This blog post was corrected October 30, 2024. Bureau of Economic Analysis state gross domestic product data was added to the source notes for figures 1, 2, and 3 below.

Donald Trump’s proposal to levy a 60 percent tariff on imports from China and a 10 percent tariff on imports from all other nations would have huge implications for businesses, consumers, and state economies. In a new analysis, the Tax Policy Center finds the cost of the proposed tariffs would fall particularly heavily on states in the Midwest and South.

The US has used tariffs since its creation, but for the past 70 years annual tariff revenue has never accounted for more than 3 percent of total federal revenue. The Trump administration increased tariffs and the Biden administration maintained those higher levels, but the US still uses tariffs sparingly to help America compete in emerging industries and protect jobs in specific sectors.

Trump’s 60 percent and 10 percent proposal would dramatically change the policy equation. The Tax Policy Center estimates this proposal would raise roughly $3.7 trillion in additional revenue over the next decade, increasing what the US currently collects from tariffs by nearly 500 percent. (Trump has mentioned far higher tariff levels at other times during the campaign, but both the revenue estimate and this state-based analysis used the 60 percent and 10 percent levels.) Notably, US presidents have a wide degree of discretion in setting tariff policy without legislation because Congress enacted legislation in 1934, 1962, and 1974 that gives the president the broad power to levy tariffs.

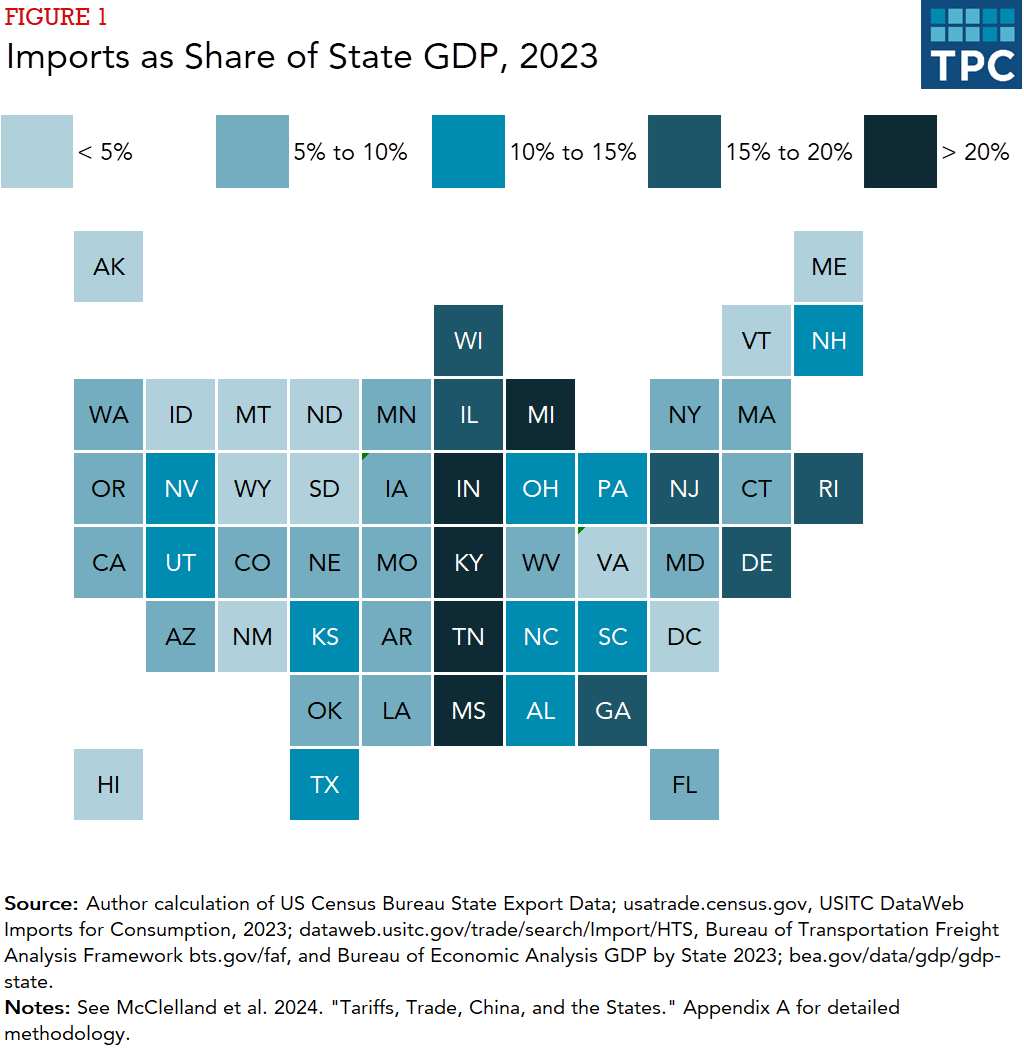

To understand how Trump’s proposal could play out across the country, we examined the distribution of imports to the states. Nationally, imports totaled about 11 percent of US gross domestic product (GDP) in 2023, but imports as a share of state GDP ranged from 2 percent in South Dakota to 27 percent in Kentucky. Overall, imports were typically a larger share of state GDP in Midwestern and Southern states, totaling more than 15 percent in Delaware, Georgia, Kentucky, Illinois, Indiana, Michigan, Mississippi, New Jersey, Rhode Island, Tennessee, and Wisconsin in 2023.

