States rely heavily on gas taxes to pay for transportation construction and maintenance costs. In 2021, state motor fuel taxes generated about $50 billion in revenue. State and local motor fuel tax revenue accounted for 26 percent of all highway and road spending.

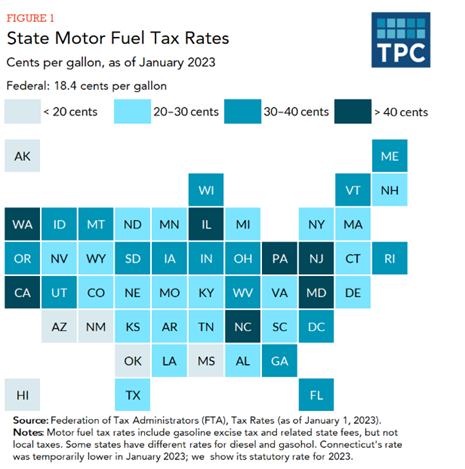

State gas taxes vary, but all states and the District of Columbia levy some kind of tax on motor fuels. In 2023, per gallon gas tax rates ranged from 8.95 cents in Alaska to 62.9 cents in California. Ten states also levy a general sales tax or gross receipts tax on purchases of motor fuel. Federally, motor fuels have not been adjusted for inflation and have been taxed at 18.4 cents per gallon since 1993.

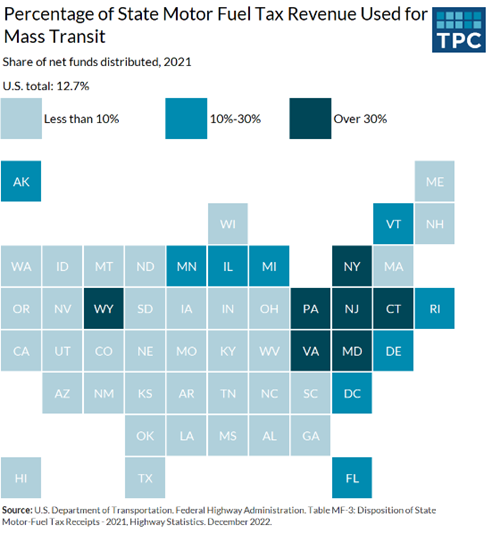

So how do states use these funds? In 2021, about 48 percent went to construction, maintenance, and repair of highways, 28 percent to local roads and streets, and 13 percent to mass transit, but this distribution varied tremendously across the country. Mass transit allocation, for example, is concentrated largely in the northeast.

But the flow of revenue isn’t as strong as it used to be, due to improved vehicle fuel efficiency and the failure of many states to adjust their taxes for inflation.

States levy motor fuel taxes on each gallon drivers buy. Over the last two decades, Americans have been driving fewer miles and purchasing more fuel-efficient vehicles. Inflation-adjusted state and local motor fuel tax revenue has begun to fall, though many states, such as Alabama and Virginia, have increased their motor fuel tax rates in recent years to help make up the gap.

These trends have constrained states’ abilities to pay for highways, roads, and mass transit. States have other funding solutions, like enacting tolls on some roads, increasing registration fees for electric vehicles, tying the gas tax rate to the price of gasoline or even allowing highway-only funds to fund transit programs. Time will tell how states choose to tackle this pressing issue.

Learn more about state gas taxes by reading “How do state and local motor fuel taxes work?” in our Briefing Book.