Expansions to the Child Tax Credit (CTC) are among many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) scheduled to expire at the end of 2025. If Congress does nothing, the credit will be cut in half, among other changes. As the TCJA deadline looms, the CTC could become a top priority to policymakers interested in decreasing child poverty.

Below are some issues and options to consider.

How did TCJA change the CTC?

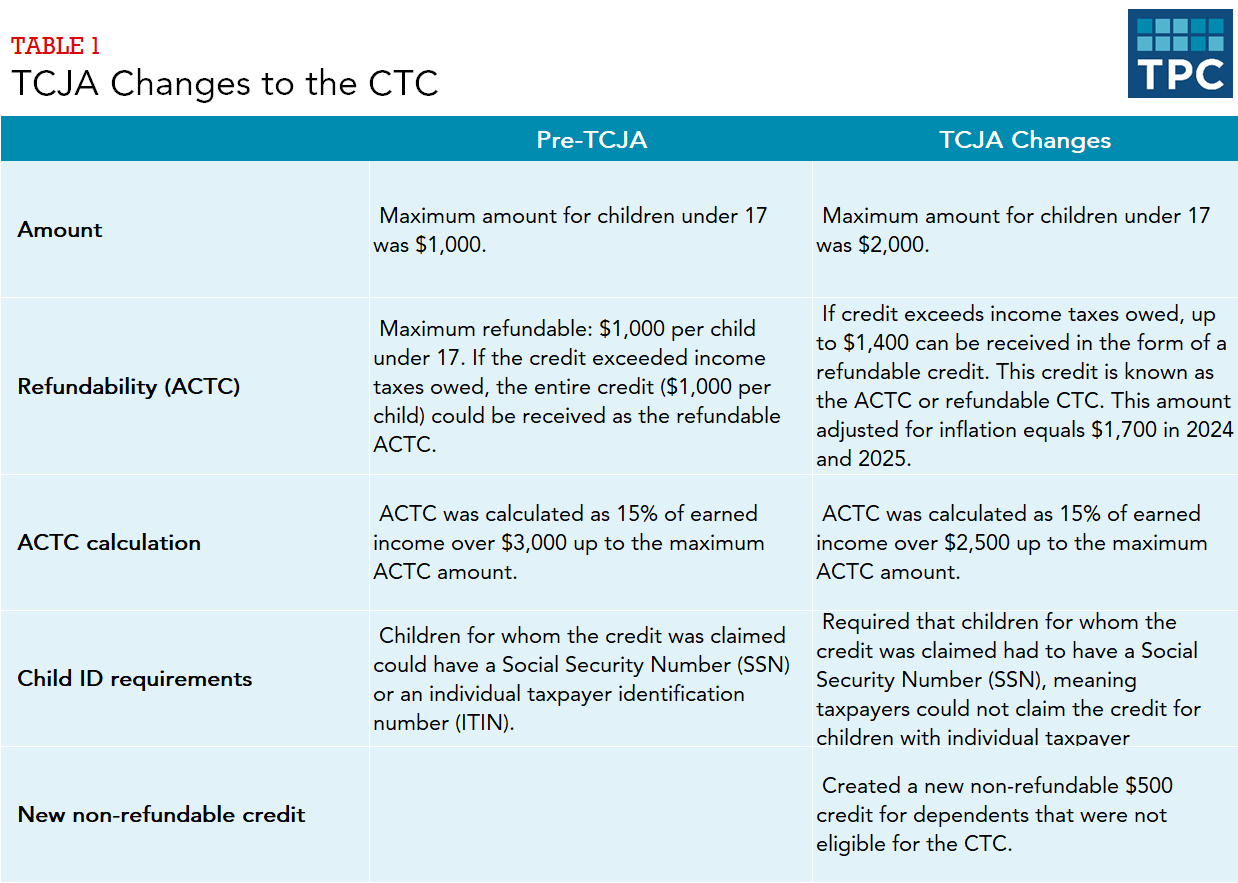

The major change made by the TCJA was to increase the maximum credit and make it available to higher-income families.

Specifically, the TCJA:

- Doubled the maximum credit amount from $1,000 to $2,000 per child.

- Increased the refundable portion of the credit available to lower-income families from $1,000 to $1,400 per child. The refundable portion of the credit—known as the additional child tax credit (ACTC) or refundable CTC—is the amount of the credit that can exceed income taxes owed. This amount adjusted for inflation equals $1,700 per child in 2024 and 2025.

- Lowered the earned income threshold to be eligible for the refundable CTC by $500. Prior to the TCJA, the ACTC was calculated as 15 percent of earned income over $3,000 up to the maximum ACTC amount. The TCJA reduced the threshold modestly from $3,000 to $2,500.

- Required that children for whom the credit was claimed had to have a Social Security Numbers (SSNs), meaning taxpayers could not claim the credit for children with individual taxpayer identification numbers (ITINs).

- Created a new non-refundable $500 credit for dependents that were not eligible for the CTC.

What happens when TCJA expires?

If the TCJA expires, the maximum credit per child under 17 would revert to $1,000, the maximum refundable portion would also fall to $1,000 per child, and the SSN requirement for qualifying children would no longer be in effect (meaning children with ITINs could also be eligible). The $500 non-refundable credit will also expire.

What options does Congress have?

In early 2024, the House passed a bipartisan bill to extend an expanded CTC. The bill would have:

- Phased in the credit for low-income families on a per-child basis (15 percent phase in for one child, 30 percent for 2 children etc)., meaning many low-income families with more than one child would have been eligible for a larger credit.

- Increased the per child ACTC amount to $1,900 in 2024 and $2,000 in 2025.

- Allowed tax filers to apply the previous year’s income to their tax return, potentially resulting in a higher credit.

The bill failed in the Senate in August but a version of it could be reconsidered in the new year.

TPC has analyzed other potential changes to the child credit that could benefit lower-income families including:

- Reducing the eligibility threshold from $2,500 to $0.

- Providing a minimum guaranteed credit of $1,000 per child to all families.

- Phasing in the remainder of the credit with earned income.

According to TPC analysis, these options or some combination of them could benefit 28 to 63 percent of low-income households by an average amount of $270 to $1,100.

Learn more about the other options on the child tax credit by reading "A Newborn Tax Credit Could Be Worthwhile, With Sound Administration” and “Options to Improve the Child Tax Credit for Low-Income Families: An Update.”

This post has been corrected. In the second bullet, the Tax Cuts and Jobs Act lowered the earned income eligibility threshold for the refundable child tax credit by $500, not $50. In table 1, the additional child tax credit refundability amount before the TCJA was $1,000, not $1,00 (corrected January 13, 2025).