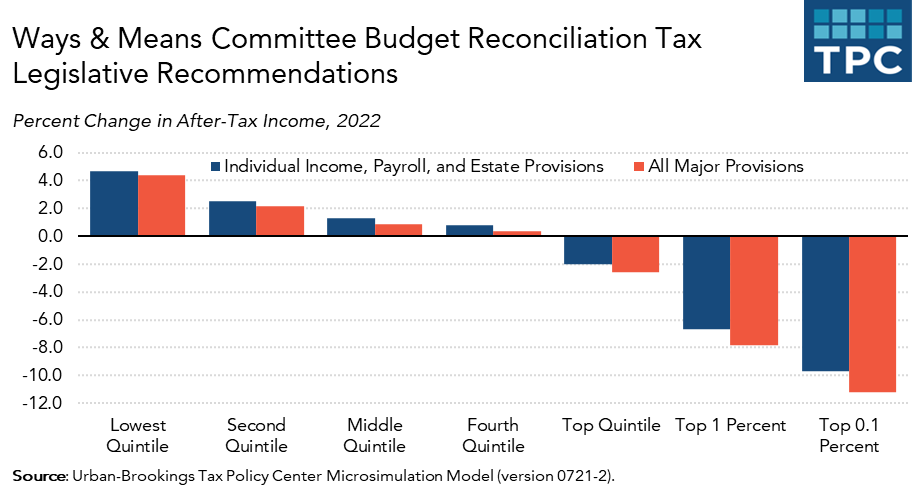

All major provisions of the House Ways & Means Committee’s budget reconciliation tax bill would cut 2022 taxes on average for households making $200,000 or less. At the same time, the bill would raise taxes substantially for those making $1 million or more, according to a new analysis by the Tax Policy Center.

The bill’s individual income, payroll, and estate tax provisions alone, however, would cut taxes on average for households making $500,000 or less while still increasing them significantly for the highest income households.

As a result of the individual income, payroll, and estate tax changes, only a handful of households making $500,000 or less would pay more in taxes in 2022 than under current law. However, including all major provisions, including corporate income and excise tax increases, about 58 percent of all households and nearly 80 percent of households making between $200,000 and $500,000 would pay more. About two-thirds of those making between $100,000 and $200,000 would face somewhat higher tax bills—about $650 on average.

The Joint Committee on Taxation estimates the Ways & Means bill would raise taxes on corporations and high-income households by about $2 trillion and cut taxes on low- and moderate-income households by about $835 billion.

Among its key provisions, the bill would:

- Raise the corporate income tax rate from 21 percent to 26.5 percent.

- Limit deductions for interest expenses.

- Revise taxes for US-based multinational corporations, including creating a country-by-country minimum tax.

- Raise the top individual income tax rate to 39.6 percent.

- Impose a 3 percent surtax on incomes in excess of $5 million.

- Increase the top capital gains tax rate from 20 percent to 25 percent.

- Increase taxes on large estates.

- Raise tobacco taxes.

- Extend through 2025 most of the American Rescue Plan increases in the Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care Tax Credit (CDCTC).

- Make permanent full refundability of the CTC

Who gets a tax cut?

TPC found that, including corporate income taxes and excise taxes, the lowest income households (those making $27,000 or less) would get a tax cut averaging about $700 in 2022. Excluding their share of corporate income and excise tax increases, those low-income households would pay about $750 less than under current law.

Because so many of the Ways & Means tax cuts are focused on low- and moderate-income families with children, those parents would get much bigger tax cuts. Excluding corporate and excise tax hikes, the lowest income parents would receive a tax cut (or a direct payment) of about $3,700 while middle-income households would get about $3,000.

By contrast, the lowest-income singles without children would get a tax cut of less than $500 while taxes for childless middle-income singles would decline by less than $150.

Overall, middle-income people—those making between about $54,000 and $97,000—would enjoy a modest tax cut. Including their share of corporate income taxes and excise taxes, their federal taxes would fall by an average of about $630. Looking only at individual income, payroll, and estate taxes, their tax bill would fall by about $840 on average.

Who pays more?

As Democrats promised, the Ways & Means bill would substantially raise taxes for high-income households.

Including all provisions, the measure would raise taxes for the top 1 percent (those making $885,000 or more) by about $160,000. The top 0.1 percent (who make at least $4 million) would pay $1.1 million more in federal taxes. Their tax hikes would be slightly smaller if their share of corporate tax increases is excluded—about $137,000 for the top 1 percent and about $957,000 for the top 0.1 percent.

TPC, like the Joint Committee on Taxation and the Congressional Budget Office, allocates corporate income taxes among shareholders, owners of other capital, and workers. Corporate tax increases would modestly lower the after-tax incomes of workers, whose wages would be a bit lower than under current law.

Biden’s Promise

President Biden regularly promises that no households making $400,000 or less would pay more in taxes under a Democratic tax bill than under current law. TPC does not break out income groups into $400,000 or less, but it does look at those making between $200,000 and $500,000.

By that measure, looking at individual income taxes, payroll taxes, and estate taxes, effectively no households making less than $200,000 would pay higher taxes. And 99.4 percent of those making between $200,000 and $500,000 would avoid a tax increase. About one-third of that group would get a tax cut averaging about $1,500 and 0.6 percent would pay an average of about $50,000 more, mostly due to increases in the estate tax.

The Ways & Means bill is one step towards a major 2021 tax bill. It dropped or scaled back some key provisions of Biden’s campaign agenda. But at 30,000 feet, it roughly tracks the president’s wish list.