This week, House Republican leadership is pushing for a floor vote on its budget resolution, a framework that establishes total amounts for yet-to-be specified tax and spending cuts. While passing the resolution will reportedly be tough, the next part could prove harder.

How will Congress extend expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA) and advance other Trump Administration tax priorities—that some budget watchers have ballparked could cost up to $11 trillion—while staying within the resolution’s $4.5 trillion tax cut target? One suggested but not fully examined idea: Modify the extension of the TCJA's lower individual income tax rates.

Lower tax rates account for 80 percent of the net cost of TCJA extension

TPC estimates that if Congress extended all TCJA’s expiring provisions except for the lower individual income tax rates, the cost of making TCJA permanent would fall from about $4 trillion to about $800 billion through 2034. In other words, if individual income tax rates returned to their pre-TCJA levels of 10, 15, 25, 28, 33, 35, and 39.6 percent, as scheduled under current law, the cost of extending the TCJA would fall by about $3.2 trillion, or nearly 80 percent.

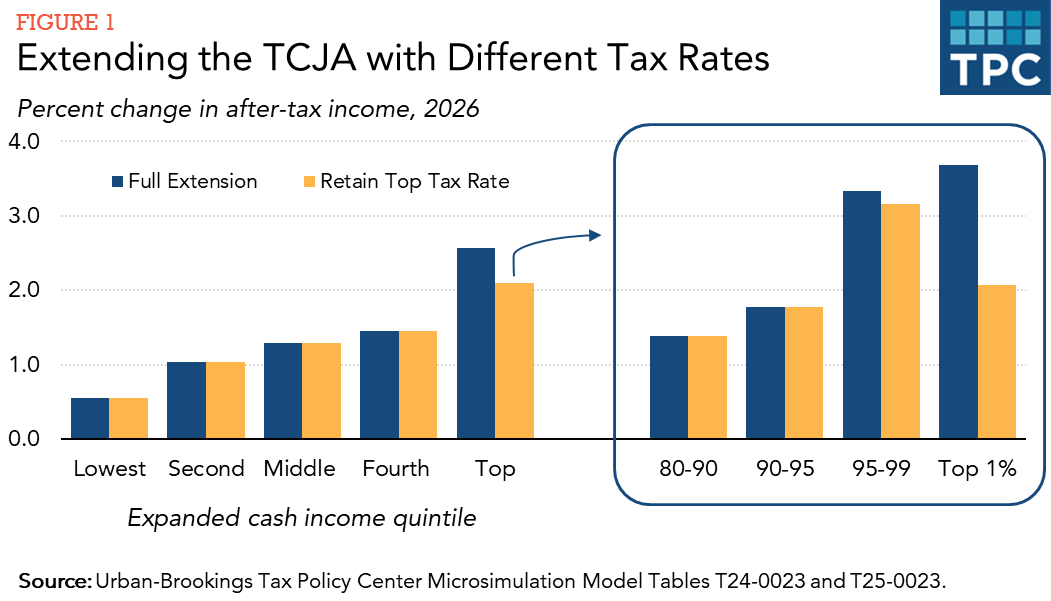

Congress is unlikely to undo all the rate cuts included in the original TCJA. But what if instead Congress allowed only the top individual income tax rate of 37 percent to return to its pre-TCJA level of 39.6 percent as scheduled in 2026? The cost of TCJA extension would then fall by about $360 billion, or 10 percent, through 2034.

That change would mostly affect taxpayers within the top 1 percent of the income distribution (Figure 1). Because of how our graduated income tax rate structure works, these households would still get an average tax cut of about $45,000 (or about 2 percent of after-tax income) but far less than the $80,000 (nearly 4 percent of after-tax income) they would receive with a full extension relative to current law.

Why does “stacking order” affect cost estimates of TCJA rate cuts?

TPC’s $3.2 trillion estimated cost of extending the TCJA’s rate cuts is much larger than the $2.2 trillion estimate from the staff of the Joint Committee on Taxation in May 2024. What accounts for this $1 trillion difference?

