Just as movie theaters are full of sequels (Top Gun, Jurassic Park, and Thor), state capitols are also replaying last year’s big hit: tax cuts.

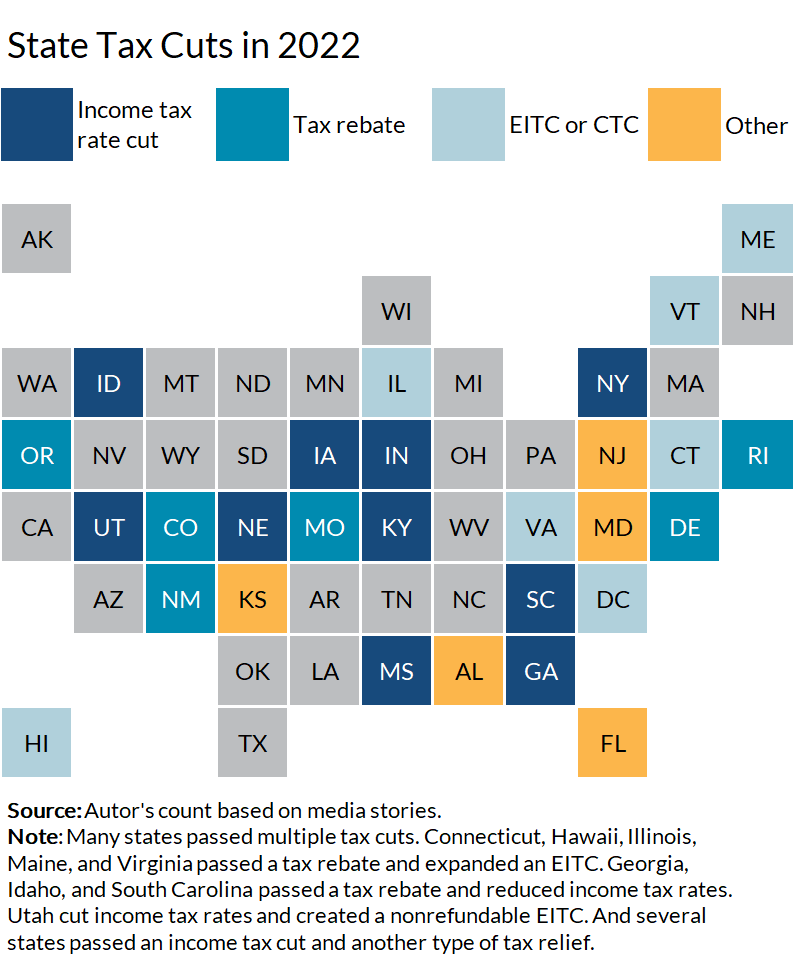

So far this year, 27 states and the District of Columbia have passed significant tax cuts. Last year’s total was 29 states and the District of Columbia. Like in any good sequel, our favorite characters (income tax rate cuts, refundable tax credits, and tax rebates) returned but with some new plot twists (relief from taxes on groceries and gas).

In both years, the scene was set by unexpectedly strong tax collections resulting from a combination of unprecedented federal pandemic spending and economic growth.

However, unlike Hollywood scriptwriters, state legislators cannot simply write a happy ending. In fact, some enacted huge tax cuts just as economic and geopolitical challenges accelerated. The ongoing pandemic, high inflation, rising interest rates, and the war in Ukraine could all slow the economy and put pressure on state budgets.

So here’s a quick look at what tax cuts were passed in 2022 and why some states might have created a budget cliffhanger.

Individual income tax rate cuts

Ten states cut income tax rates this year. That’s one more than did so in 2021. Idaho and Iowa reduced income tax rates in both years.

Although the details vary, the big winners of state income tax rate cuts are typically high earners. For example, we ran Arizona’s and Ohio’s 2021 income tax rate cuts through the Tax Policy Center state income tax model and found households earning more than $100,000 received 93 percent of the benefits from Arizona’s cut and 73 percent of Ohio’s.

Refundable tax credits

Six states and the District of Columbia created or expanded a major refundable tax credit in 2022.

Most state earned income tax credits (EITC) are calculated as a percentage of the federal credit, so Connecticut, Illinois, and Maine simply increased their match rate. Other states made more filers eligible for the EITC or made their credits refundable. The Tax Policy Center’s 2021 analysis of state tax cuts showed similar EITC expansions in Maryland and New Mexico sent nearly all of the tax relief to households earning less than $30,000.

Meanwhile, Vermont created a $1,000 refundable child tax credit (CTC) for households with children younger than age six. It becomes the sixth state to offer a CTC and third to provide a refundable CTC.

Several states also expanded nonrefundable income tax deductions—particularly for retirement income.

One-time tax rebates

Households in 14 states will get another government check in 2022. But this time it will come from governors rather than the US Treasury. Only three states sent out rebates in 2021.

In most of these states every resident who filed a tax return in the past year or two will get a payment. A handful will limit the payments to households with low- or moderate-incomes.

However, Missouri and South Carolina may send rebates only to residents with a tax liability, which would exclude many low-income households and seniors. Leaders in both states have agreed to rebates but not yet enacted the final legislation.

Grocery and gas tax relief plus everything else

While most states only cut income taxes in 2021, rising prices pushed some states to reduce grocery and gas taxes this year.

Kansas and Virginia ended their state grocery taxes while Illinois suspended its tax for the fiscal year. At the pump, Connecticut, Florida, Georgia, Maryland, and New York all temporarily suspended their gas taxes while Illinois and Kentucky blocked scheduled gas tax rate hikes.

Several states also cut property taxes or businesses taxes.

Episode III: Revenge of The Tax Cuts?

Distributing tax rebates when consumer demand is driving up prices may not make a lot of economic sense, but that type of tax cut only affects one budget year. And even a relatively large EITC expansion carries a modest price tag. Increasing Connecticut’s match of the federal credit from 30.5 percent to 41.5 percent cost $49 million.

But the annual cost of the 2022 income tax rate cuts were massive: $525 million in Mississippi, $1.2 billion in Georgia, $2 billion in Iowa. Some cuts will phase in over multiple years, and a few depend on state’s hitting revenue triggers.

But the budget math for states that cut income tax rates could turn bad quickly if the economy weakens and strong revenue growth doesn’t continue. And forecasts show essentially no revenue growth in fiscal year 2023. Plus, keep in mind that many of these states have supermajority rules that make tax hikes far harder than cuts.

Maybe these tax-cutting states will get their Hollywood ending. But horror is also a genre of state budget debate that lends itself to sequels.