Researchers have shown how the tax system can reinforce disparities between households of different races or ethnicities, even though the Internal Revenue Code does not explicitly favor any racial group. These disparities arise because the tax code favors certain types of income, expenses, and family characteristics—factors that often vary by race and ethnicity.

Despite being the fastest-growing racial group in the country, Asian American households remain an understudied population in tax policy research. Around 24 million Americans, or 7 percent of the US population, identify either as Asian or Asian in combination with another race. Using newly available data, we find that among American households in the top 20 percent of the income distribution, Asian American households pay a higher average individual tax rate than white households, in large part because they earn more of their income from labor earnings, while white households are more likely to own tax-favored assets.

How do we know? Previously, the triennial Survey of Consumer Finance (SCF) had assigned information on all Asian American households to the “Other” racial category. The 2022 SCF oversamples minorities and is the first wave to present specific data for households in three separate categories: Asian American, American Indian or Alaska Native, or Native Hawaiian or Pacific Islander.

Researchers can now explore the impact of the tax code on Asian American taxpayers relative to white taxpayers. Our analysis uses the 2022 SCF data, an established methodology to convert households into tax filing units, and the NBER’s TAXSIM microsimulation model. Still, the small number of Asian Americans in the 2022 SCF sample, limit the level of detail in our statistical analysis. But that limit highlights the need for more specific data and research.

Differences in income distribution

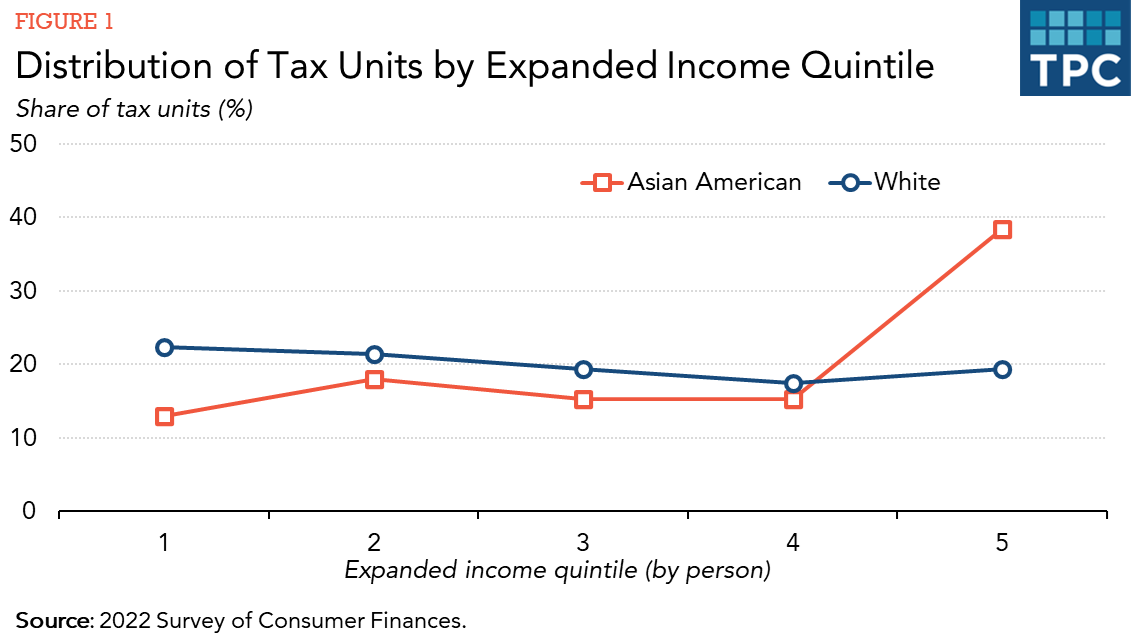

Figure 1 compares the expanded income (EI) distribution of Asian American and white households. EI includes adjusted gross income, cash and near-cash benefits, and untaxed sources of capital income such as unrealized capital gains and imputed rent from owning a home.

Asian American taxpayers have a bimodal distribution; that is, they largely fall into two main areas of this distribution, and their incomes vary more widely compared to white taxpayers. While a large proportion of Asian Americans are in the top 20 percent of the distribution, a sizable share is in the lowest 20 to 40 percent of the distribution, revealing diversity within the Asian American community. This finding challenges the “model minority” stereotype that all Asian American families are financially well-off.