Many goods enter the US via states bordering the Atlantic and Pacific Oceans, but trucks and trains then distribute these imports throughout the nation to businesses that use and sell them. Our analysis accounted for this by using Freight Analysis Framework data produced by the US Bureau of Transportation Statistics with support from the Federal Highway Administration. (Please see the report’s methodology for a full explanation.)

Knowing how much each state imported, how much was paid in tariffs, and where the goods were shipped allows for comparison of tariffs paid on imported goods to state GDP. This includes both tariffs on goods sold directly to consumers and those used by businesses to then assemble products.

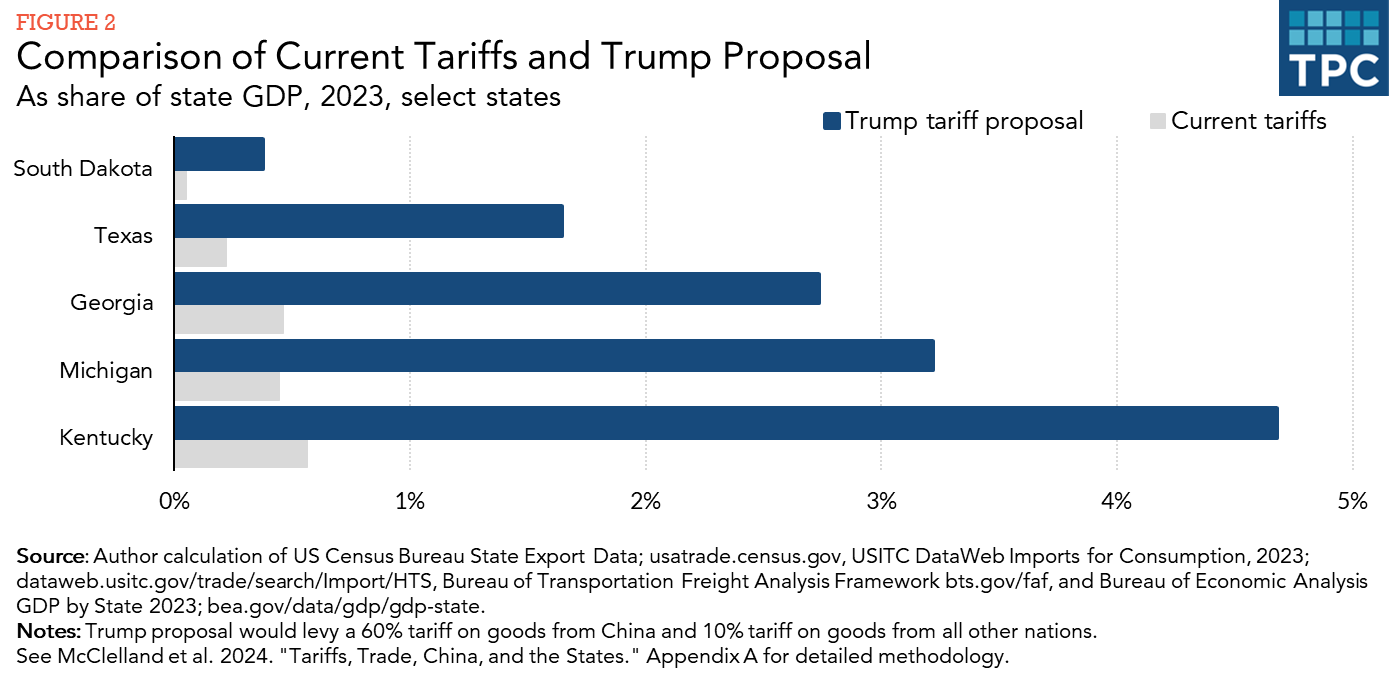

In 2023, estimated tariff payments as a share of state GDP ranged from 0.05 percent in South Dakota to 0.6 percent in Mississippi. Broadly speaking, current tariff payments were highest in the states where imports made up the largest share of state GDP.

