In 2017, about 30 percent of households used SALT. No, not when cooking, but when filing their taxes.

The 2017 Tax Cuts and Jobs Act (TCJA) changed that. Lawmakers wanted to limit how much the law’s tax cuts added to the national debt. To do so, they limited the value of certain tax breaks—like the deduction for State and Local Taxes (SALT).

Before the TCJA, about 30 percent of households itemized deductions when filing their taxes. But the TCJA capped the SALT deduction at $10,000 a year and increased the federal standard deduction. As a result, taking the standard deduction became more valuable to many filers compared to itemizing individual deductions.

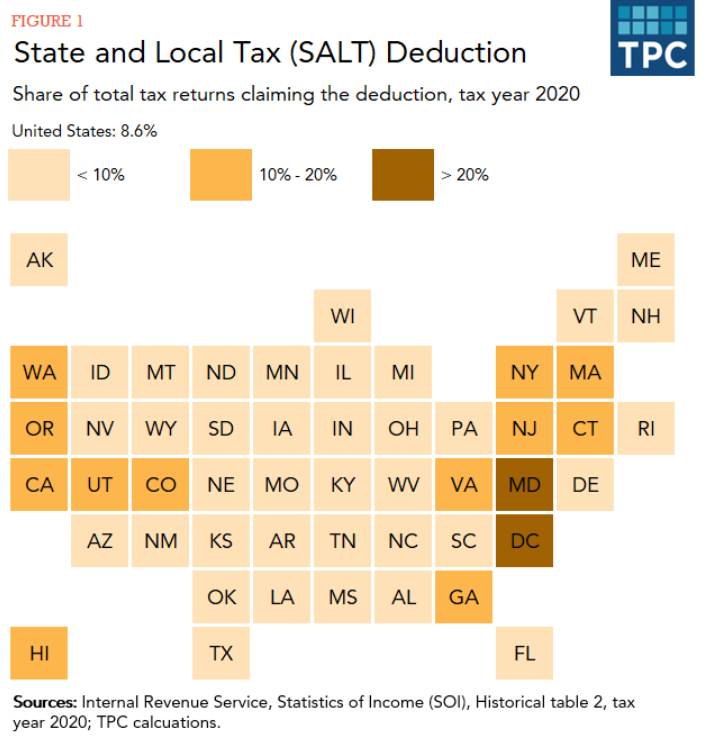

The share of filers who itemized deductions, including SALT, fell to 9 percent in 2020. The federal government also gained more income tax revenue, since the cost of the SALT deduction fell from $104 billion to $13.5 billion in 2020.

But the SALT cap didn’t impact taxpayers evenly. It primarily impacted itemizers, who tend to have higher incomes, and taxpayers living in states with higher state and local taxes.

Lawmakers of both political parties are pushing for changes to the $10,000 SALT cap in 2025, when many TCJA provisions are scheduled to expire. Some propose to raise the cap. On the 2024 presidential campaign trail, President-elect Donald Trump suggested lifting the cap entirely.

A higher cap or a full repeal of the SALT cap would mostly benefit high-income earners, making either change a regressive policy.

A TPC analysis of a $25,000 SALT cap found three-quarters of the benefit of raising the cap to $25,000 would go to those making about $250,000 or more (the top 10 percent of households).

Likewise, a full repeal would mostly benefit high-income earners. A TPC analysis found the top 1 percent of earners (making about $1 million or more annually) would get 43 percent of all the benefit from a repeal. Their after-tax income would climb by about 1.6 percent, or roughly $35,000.

The extent of the regressivity of any SALT changes would depend on other policy changes from the TCJA, including whether the Alternative Minimum Tax returns. returns.

Learn more about recent changes to SALT in the TPC Briefing Book: “How does the federal income tax deduction for state and local taxes work?” Learn more about TPC’s analysis of a $25,000 SALT cap and its impact in “A $25,000 SALT Deduction Cap Would Be Only A Modest Improvement Over The House’s $80,000 Version”. Learn more about TPC’s analysis on the SALT repeal and its impact in “Repealing The SALT Cap Would Overwhelmingly Benefit Those With High Incomes”.