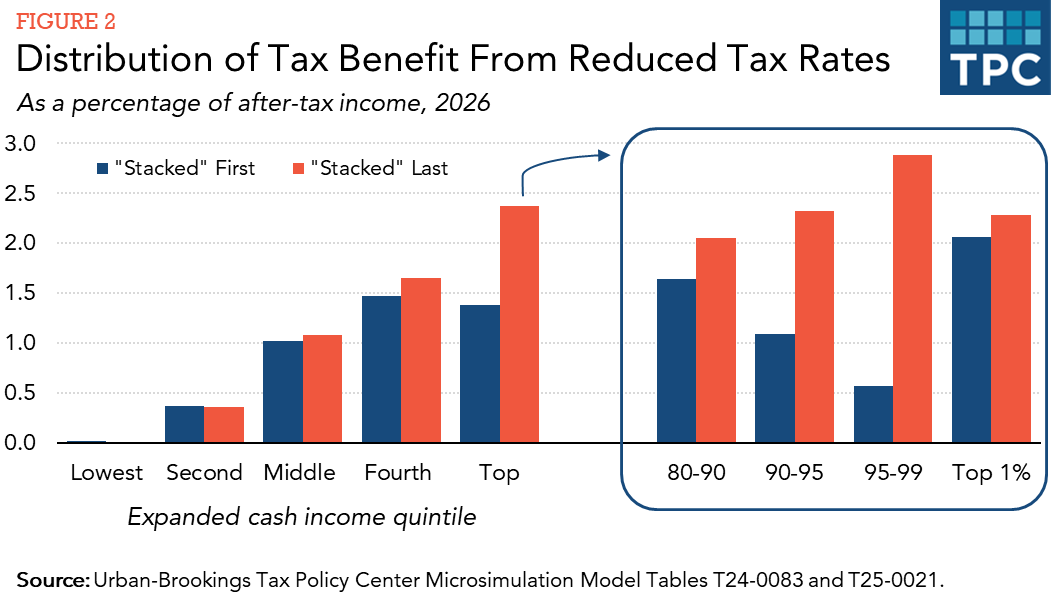

The gap mostly results from differences in how budget estimates are presented within a legislative package, sometimes referred to as the “stacking order.” When estimating the cost of a comprehensive bill like the TCJA, analysts must account for interactions among its various provisions. To do this, they estimate proposals sequentially, meaning each estimate reflects interactions among all previously analyzed provisions. While the stacking order doesn’t change the bill’s total cost, it does affect how individual provisions appear in cost estimates.

Figure 2 illustrates this effect. It shows that if the tax benefit from TCJA’s lower individual income tax rates relative to current law is estimated (or “stacked”) last (as TPC estimated here), the average tax cut relative to current law is nearly 45 percent larger than if it is estimated first (as TPC did here).

One of the biggest reasons for the size difference: TCJA’s sharp reduction in the number of taxpayers affected by the individual alternative minimum tax (AMT), especially among higher-income (but not the highest income) taxpayers who were previously most affected by it.

When rate cuts are stacked first, some of the revenue loss relative to current law is absorbed by the more stringent pre-TCJA AMT rules. But when tax rates are stacked last, they are measured after the AMT has already been adjusted to its more generous TCJA parameters. That makes them appear less costly (and makes reducing the AMT appear more costly).

This analysis highlights the complexity of the TCJA and the relationships its provisions have with one another. Once the lower tax rates are removed, the remaining expiring TCJA provisions account for only about 20 percent of the total cost of extension.

Those provisions, which involve both tax decreases and tax increases, resulted in many of the benefits the TCJA achieved in terms of simplicity and base broadening. Policymakers should note the relatively low cost of securing those gains as they decide how to extend the TCJA.

No matter how you stack it, letting one, some, or all the TCJA’s rate cuts expire presents a big opportunity to reduce the cost of TCJA extension.