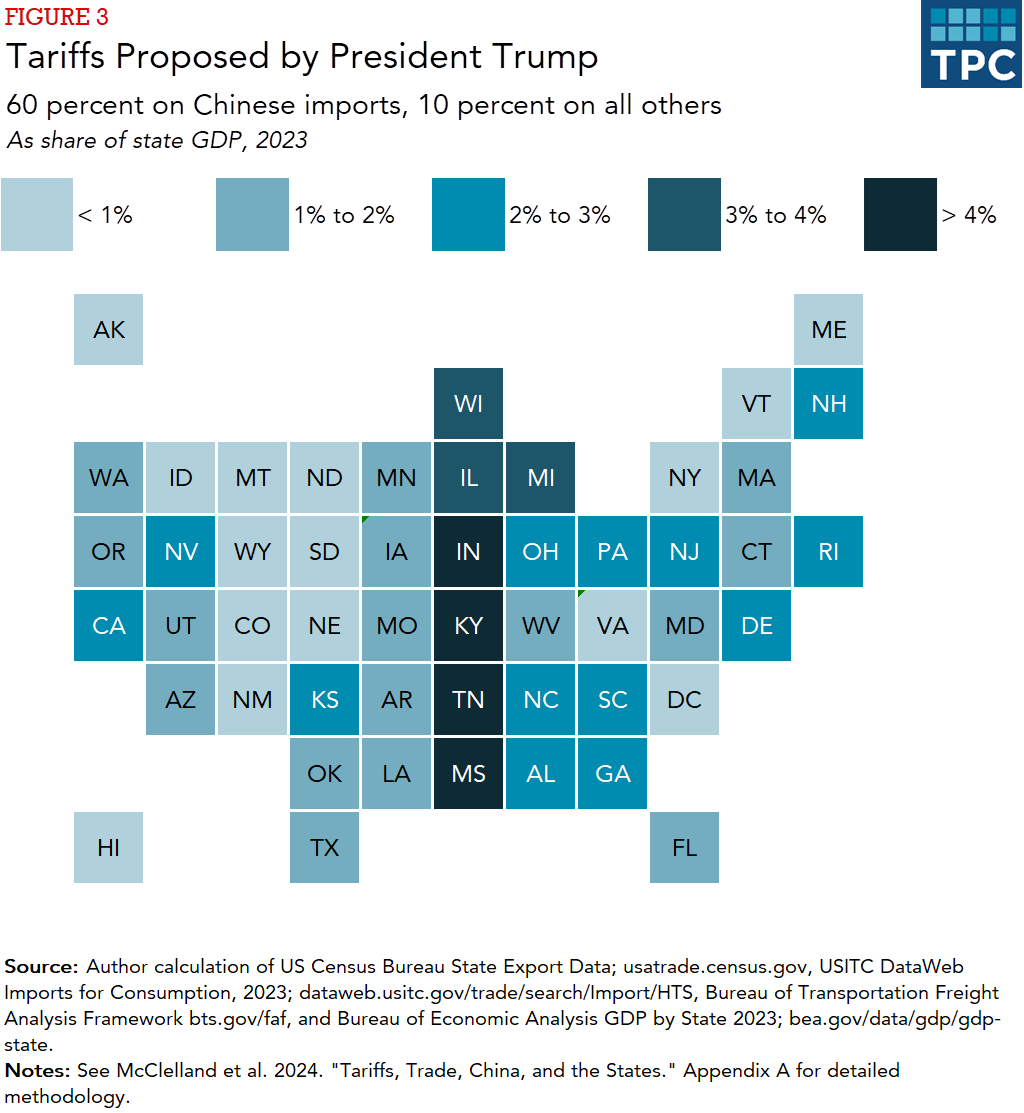

On average, Trump’s proposed 60 percent tariff on goods from China and 10 percent tariff on goods from all other nations would increase tariff payments as a share of state GDP by 1.5 percentage points across all 50 states and the District of Columbia. The largest percentage point increases would occur in Kentucky (4.1 points), Indiana (3.9 points), Tennessee (3.6 points), Mississippi (3.5 points), and Michigan (2.8 points). The smallest increase would occur in South Dakota (0.3 points).

Although Trump’s elevated tariff levels would increase tariff payments relative to state GDP in states across the nation, as with current tariff payments, the highest tariff payments would occur mostly in states in the Midwest and South.

Trump’s proposed tariff payments would total more than 3 percent (but not 4 percent) of state GDP in Illinois, Michigan, and Wisconsin and total more than 4 percent of state GDP in Kentucky, Indiana, Mississippi, and Tennessee. Kentucky would see the largest total tariff payment under Trump’s proposal, with tariff payments totaling nearly 5 percent of its state GDP.

Research shows that recent tariffs were passed on to consumers and businesses rather being paid by the exporting nations. Past arguments for accepting these higher costs included supporting emerging and important industries in the US, protecting jobs in specific sectors, and enhancing our national security. Trump’s proposed tariffs would create an entirely new policy tradeoff calculation, and the costs of that policy would not be spread equally across the 50 states.