Differences in average tax rate

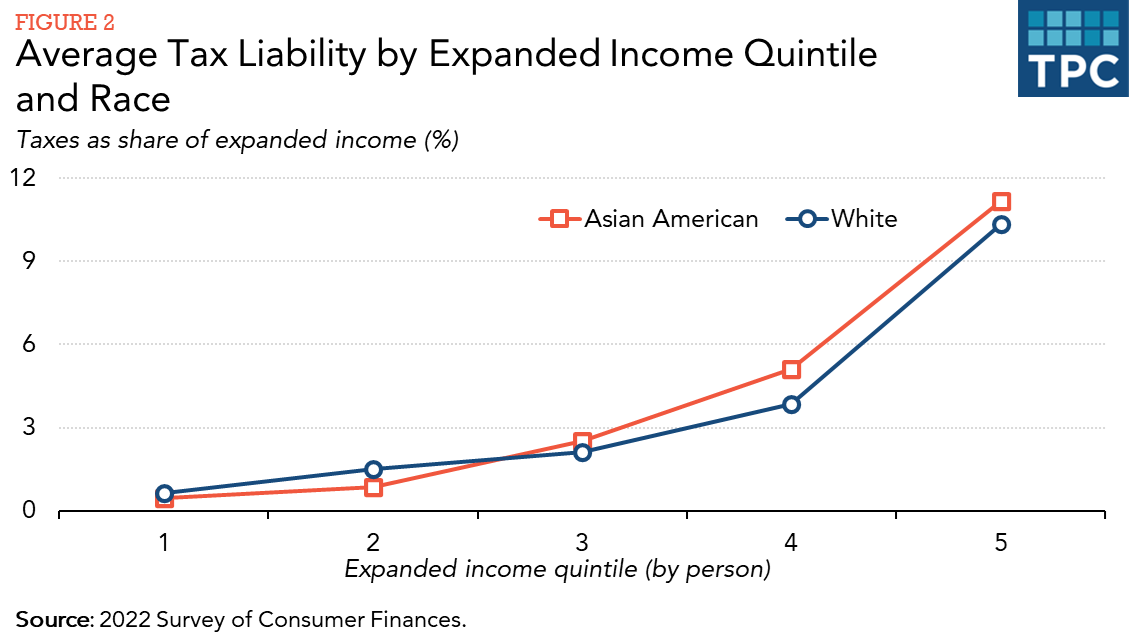

Figure 2 shows the average tax rate (ATR, or the ratio of income tax liability to EI) for Asian American and white households.

The ATR generally rises with income for both groups, reflecting the progressive nature of the federal income tax. Among those in the top 60 percent of the income distribution, Asian American households pay higher ATRs than white households. Subsequent regression analysis (not shown), however, indicates this difference is statistically significant only for the top quintile (at the 10 percent level, a criterion we chose based on the limited sample size). The higher ATR arises because, relative to white households, Asian American households earn a greater share of their income from fully-taxed labor income (earned from working) rather than tax-favored capital income (earned from sources including realized or unrealized capital gains, unreported business income, or imputed rent on owner-occupied housing).

Contributing factors to tax disparities

While differences in the composition and level of income matter when assessing the tax treatment of Asian American households, other factors may also contribute these differences.

For example, the tax code generally favors single-earner married couples, but the labor force participation of Asian American women is higher than that of white women. That raises the possibility of a higher occurrence of marriage penalties among Asian households. The younger age distribution of Asian Americans compared to white Americans may drive other differences. Asian American households are less likely to own homes but owe more when they do, possibly because a large share of Asian American people live in high-cost areas like San Francisco. This suggests potential differences in the use of the mortgage interest deduction.

Asian American households are also less likely to hold tax-preferred retirement accounts, and their households are more likely to be multigenerational, which may cause confusion about which adults are eligible for benefits. In fact, a recent Treasury study found that low-income Asian Americans are less likely to receive the Earned Income Tax Credit and Child Tax Credit than any other low-income racial group.

There’s much more to learn

While these preliminary findings show how the tax code affects Asian American and white households differently, researchers need more data to conduct deeper analyses. There may be disparities in income tax liabilities within the broadly diverse Asian American population. Cultural norms, socioeconomic statuses, and lived experiences vary widely among Asian American families from different countries and regions.

In March 2024, the Biden administration updated Statistical Policy Directive No. 15 to require federal data to subdivide the “Asian American” category into subgroups, including Chinese, Asian Indian, Filipino, Vietnamese, Korean, and Japanese. With these detailed data, researchers can perform more nuanced analyses that further debunk the “model minority” myth.

Policymakers should use this research to better understand the economic needs of low-income Asian American families, particularly the most vulnerable among them. That includes the uncertainty faced by undocumented immigrants and the high poverty rates among Burmese (19 percent) and Hmong (17 percent) Americans.

Examining differences in tax treatments between Asian American subgroups will allow researchers to capture the diverse experiences and needs of these communities, enabling the development of responsive policies.