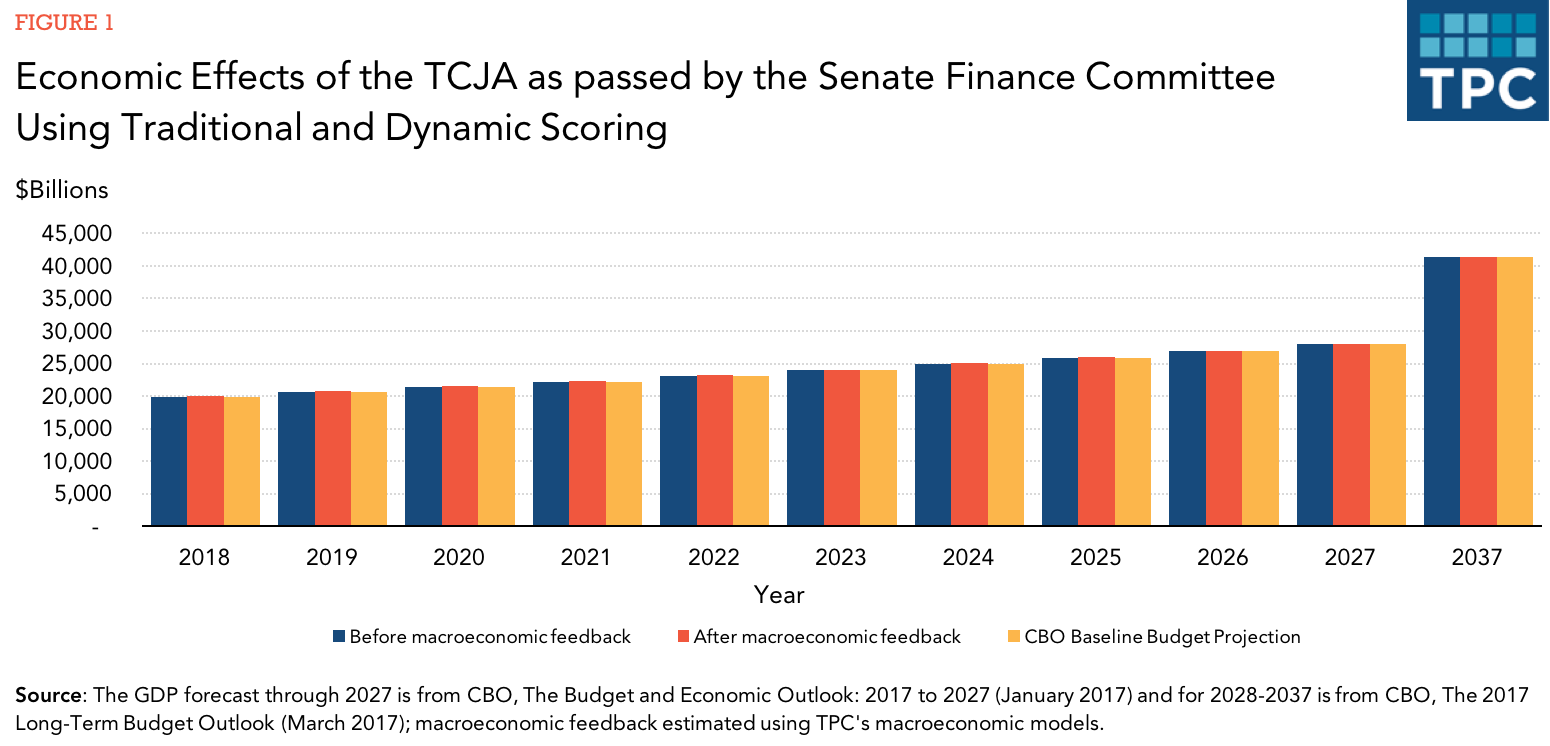

The Senate Finance Committee version of the Tax Cuts and Jobs Act would increase Gross Domestic Product modestly until 2025, and by even less after many of its tax cuts expire in that year, according to a new report by the Tax Policy Center. The Finance panel’s version of the TCJA would barely change the size of the economy in 2027 or in 2037.

As a result, the tax bill would generate roughly the same amount of revenue whether it is measured using traditional budget scoring or taking into account the macroeconomic effects of the bill (dynamic scoring).

Using conventional scoring, TPC estimates the Senate Finance bill would increase deficits by about $1.4 trillion from 2018 through 2027, not including added interest costs. After taking into account macroeconomic feedback effects (also excluding interest costs), the bill would add $1.2 trillion to the debt over the 10 years. Thus, additional economic growth would trim the bill’s cost by just $179 billion over the decade, or roughly 12 percent.

In the 2028-2037 period, the bill would reduce deficits by about $174 billion before taking into account macroeconomic effects and extra interest. Dynamic scoring shows the bill would trim the bill’s cost by an additional $34 billion, resulting in a small net decline in deficits of about $208 billion over the second 10 years.

Over two decades, dynamic effects would raise about $223 billion more than conventional scoring shows.

In the short-run, the bill’s tax cuts would increase demand for goods and services by both households and businesses. But partly because the economy is near full-employment, the increase in output from higher demand would be relatively small.

In the first few years, the bill would also boost the labor supply by cutting marginal income tax rates for most workers. But those benefits would be reversed after nearly all individual income tax provisions expire in 2025. Higher marginal tax rates resulting from the bill’s less generous formula for indexing the tax code for inflation would reduce labor supply.

By cutting corporate income tax rates and temporarily allowing firms to more rapidly depreciate their costs of plant and equipment, the bill would also increase after-tax returns to investment. But its incentives to boost saving and investment would be largely washed out by higher interest rates caused by increased federal deficits over the first decade.

Note that TPC estimated the effects of the bill reported by the Finance Committee on Nov. 16. The estimate does not include changes made after the bill reached the Senate floor. The macroeconomic effects of the Senate Finance bill are very similar to TPC’s analysis of the House-passed version of the TCJA.

TPC shows slightly more modest growth than the results of the Penn-Wharton Budget Model (PWBM). The congressional Joint Committee on Taxation is more optimistic than both TPC and Penn-Wharton. It concluded that macroeconomic effects would reduce the cost of the bill by about $400 billion or about one-fourth.

However, all these models tell roughly the same story: The Tax Cuts and Jobs Act won’t produce dramatic increases in the economy nor would it come close to paying for itself.