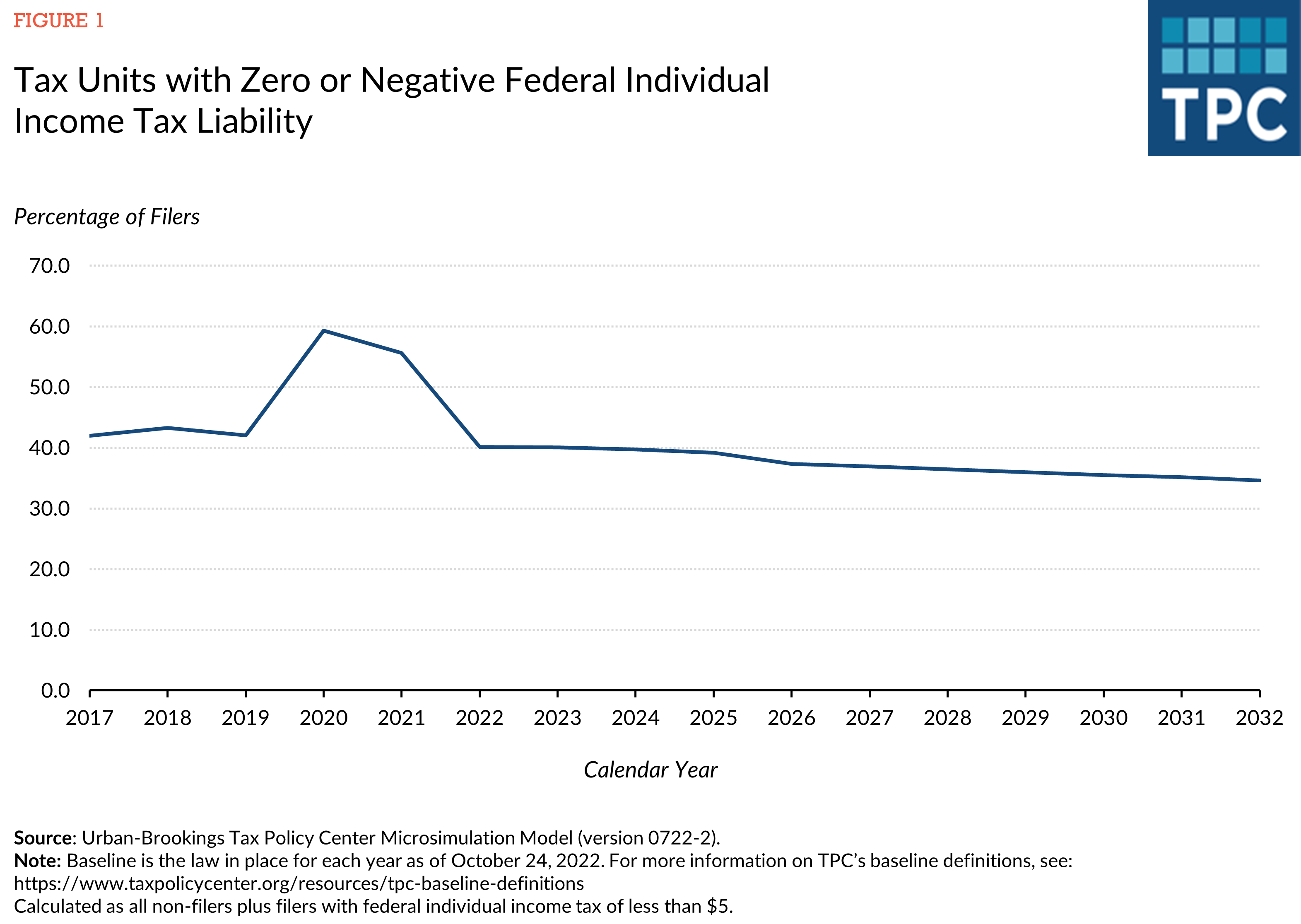

After dramatically rising during the worst of the pandemic, the number of households who pay no federal income tax has fallen sharply. It will remain relatively steady in absolute numbers and as a share of tax filers as long as the job market remains relatively healthy and until the individual tax provisions of the 2017 Tax Cuts and Jobs Act (TCJA) expire at the end of 2025.

A new Tax Policy Center analysis finds about 72.5 million households, or roughly 40 percent, will pay no federal income tax this year. That is significantly fewer than the 59.3 percent at the height of the pandemic-driven recession in 2020 and even down a few percentage points from pre-pandemic levels of between 42 percent and 43 percent.

About 30 million households, or about 16.5 percent, will pay neither federal income tax nor payroll taxes this year. That share too is down from the 20 percent in 2020 and roughly consistent with pre-pandemic levels.

Only a tiny fraction of people with very high incomes avoid paying federal income tax. TPC estimates that 0.6 percent of those in the highest-income 20 percent of households (those making about $190,000 or more) are non-payers. That’s often because they have many large itemized deductions or perhaps big businesses losses from a prior year they can use to reduce current taxable income.

But, for the most part, people don’t pay income tax because they have little income. About 60 percent of non-payers make less than $30,000 and another 28 percent make between $30,000 and about $60,000.

The federal standard deduction this year is $12,950 for single filers, $19,400 for heads of household, and $25,900 for married couples filing jointly. Anyone making less than those amounts will owe no federal income tax. In addition, most families with children are eligible for the Child Tax Credit (CTC) and many workers are eligible for the Earned Income Tax Credit (EITC). Both are at least partially refundable and can reduce tax alibility to zero or even give money to those with no income tax liability.

About 90 percent of households making less than $30,000 (the lowest-income 20 percent of households) pay no federal income tax as do about half of those making between $30,000 and about $60,000 (the next 20 percent).

Of the 72 million households that will pay no federal income tax this year, about 24 million, or roughly one-third, are age 65 or older. Many likely are living primarily on their Social Security income. Roughly the same number are families with children, most of whom benefit from the CTC and many who claim the EITC.

During the COVID-19 recession, many households also fell below the income tax thresholds because they received large Economic Impact payments in the form of tax credits that also reduced their income tax liability. In addition, in 2020, unemployment insurance benefits were tax exempt. Those benefits have now ended.

Assuming the US avoids an economic slump, the share of households who do not pay federal income tax will remain steady in 2023, then fall slightly. But if the economy falters in the coming year, the number of non-payers will rise again. Similarly, more households will pay income taxes starting in 2026 if the individual tax cuts of the TCJA expire as scheduled at the end of 2025. TPC estimates about 37 percent of households will pay no federal income tax in 2026, falling to below 35 percent by 2032.

While some politicians imply that people somehow are cheating the system by not paying taxes, the reality is quite different. People generally don’t pay federal income tax because, well, they don’t make very much money.

As recent trends show, the number of non-payers really is driven by the economy—when people lose their jobs in a recession, they make less money—and by changes in the tax law.