Like other forms of income, long-term capital gains and qualified dividends are taxed at graduated rates. Long-term capital gains and qualified dividends, however, receive preferential tax rates compared to wage and salary income. Taxpayers in the 10 percent or 15 percent ordinary income tax brackets pay zero percent on long-term gains and qualified dividends. Understanding who benefits from this provision could help inform the tax reform debate.

Filers in the lowest brackets, some of whom have substantial investment income, may avoid income tax liability on their gains and dividends. Taxpayers in higher brackets (25 percent to 35 percent) face long-term capital gains and qualified dividends tax rates of 15 percent, while taxpayers in the 39.6 percent ordinary income bracket have a 20 percent rate on these forms of income. Additionally, some high-income filers pay a 3.8% ACA surcharge on their investment income.

The 2003 tax cuts created the zero percent bracket for long-term capital gains and qualified dividend income, which went into effect in 2008. Supporters argued that lowering taxes on capital gains and dividends would boost growth, reduce double taxation, and help middle-class seniors. The 2012 tax bill made the lower rates permanent for most filers.

Today, singles with taxable income under $37,950 and couples with $75,900 or less pay the zero rate on this investment income. Some of these filers face marginal tax rates of 25 or 30 percent if additional income taxed at ordinary rates pushes their long-term gains or qualified dividend income from the zero percent bracket into the 15 percent bracket for investment income.Conversely, itemized deductions reduce ordinary income under the top of the 15 percent bracket and increase the amount of capital gains or dividends taxed at zero percent. This explains why a taxpayer can have a high Adjusted Gross Income (AGI) but still face a zero percent tax on their long-term capital gains and qualified dividend income.

In 2014, 11.1 million returns reported $77.2 billion in gains and dividends that were taxed at zero percent. About four-in-ten of those filers were age 65 or older and most untaxed gains and dividends were reported by filers making under $200,000 in AGI.

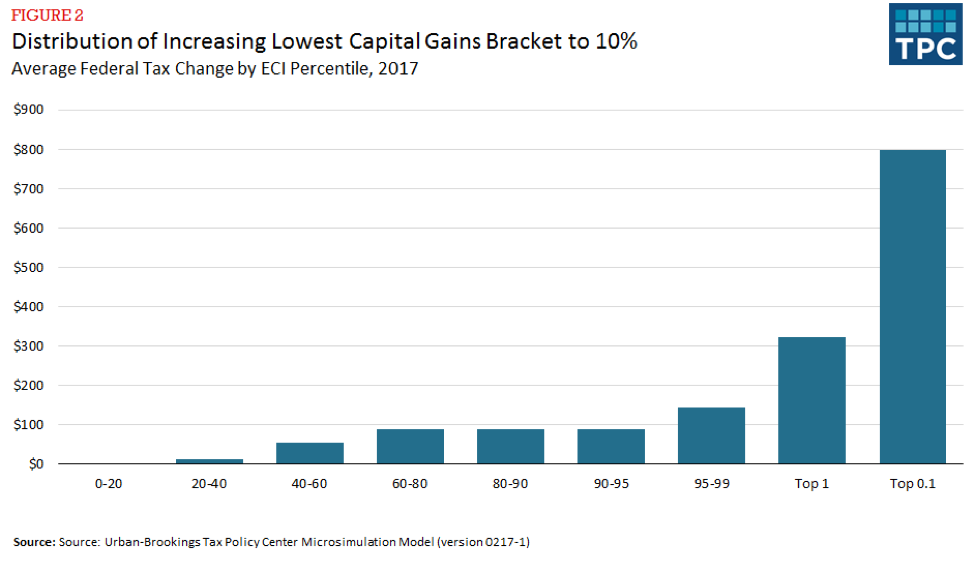

Restoring a bottom rate of 10 percent on long-term capital gains and qualified dividend income—which was the lowest rate prior to the 2003 Act—would generate about $7 billion additional revenue in 2017 but have little effect on the after-tax income of taxpayers at all levels of income distribution by Expanded Cash Income (ECI). The Tax Policy Center’s microsimulation model uses ECI to measure taxpayers’ economic well-being and capacity to pay taxes. The lion’s share of the aggregate benefits from the zero percent bracket goes to filers between $50,000 and $200,000 in Adjusted Gross Income, but on an individual basis this amounts to about $100 per household. As Figure 2 indicates, in absolute dollars individual filers in the top one percent of income benefit the most.