Some federal lawmakers want to stop taxing tip income. This would allow tipped workers like servers or bartenders to keep more of what they earn. But TPC research shows that many tipped workers already pay little or no federal income tax. Here’s what to expect if tip income were tax-free, or tax-exempt:

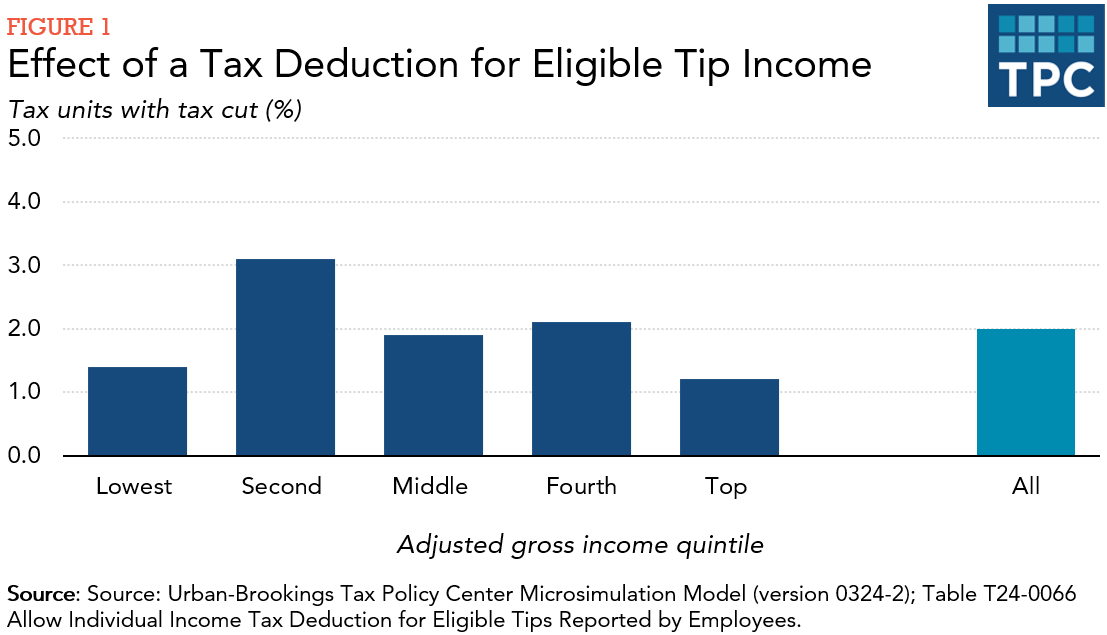

- Few people would benefit: Only about 2 percent of all households, or 60 percent of households with tipped workers, would receive a tax cut.

- Modest tax savings: Among that 60 percent, the average tax cut would be about $1,800 a year or $35 a week.

- Very small benefits for those earning the least: For households making less than $33,000 a year, after-tax income would increase by $10 a year on average, or $450 a year if they are among the 1.4 percent of households in this group benefitting from the proposal.

In the future, benefits are less clear. If tips are not taxed, some employers might pay lower wages and expect workers to rely more on tips. In places where tips are lower, workers might earn less overall if wages do not increase. But workers in areas with higher tipping could earn more, increasing pay gaps. Or customers already feeling “tip fatigue” might tip less.

And the federal budget will lose revenue. TPC estimates that exempting tips from income tax would reduce federal revenue by $6.5 billion in 2025, while capping the benefit to those making $75,000 or less would limit the revenue loss to $3.2 billion.

To learn more about tips, read our blog “Exempting Tips From Federal Income Tax Would Benefit Very Few Workers.”