with their own tipped minimum wage laws, tipped minimum wages range from $2.23 in Delaware to $12.75 in Hawaii. Companies must ensure their workers earn enough tips to meet the prevailing minimum wage, but evidence suggests this does not always happen.

The gap between the tipped and standard minimum wage shows which workers are most likely to need more tip income to close the gap. For example, Delaware has a higher standard minimum wage than Florida, but because its tipped minimum wage is a much lower share of its minimum wage (17 percent) than in Florida (75 percent), Delaware’s tipped workers must rely more heavily on tips to collect earnings at or above the minimum wage.

There is no gap in seven states: The state minimum wage and the tipped minimum wage are the same. Employees in these states can still earn tips on top of the minimum wage.

Proponents argue a single minimum wage prevents employers from underpaying their employees, among other abuses. For example, Chicago recently began phasing out their tipped minimum wage and moving toward a single minimum wage. Chicago’s Office of Labor Standards published research on the prevalence of workplace tip violations and the income insecurity facing workers who rely on tips, and recommended eliminating the tipped minimum wage.

Meanwhile, opponents such as representatives of the restaurant industry argue that eliminating the tipped minimum wage increases labor costs. That increase, they say, drives up prices, harming their ability to operate and compete.

How could exempting tips affect state tax collections?

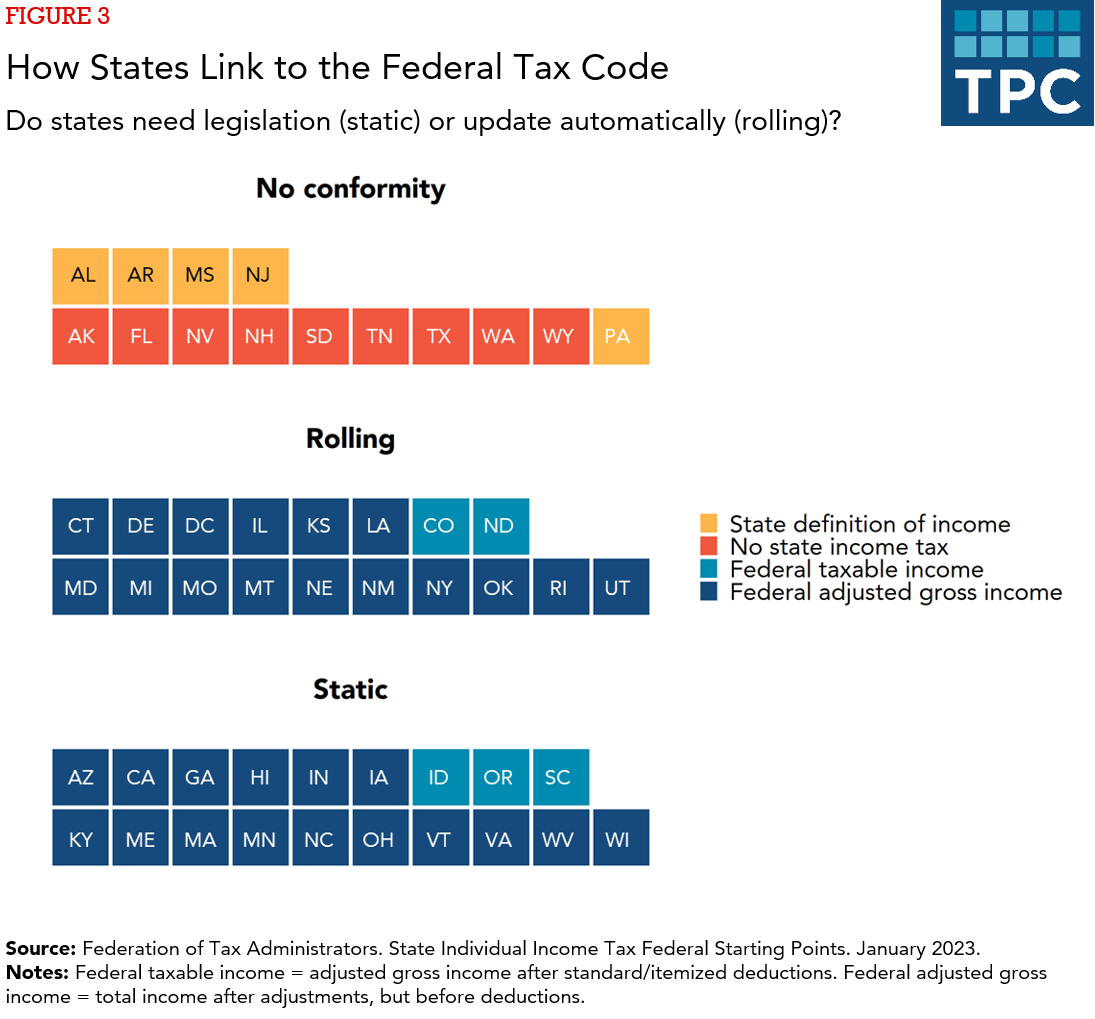

States with income taxes often “conform” with federal tax rules and definitions, including the definition of income, to simplify filing and enforcement for taxpayers and tax administrators. If the federal government exempted tips from federal income tax, each of the 41 states with an income tax would have to choose whether to follow along.

In 18 states, the federal law would take effect automatically (because of “rolling” conformity), and lawmakers would have to act to overturn it. Nineteen other state legislatures would need to pass a law (known as “static” conformity) to adopt the tipped income exemption.

States would face two hurdles to maintaining taxes on tips if a federal exemption were enacted. One hurdle is administrative: If a filer still reported tips on federal tax forms, but deducted them from taxable income, states could simply add tips back to taxable income. If a filer didn’t have to report tips on federal tax forms, states would need to collect an additional piece of information from employers and taxpayers.

The other hurdle is political: As with some other federal tax exemptions, it might be politically difficult to tax something when the federal government does not.

Still, a state’s exemption of tip income will have a fiscal cost. After years of exempting it, Montana recently decided to tax tipped income. Montana estimated that tip exemption previously cost the state roughly $6 million, or about 0.3 percent of its individual income tax collections in 2021. That’s not a large amount of revenue, but any loss would require an offsetting tax increase or spending reduction because of state balanced budget rules.

And that figure does not account for more workers seeking to be paid through tips because of the exemption. If high-income workers were able to shift their earnings into tips, state revenue losses could be much higher.